Why Deflation Is Coming?

Image Source: Pixabay

We have been observing for many months as the world's central banks try to struggle with inflation. It has been portrayed as the most dangerous problem they must solve whatever the cost. But in “fierce battle “ they can face more insidious trouble - deflation

Deflation is a general decline in prices for goods and services, typically associated with a contraction in the supply of money and credit in the economy. During deflation, the purchasing power of currency rises over time. Periods of deflation most commonly occur after long periods of artificial monetary expansion. The early 1930s was the last time significant deflation was experienced in the United States. The major contributor to this deflationary period was the fall in the money supply following catastrophic bank failures. Other nations, such as Japan in the 1990s, have experienced deflation in modern times.

In general, deflation is eliminating the debt that has been accumulated during credit expansion (artificial monetary expansion). The burden of debt becomes unservable and the economy and markets crash. Below we can find some charts that show the deflation collapse is at the corner.

1. Consumer loan on the highest level:

But savings on the lowest since 2013:

2. Sharpe reduces the money supply. The yellow line is the inflation:

3. Fed is absorbing liquidity:

Fed balance sheet:

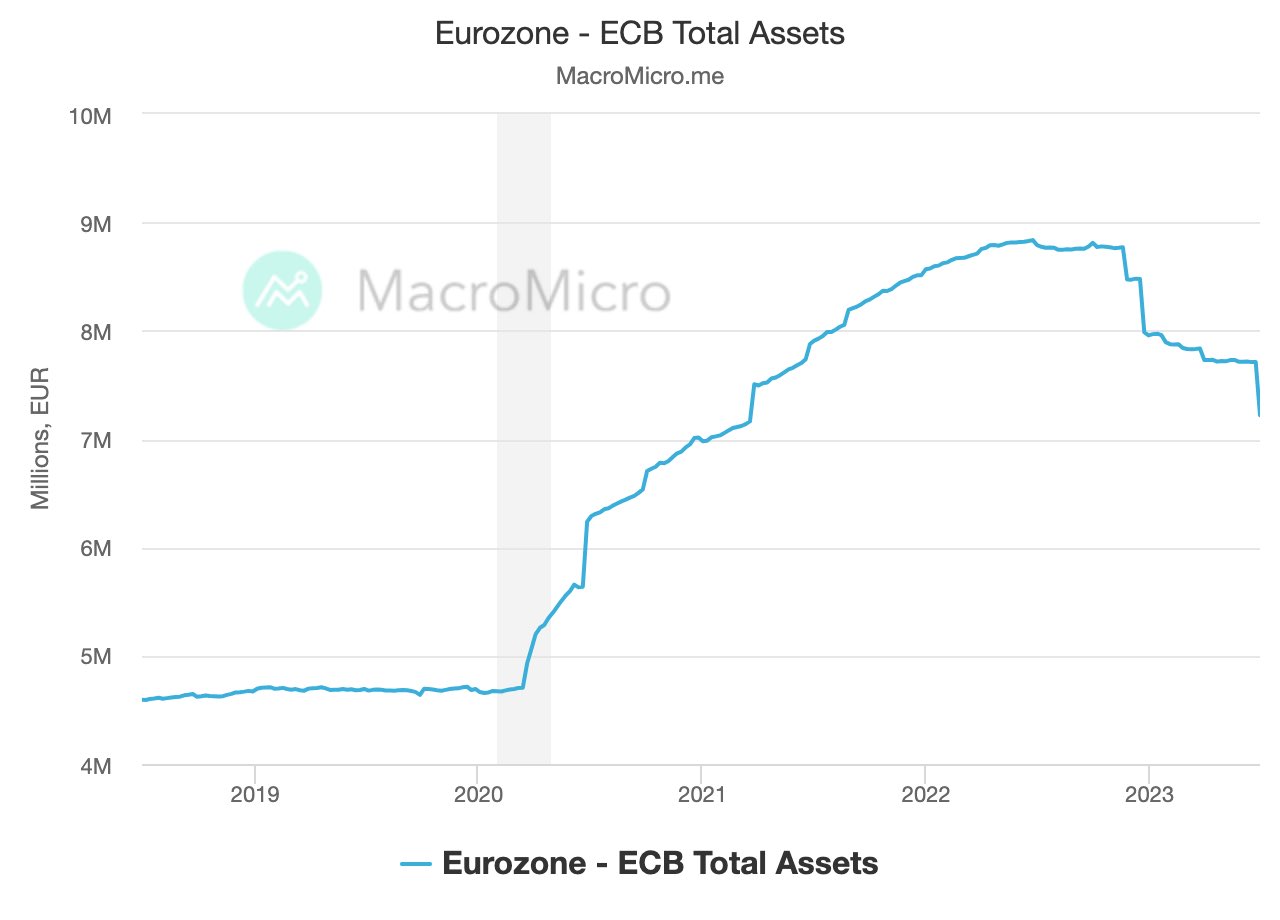

ECB balance:

4. The lending indicators are near or in deflation. For example PPI:

5. The probability of a recession:

6. Yield curve inversions (economic indicator).

There are many other charts and indicators that point out the coming deflation collapse. Understanding the exact type of recession can help us to be prepared for future events.

More By This Author:

Gold: Should We Wait For A Medium-Term Decline?

Brent (Crude Oil): Long-Term And Medium-Term Forecast

Medium And Long-Term Forecast: Dollar Index And Euro Dollar

Disclaimer: My opinion is provided as general market information and do not constitute investment advice