Where Are The Bond Vigilantes?

“No one really knows at what level a government’s debt begins to hurt an economy; there’s a heated debate among economists on that question. If interest rates remain low, as currently anticipated, the government can handle a much heavier debt load than was once thought possible. And the recent increase in borrowing—while enormous—is a temporary increase intended to combat an emergency; it changes the level of the debt, but not its long-run trajectory.” (David Wessel, How worried should you be about the federal deficit and debt? July 8, 2020)

How worried should we be about high government debts? Where are the bond vigilantes which usually upset markets?

Is government debt at a global level a real problem, or does it depend upon the specific country that is indebted? Does the surge in government borrowing at close to zero interest rates really matter?

At this time, the large-scale government debts of the advanced economies and which are supported by central banks to fight the pandemic recession are not seen to be a major problem.

Indeed, the US, European and Canadian governments are borrowing vast amounts of money at extremely low-interest rates, and one cannot make the argument that private sector borrowing is being crowded out either by having to pay higher interest rates or because they have no room to borrow.

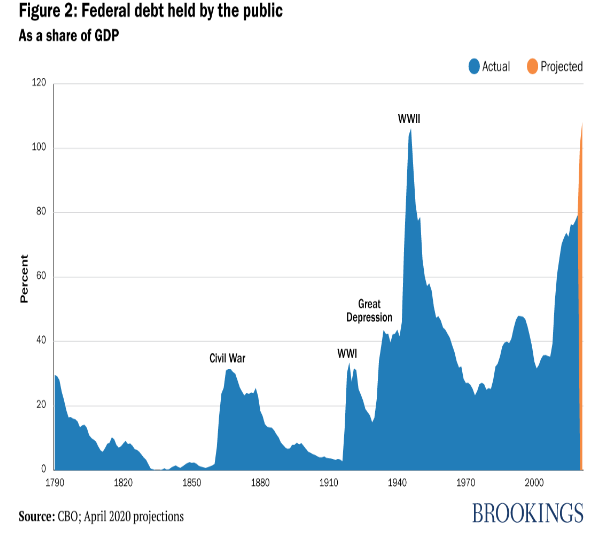

Here is an example of how quickly US government debt has increased. Measured against the size of the US economy, the US government debt was around 35% of GDP before the Great Recession of 2007–09 and increased to nearly 80% of GDP just before the pandemic began.

The US federal debt percentage is heading to around 100% of GDP this year. It likely will continue to rise next year and shortly exceed the record set in 1946 of 106.1% of GDP.

With respect to central bank financing of US government debt, in 2010 the Federal Reserve held about 10% of all Treasury debt outstanding; today it holds more than 20%.

Aside from the worry that huge government borrowing will eventually trigger higher inflation, in the current anti-inflation environment, we should welcome a future of higher inflation as a sign of a sustainable economic recovery.

For example, the US treasury has been borrowing trillions of dollars on the global financial markets at exceptionally low-interest rates, and there doesn’t appear to be much private-sector borrowing that is being crowded out by the treasury borrowing.

It is obviously clear to the financial markets that the massive US government debt isn’t seen to be a problem.

Indeed, the fact that global interest rates remain incredibly low while governments around the world are borrowing heavily to fight the COVID-19 recession suggests that there is still too much savings around the world, more than is needed to finance private investment.

Nonetheless, while government spending may be regarded as today’s savior during the pandemic, some economists still believe that the massive increase in borrowing will create significant challenges in the future.

Here is why one hopes the fiscal challenge will be manageable. As the US economy bounces back from the recession, tax revenues will rise and government spending will fall, thus helping to bring the deficit and debt down. Hopefully, this would restore more confidence in US public finance.

Moreover, in the past, the bond markets were an ultimate check on government borrowing by pushing up yields on bonds. Today we are not seeing any sign of this. That is, the bond vigilantes are properly quiet.

And while the recent increases in debt seems manageable, the federal debt cannot indefinitely grow faster than the economy. Economic recovery will come, even if it is delayed to 2022. The recovery will inevitably put pressure on central banks to raise interest rates creating a clash with governments that will face significantly higher borrowing costs. Central banks may find their independence challenged as a result.

(Click on image to enlarge)

(Click on image to enlarge)

Arthur you're mixing a stock with a flow when you start comparing outstanding debt to GDP. There's no criteria to judge the burden of debt in that way

With 17 trillion dollars of debt trading at negative interest rates the bond market is giving an opposite signal. Namely that deflation is the order of the day. The Bond vigilantes have spoken.

Good point.