We Should Not Be Surprised That The Phillips Curve Has Broken Down

It takes a long time for economists to recognize and concede that a theory is no longer valid. This is certainly the case when it comes to understanding the relationship between falling unemployment rates and wage gains---- the Phillips curve made famous by William Phillips in the 1960s. The curve has become a cornerstone of policy making for all central banks, however, it now a major headache as the real world does not seem to conform to the theory.

Phillips identified an inverse relationship between wage gains and unemployment over a one-hundred-year period. As the unemployment rate fell, wages rose to attract workers. The theory then was extended to measuring the relationship between unemployment and inflation---- prices rise when unemployment falls and goes in reverse when prices fall. The data mapped a smooth non- linear curve that is taught to every first-year student in economics.

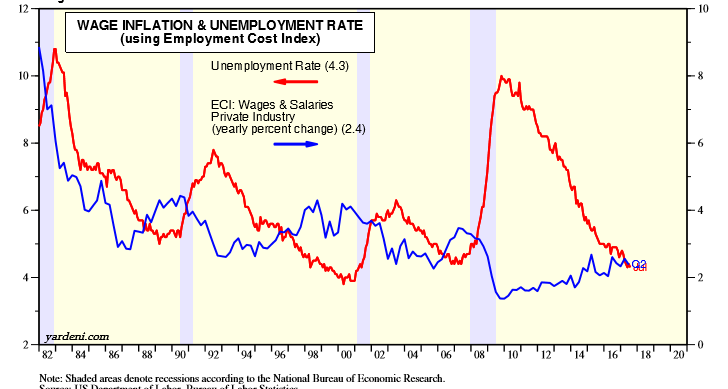

As Figure 1 demonstrates, this correlation held up very well for decades until around 2010 when the unemployment rate started to fall dramatically without any increase in wage rates.

Figure 1 US Wage and Unemployment, 1982-2016

Those who maintain that the Phillips curve model continues to be valid pointed out it “is just a matter of time” before wages accelerate. We should expect lags in wage gains as they adjust to a tightening employment market. We must be patient. Central banks, on the other hand, must be able to anticipate price movements in the future and they must not be influenced by current muted wage gains. Yellen has made statements that inflation will return to the 2% target rate in “the medium term” in support of the Fed’s position that monetary policy needs to tighten. The Bank of Canada has joined the chorus of bankers who have labeled the recent decline in price gains as “transitory” in its most recent policy decision to raise the bank rate.

Patience is not needed. Instead, we should acknowledge that there are some very fundamental changes in the industrialized economies that render the Phillips curve less effective in setting policy, such as:

- Labour unions no longer dominate the labor markets; union power has been on the wane for more than two decades; traditionally strong unionized industries e.g. manufacturing, have diminished in relative importance;

- Labour shortages are being addressed by the introduction of robots, often at a much lower cost than would be incurred in relocating and training workers; robots are expected to continue to push down the cost of manufacturing;[1] and,

- The emergence of China as a major supplier of manufactured goods has shifted the labour supply curve to the right; that is, there are many millions of industrial workers in Asia who are prepared to supply goods to North America and Western Europe for wages that are a fraction of those in the industrialized nations; there is no sign that this trend is reversing.

William Phillips examined his world in the immediate post-WWII era. At that time the United States was a relatively a closed economy, relying very little on international trade. Unions represented a larger share of the employed workers and commanded considerable bargaining power especially in the automotive and related industries. Robots were just in the realm of science fiction. China was a backward nation that posed no economic threat to its neighbors let alone the rest of the world.

As Bob Dylan famously said, “The times are a changin’ “.Now it is time for central bankers to recognize these changes and that the Phillips curve theory is no longer applicable.

[1] https://www.bloomberg.com/news/articles/2017-08-22/china-s-robot-revolution-may-weigh-on-global-rebalancing

Disclosure: None.

Good article. It certainly gives us something to think about. It reminds me of the book, The affluent Society. The simple fact is there is now less work than people and I don't see it changing in our lifetime.

I agree. Thanks for your comment.