Net Zero: Time Is Of The Essence

At Glasgow’s COP26, banks, insurers, and investors representing USD 130 trillion in private capital made a historic commitment through the Glasgow Financial Alliance for Net Zero (GFANZ) to achieve net zero emissions by 2050 at the latest,1 mirroring government pledges.

The question remains how to integrate these commitments into a simple, transparent solution with limited impacts on portfolio construction and in line with investors’ needs to attain both a climate and investment objective.

Inspired by the same paper GFANZ has recently recommended for tackling this problem,* S&P Dow Jones Indices (S&P DJI) has launched the S&P Net Zero 2050 Carbon Budget Indices, a series of benchmarks that reflects net zero alignment in a simple and innovative way. This series complements the S&P PACT™ Indices (S&P Paris-Aligned & Climate Transition Indices). Unlike the S&P PACT Indices, this series was developed with a sole focus on aligning with the specific net zero assessments published by the Intergovernmental Panel on Climate Change (IPCC) on achievement of the Paris Agreement and does not align with the strictures of the European Union benchmark regulations for the use of the label EU Paris-aligned benchmark, which requires a specific decarbonization trajectory and other elements of ESG such as governance standards and business involvement screens.

Our methodology is simple and based on the following principle: the same approach for reducing greenhouse gas emissions for the planet can also be applied to all forms of diversified financing.

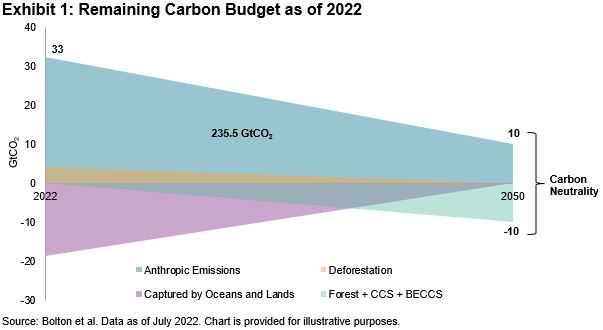

In other words, all types of financing, including equity, debt and other securities that compose benchmarks, can collectively reflect—as well as support or detract from—progress toward the goal to remain within a global carbon budget that would keep global warming at or below 1.5°C with an 83% probability (according to a 300 GtCO2 budget with a starting point of 31.5 GtCO2 in 2020).

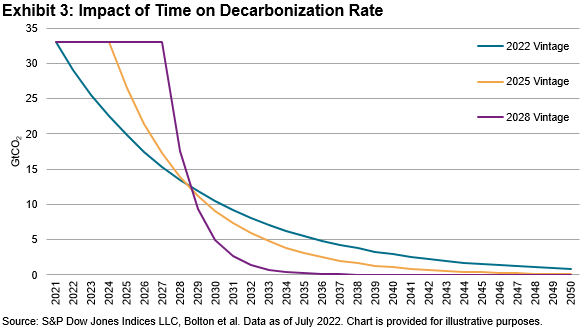

The S&P Net Zero 2050 Carbon Budget Index Series, a series of broad benchmarks reflecting a diversified portfolio, aligns with the IPCC approach by allocating a carbon budget across index constituents based on their total emissions, defined by Scopes 1, 2 and 3 emissions calculated by S&P Global Trucost. The sum of the yearly carbon budgets will mirror the trajectory necessary to be carbon neutral, given the current year and the decarbonization required considering these variables. In the case of the initial “2022 Vintage” in this index series, an approximately 10% annual reduction will be required after a 25% initial haircut to align with net zero by 2050. We anticipate releasing other vintages of indices that will target a net zero outcome based on the carbon budgets and years to 2050 at launch.

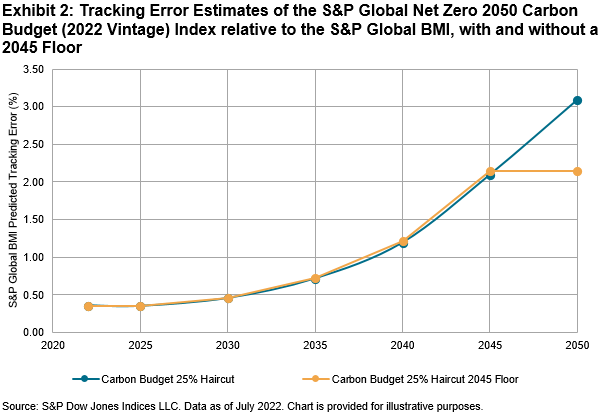

Furthermore, the approach has limited index construction impacts, as illustrated by a low tracking error to general equity markets. For instance, the S&P Global Net Zero 2050 Carbon Budget (2022 Vintage) Index had a tracking error of 0.36% at launch in 2022, which is anticipated to rise to 2.10% in 2045 and 3.09% in 2050.2

The tracking error, which is projected to rise closer to 2050, can be further mitigated by imposing a carbon reduction floor near 2045. By this time, the index is projected to be over 90% decarbonized and the tradeoff between further reductions in emissions and higher tracking error may not make sense for certain investors.

Finally, with industry neutrality targeted within the methodology, weight is reallocated within each industry toward the lowest carbon emitters, creating competition among peers toward reducing emissions toward 2050, for the benefit of the planet.

But time is of the essence. If being carbon neutral in 2022 means reducing the volume of CO2 by 12% per year (without an initial 25% haircut), this would become 20% in 2025 and impossible by the end of the decade, based on the current levels of emissions.

In conclusion, S&P DJI has applied the approach of the IPCC to keep global warming at or below 1.5°C with an 83% probability in a clear and transparent manner, with limited impacts on portfolio construction, with the aim of helping companies live by their historic GFANZ commitments for the benefit of financial markets and the planet.

*GFANZ recently highlighted the decarbonization approach (which is central to the S&P Net Zero Carbon Budget Indices methodology) in its publication “Measuring Portfolio Alignment” (see page 10). This is available at www.gfanzero.com. This publication refers to a paper by Bolton, P., Kacpercyzk, M., Samama, F., “Net-zero carbon portfolio alignment”, Financial Analysts Journal, Volume 82, Issue 2, 2022.

1 “Companies managing private capital totaling $130tn set commitments aligning with the goals of the Glasgow Financial Alliance for Net Zero,” https://www.gfanzero.com/press/amount-of-finance-committed-to-achieving-1-5c-now-at-scale-needed-to-deliver-the-transition/

2 The simulations assume constant emissions from companies, constant variances of risk factors, constant covariances between risk factors and constant index constituents.

More By This Author:

Commodities Take A Break Over The Northern Hemisphere SummerDefense In The Balance

S&P U.S. Indices Mid-Year 2022: Analyzing Relative Returns To Russell

Disclaimer: See the full disclaimer for S&P Dow Jones Indices here.