Medium And Long-Term Forecast: Dollar Index And Euro Dollar

At the end of September, the dollar index (DXY) reached its highest level since 2002. EUR-USD dropped below parity.

Many investors anticipated the continuation of the dollar growth, but something went wrong and the price reversed. We could witness how sentiment works. When 90%-80% of traders or investors are sure in the future the growth of markets will reverse

What will happen in the long-term and middle-term prospects? Let’s try to find out.

DXY. I suppose the dollar has good prospeсts. In my opinion, the dollar is on the verge of ending wave ((ii)), which was the correction of all growth since 2021. You can see the main targets.

EUR/USD

Weekly Chart

Wave 2 is very likely over. Now is quite an important moment because we are testing a long-term trend.

Daily chart

In more detail. In the coming weeks, it is important to make a serious impulse in the wave ((i)).

Optimism against the dollar is associated not only with fundamental factors but also cyclical. On April 14 or May 4 (a run-up because the "double bottom" model turned out), the minimum of the medium-term cycle was very likely set much earlier than expected (the end of May - the first half of summer) and, accordingly, the bottom of the annual cycle. This is a strong bullish signal, especially since the short-term cycle is strongly shifted (in favor of the dollar). In this case, we expect a rapid strengthening of the US currency, an additional confirmation will be the formation of a more serious impulse (in the charts above) and overcoming important levels.

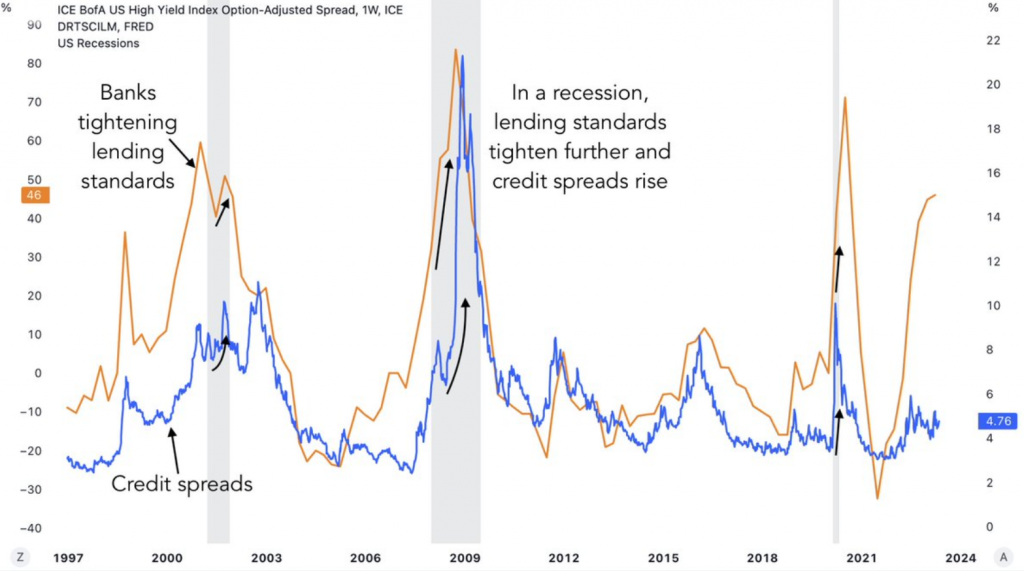

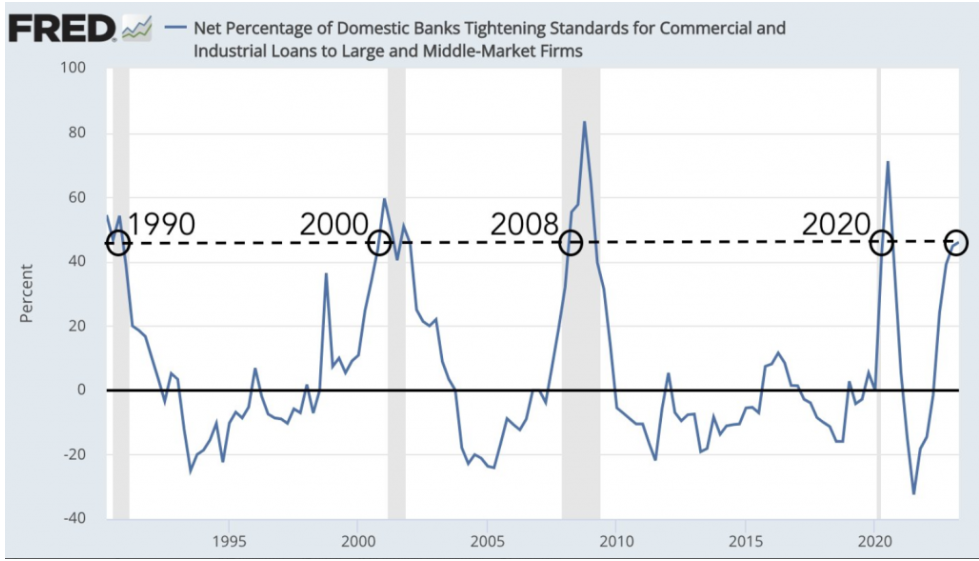

An important fundamental factor is the tightening of "credit standards" and "financial conditions". This has always led to serious crises.

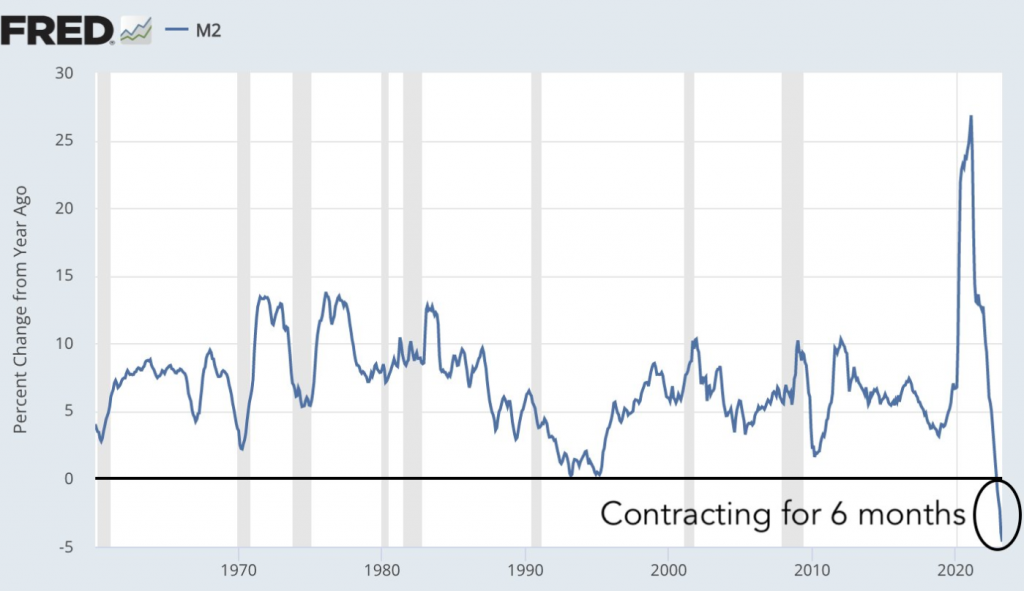

M2 is shrinking rapidly, a credit crunch in 2023 is just a matter of time.

Conclusion:

The situation has cleared up, and all the fundamental and technical factors are in favor of the dollar's growth. With a high degree of probability, we can say that the medium-term trend has changed and on 14.04 or 04.05, the minimum of the annual cycle for the dollar index was set. There may be local pullbacks in the short term, but no more.

More By This Author:

S&P500 And US Stock Market Forecast

Bitcoin Is On The Verge Of Collapse

Disclaimer: My opinion is provided as general market information and do not constitute investment advice