The External Environment And Prospects For GDP Growth

As noted by Jim Hamilton in his post on the 2022Q3 GDP release, exports and imports accounted (mechanically) for more than 100% of 2022Q3 GDP growth:

Figure 1: Top panel: GDP growth (blue); Bottom panel: consumption, investment and government spending (blue bar), exports (tan), imports (green), all in %, q/q SAAR. Source: BEA, 2022Q3 advance release and authors calculations.

Increase in real exports of goods and services, and decreases in real imports, accounted for 2.8 ppts of the 2.6 ppts of growth, q/q SAAR. Domestic components (C, I, G) fell from a big contributor of overall growth in 2021 Q4, to a small negative in Q3.

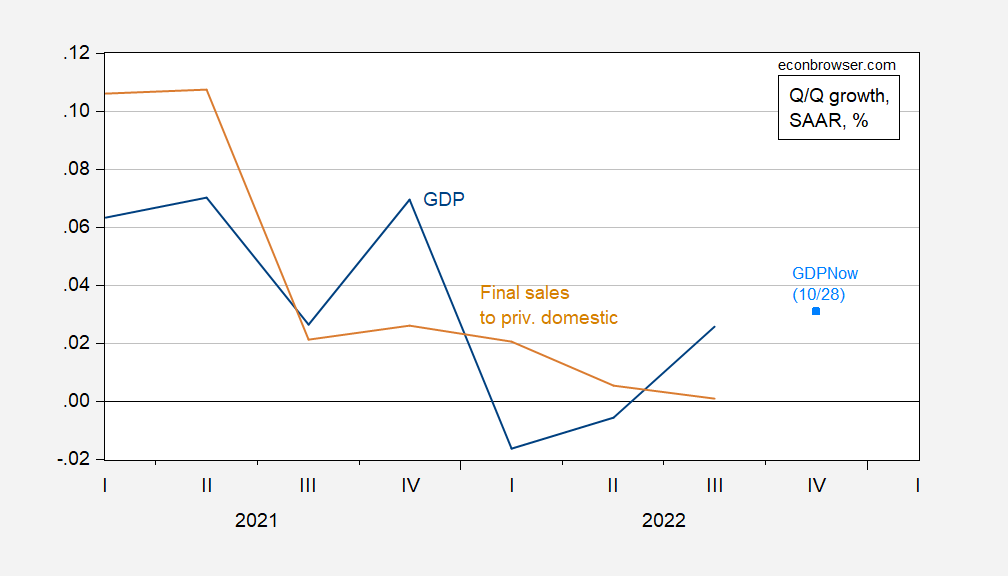

In other words, the domestic component of aggregate demand is waning in strength, and this is further confirmed by a picture of q/q growth in final sales to private domestic purchasers, as compared to GDP.

Figure 2: Real GDP growth (blue), GDPNow forecast of 10/28 (sky blue square), real growth of final sales to private domestic purchasers (tan), all in %, q/q SAAR. Source: BEA, 2022Q3 advance release, Atlanta Fed, and authors calculations.

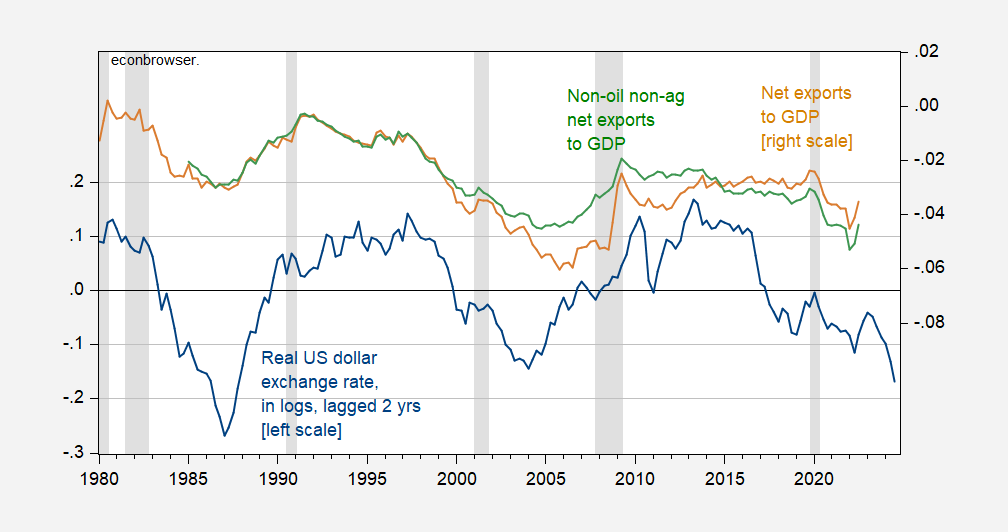

How is the external environment likely to impact GDP? Here’s a picture of net exports (total, ex-agric. exports, ex-oil) to GDP, against the evolution of the real dollar exchange rate.

Figure 3: Real US dollar trade weighted exchange rate in logs, lagged two years (blue, left scale), net exports to GDP (tan, right scale), net exports ex-agriculture, ex-oil, to GDP (green, right scale). NBER peak-to-trough recession dates shaded gray. Down in exchange rate denotes dollar appreciation. Trade weights exports of goods through 2015, exports of goods and services thereafter. Source: Federal Reserve via FRED, BEA 2022Q3 advance, NBER, and author’s calculations.

The rebound in Q3 is in part attributable to the weakening of the currency back in 2020Q3. This graph shows that net exports will probably deteriorate again in the near future as dollar appreciation feeds through into deteriorating competitiveness.

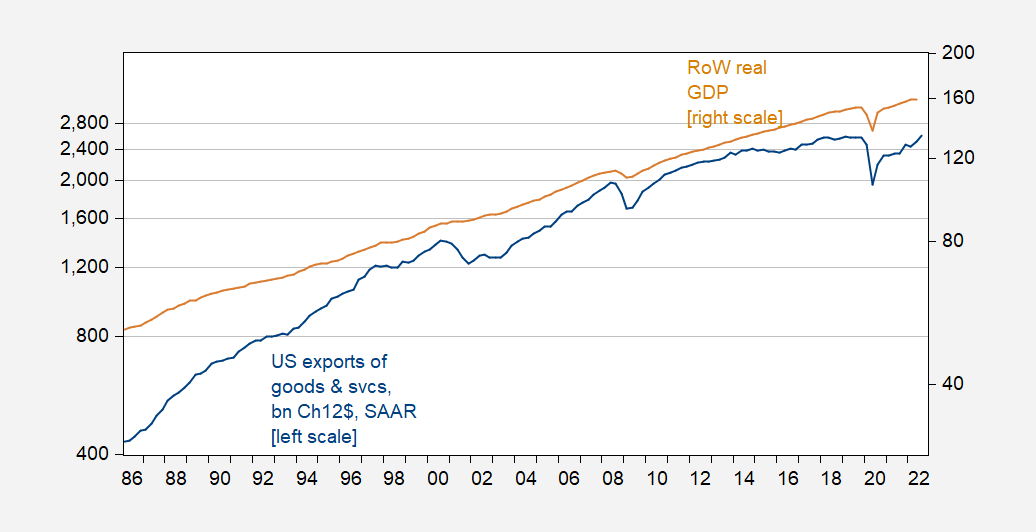

Exports also depend on foreign economic activity, as discussed in these posts. This is shown in Figure 3 below.

Figure 4: US exports of goods and services, bn.Ch.12$ SAAR (blue, right log scale), rest-of-world export weighted GDP (tan, right log scale). Source: BEA 2022Q3 advance, Dallas Fed Database of Global Economic Indicators.

The long run relationship between exports (expgs), rest-of-world GDP (y*) and the real exchange rate (q) is:

expgs = 1.1 y* + 1.43 q

For 1986-2022Q2, estimated using Johansen maximum likelihood method. This is a slightly lower income elasticity and higher price elasticity than reported in Chinn (2010), but encompasses a later sample than reported there.

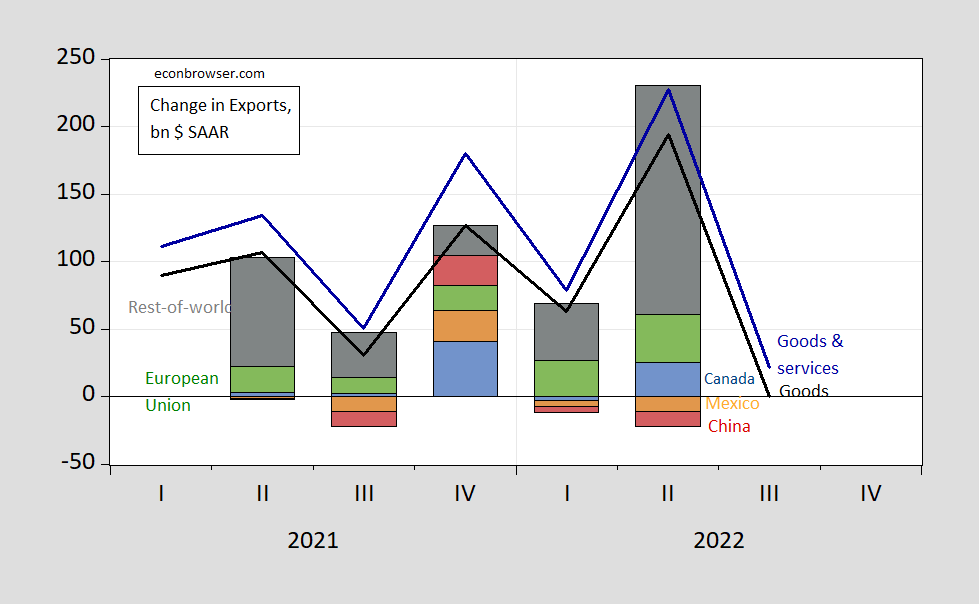

We can show the geographic contributions to q/q changes in goods exports, at least through Q2.

Figure 5: Change in nominal exports of goods and services (blue), of goods (black), goods to rest of the world (gray bar), European Union (green bar), Canada (blue bar), Mexico (tan), China (red), in billions $, q/q SAAR. Source: BEA 2022Q3 advance, BEA/Census International Trade release, author’s calculations.

While we (rightly) worry about China, the direct aggregate demand emanating from China for US goods is small (the indirect, through the rest of the world is likely not so trivial). So far, Canada and European Union has contributed measurably to exports of goods. A slowdown in the European Union should then be more worrisome insofar as there is a direct impact on US exports of goods.

October 2022 IMF World Economic Outlook forecasts are for 2.2%, 1.3% for Canada in 2022, 2023, 2.4%, 1.2% for Mexico, 1%, 1.4% for Euro Area (not EU), and 4.3% and 2.6% for China.

More By This Author:

Reminder: “Recession” Is Not The Same As “People Are Unhappy”Global Repercussions Of The Strong Dollar

Two Days Before GDP Q3 Release: What Remains Of The 2022H1 Recession Thesis?