S&P500 And US Stock Market Forecast

The medium- and long-term forecast of a serious fall remains in force, but so far there is no confirmation of its beginning, we are focusing on the above levels. Technically, we can still show a small increase, fundamentally the situation is unstable and the fall can begin at any moment. There are serious problems in the banking sector , the prospects of a recession . In previous reviews, the inversion of the yield curve (US government bonds) was mentioned more than once, at the moment the situation is only getting worse. Sooner or later, it will begin to return to a "normal state", which will be the beginning of an sharp phase of the crisis.

Weekly chart

The important level is 4326 , if we pass, it means that wave (2) has not ended yet.

Daily chart

The same thing, only in more detail. To confirm the decline, first you need to pass the trend (blue), then the mark 3901 and return to the channel.

5-hour chart

There is a correction ((a)) — ((b)) — ((c)) in 2 , or it has passed ((a)) — ((b)) and now it is (i) in ((c)) in Y

DJ

Approximately the same thing, it is not yet clear whether the wave (2) has ended.

Moving averages

Weekly schedule

MA200 (blue) MA100 (red) MA50 (black)

We are testing the MA100 in the area of 4200 .

Day chart

The nearest MA level is 50 — 4082 . There are divergences, although the RSI is not in the overbought zone.

Fundamentally, the situation remains extremely precarious. There are serious problems in the banking sector , the prospects of a recession . In previous reviews, the inversion of the yield curve (US government bonds) was mentioned more than once, at the moment the situation is only getting worse. Sooner or later, it will begin to return to a "normal state", which will be the beginning of an acute phase of the crisis.

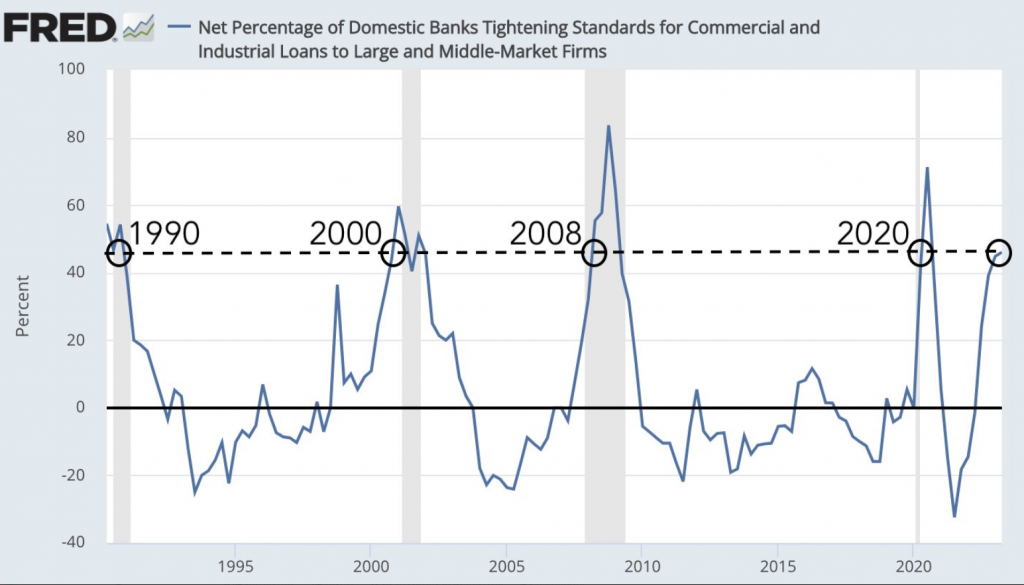

Banks continue to tighten lending standards.

The M2 money supply has been shrinking since December 2022. The credit crisis in 2023 is just a matter of time.

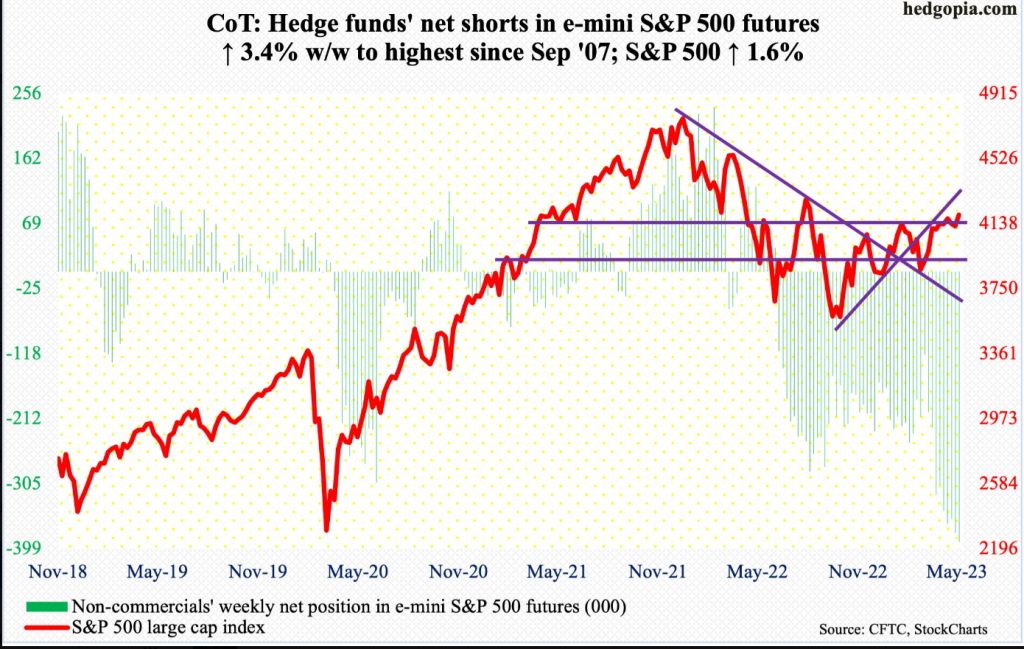

Despite the growth, hedge funds are only increasing their shorts. There must be some kind of discharge.

Conclusion: Technically, there is still room to grow, fundamentally the situation is unstable and the fall can begin at any moment. Perhaps the trigger will be a discussion about the US government debt ceiling. The medium- and long-term forecast of a serious fall remains in force , but so far there is no confirmation of its beginning, we are focusing on the above levels.

Disclaimer: My opinion is provided as general market information for educational and entertainment purposes only, and do not constitute investment advice