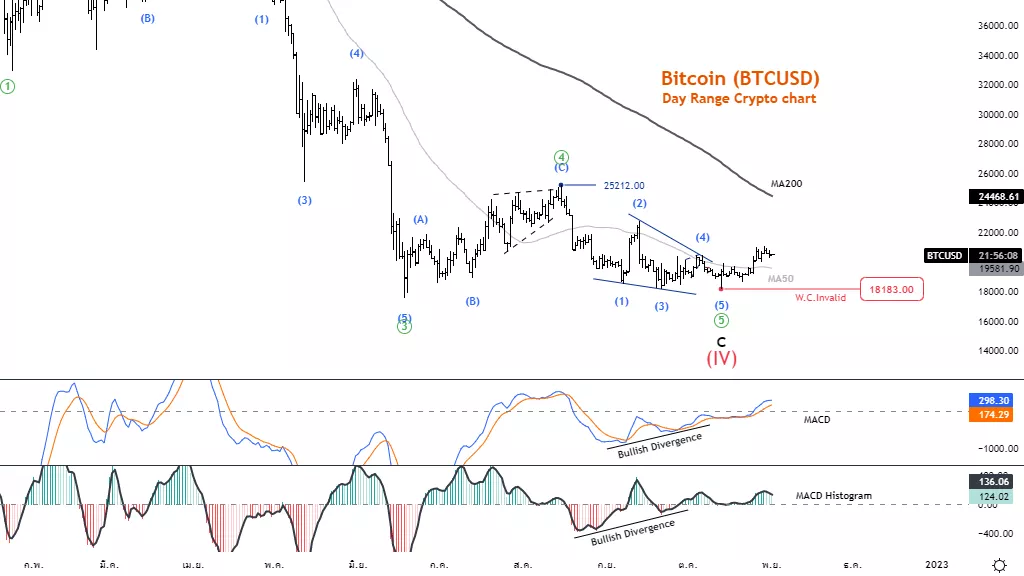

Elliott Wave Technical Analysis: Bitcoin, Nov. 1

Bitcoin

BTCUSD Elliott Wave Technical Analysis

Function: Follow trend

Mode: Motive

Structure: Impulse

Position: Wave (1)

Direction Next higher Degrees: Sub-wave of Wave ((1))

Details: Wave C is likely to end and the price is expected to trade above the 25212 level, but it

must not reverse below 18183.

Wave Cancel invalid level: 18183.

Bitcoin (BTCUSD) Trading Strategy: Wave C is likely to end and the price is expected to trade above the 25212 level but must not reverse below 18183. This could be an opportunity

to join a larger trend. But may have to wait for a shortening of the price after testing the key resistance at the MA200 line.

Bitcoin (BTCUSD) Technical Indicators: MACD and MACD Histogram has a bullish

divergence The price has a chance to turn into an Uptrend.

Tradinglounge analyst : Kittiampon Somboonsod

Bitcoin (BITCOMP)

BTCUSD Elliott Wave Technical Analysis

Function: Follow trend

Mode: Motive

Structure: Impulse

Position: Wave (3)

Direction Next higher Degrees: Sub-wave of Wave ((1))

Details: Wave 3 is usually 1.618 x wave 1 at 21540. but must not reverse below 256.4

Wave Cancel invalid level: 18183.

Bitcoin (BTCUSD) Trading Strategy: The rise of wave 3 tends to be unfinished and the price has a chance to rise again in wave 5 when wave 4 ends. This could be a short-term

buying opportunity.

Bitcoin (BTCUSD) Technical Indicators: MACD Histogram has a hidden bullish divergence. The price has a chance to turn into an Uptrend.

More By This Author:

Elliott Wave Technical Analysis: Honeywell International Inc., Oct. 31

Theta Token Elliott Wave Technical Analysis - Oct. 31, 2022

SP500 NASDAQ RUSSELL 200 DJI Elliott Wave Analysis

Disclosure: As with any trading or investment opportunity there is a risk of making losses especially in day trading or investments that Trading Lounge expresses opinions on. Note: Historical ...

more