Elliott Wave Technical Analysis: AAVE Crypto Price Today

Elliott Wave Analysis – TradingLounge Daily Chart

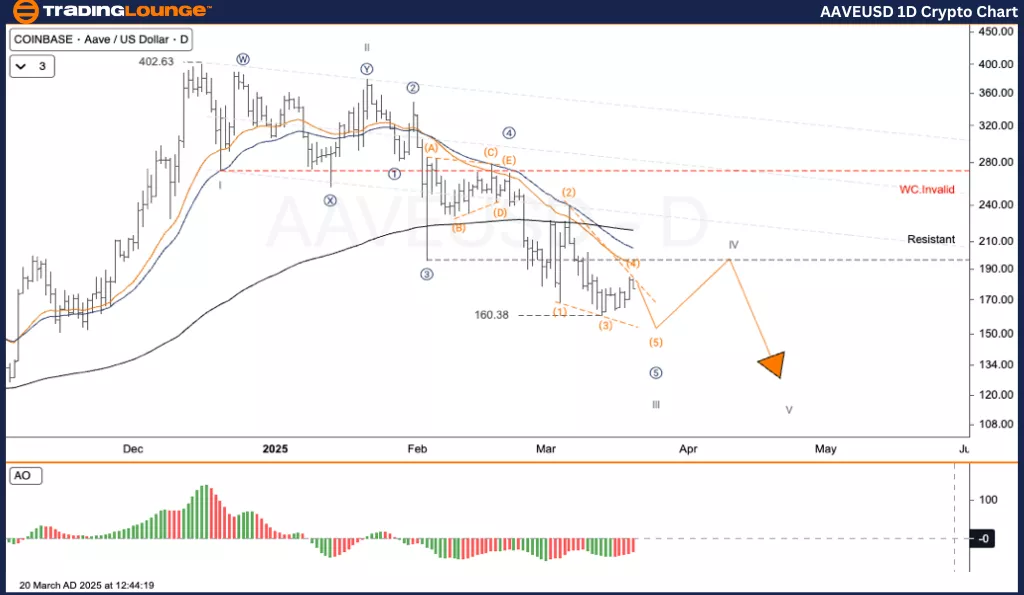

AAVE/USD (AAVEUSD) Elliott Wave Technical Analysis

Function: Trend Following

Mode: Motive

Structure: Impulse

Position: Wave III

Next Higher Degree Direction: Downtrend Continuation

Wave Cancelation Level: Not Specified

Analysis Details:

AAVE is undergoing a downward correction after reaching a high of $399. The current wave structure suggests a progressive downward movement following the pattern (1)-(2)-(3)-(4)-(5).

AAVE/USD Trading Strategy

AAVEUSD remains in a well-defined downtrend. The current wave IV represents a short-term recovery before transitioning into the final downward wave V. If the price does not break out, it is likely to test levels below $140.

Invalidation Level: If the price breaks $280, the wave structure needs reassessment.

Trading Strategies:

For Short-Term Traders (Swing Trade):

Sell when the price approaches the $180 – $200 range and shows signs of reversal.

Risk Management:

If the price breaks above $280, the structure is incorrect and requires reevaluation.

Elliott Wave Analysis – TradingLounge H4 Chart

AAVE/USD (AAVEUSD) Elliott Wave Technical Analysis

Function: Trend Following

Mode: Motive

Structure: Impulse

Position: Wave III

Next Higher Degree Direction: Downtrend Continuation

Wave Cancelation Level: Not Specified

Analysis Details:

AAVE continues its downward correction after reaching a high of $399. The wave structure confirms the development of a downward five-wave sequence (1)-(2)-(3)-(4)-(5).

AAVE/USD Trading Strategy

AAVEUSD is still in a clear downtrend, with wave IV acting as a temporary upward correction before the final wave V decline. If the price remains below key resistance levels, it is likely to test support below $140.

Invalidation Level: If the price surpasses $280, the structure must be reassessed.

Trading Strategies:

For Short-Term Traders (Swing Trade):

Look to sell when the price nears the $180 – $200 range and then reverses.

Risk Management:

Any movement above $280 suggests the need for structural reevaluation.

TradingLounge Analyst: Kittiampon Somboonsod, CEWA

More By This Author:

Master Market Trends: Elliott Wave Trading On S&P 500, Nasdaq, DAX, FTSE & ASX200

Elliott Wave Technical Analysis: Block, Inc.

Elliott Wave Technical Analysis: AbbVie Inc. - Wednesday, March 19

At TradingLounge™, we provide actionable Elliott Wave analysis across over 200 markets. Access live chat rooms, advanced AI & algorithmic charting tools, and curated trade ...

more