Defense In The Balance

Balanced portfolios traditionally (and definitionally) hold a mix of stocks and bonds. Stocks have been the better-performing asset over time, but with a level of volatility that many investors find unacceptably high. Although bonds are usually included in a balanced portfolio more as a volatility dampener than a return enhancer, during the bull market in bonds that began in 1981, such defensive allocations did not require a major sacrifice in returns.

And then, 2022 happened.

In the first half of the year, investors were confronted with both falling stock prices (the S&P 500® declined by 20.0%) and rising interest rates (the 10-year U.S. Treasury rate more than doubled). After a respite in, the same unfortunate combination has returned in August. The prospect of rising interest rates has led to increasingly bearish sentiment; in such an environment, investors may need a source of defense beyond bonds.

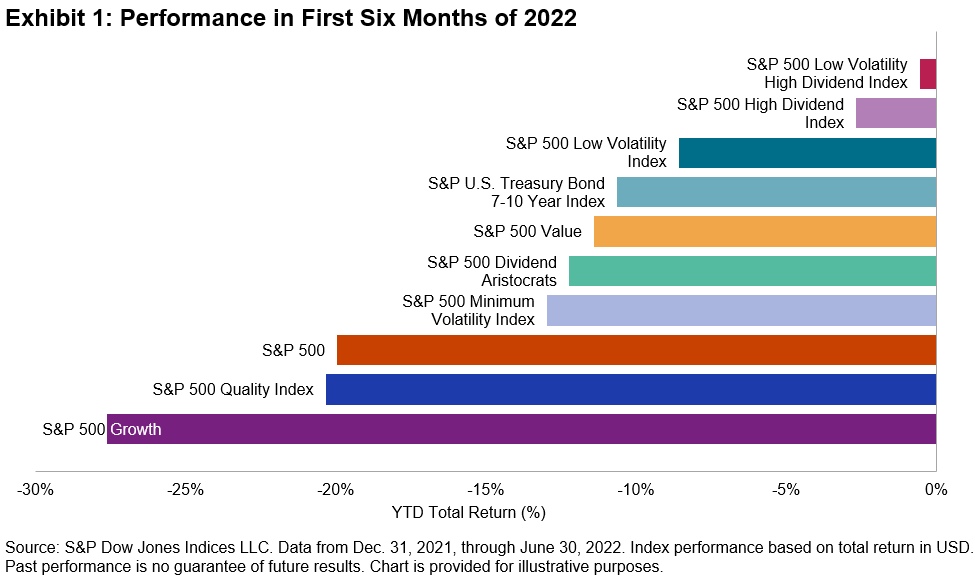

Defensive factor indices are designed precisely to perform this function. They can be characterized by what I like to call the “two Ps”—protection and participation. Defensive strategies, in other words, aim to mitigate losses in a declining market, while also participating in rising markets. Exhibit 1 shows that many factors were successful in attenuating the S&P 500’s losses in the first six months of the year; some even outperformed the bond market.

(Click on image to enlarge)

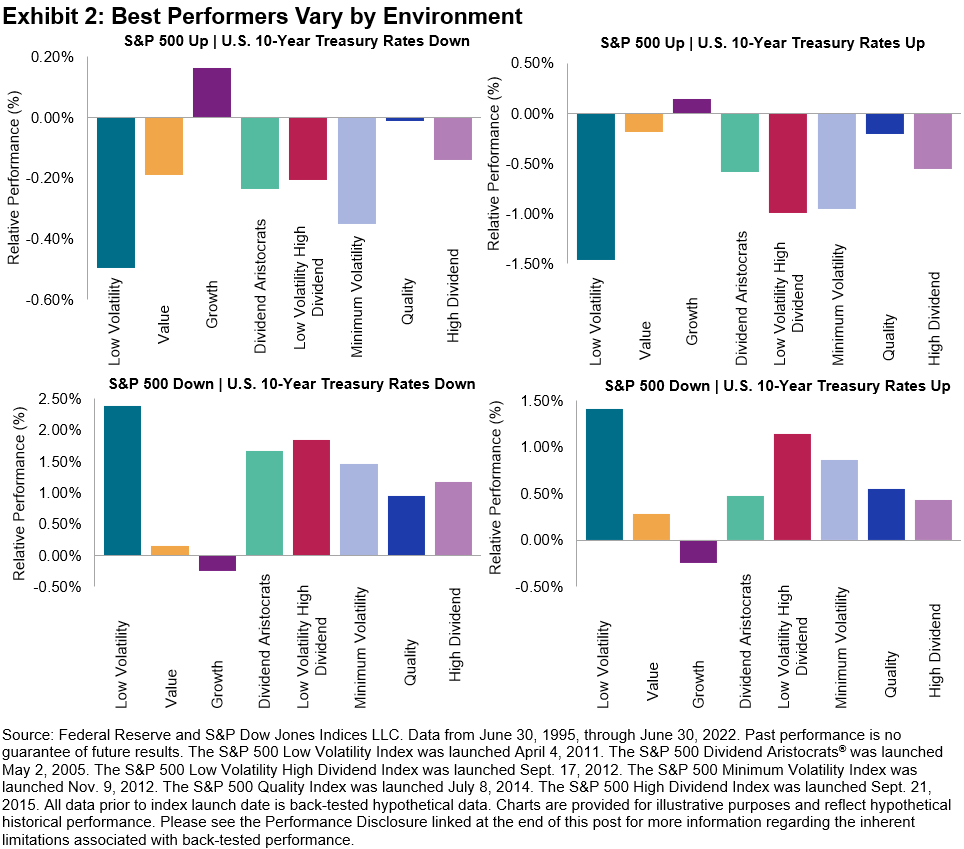

This effect was not an anomaly. Exhibit 2 shows the long-term history of the same set of factor indices. We observe relative performance in four distinct sets of months, separating rising stock markets from falling stock markets and rising interest rates from falling interest rates.

(Click on image to enlarge)

The most important observation about these scenarios is that the direction of the stock market matters much more than the direction of the bond market. Otherwise said, each panel looks more like the panel to which it is horizontally adjacent than the panel to which it is vertically adjacent. In months when the S&P 500 fell, Low Volatility and Low Volatility High Dividend were the best relative performers, and Growth was the worst, regardless of whether interest rates were rising or falling.

This means that a balanced portfolio might achieve two benefits by substituting a defensive factor index for a comprehensive market index such as the S&P 500. Most directly, if equity prices weaken, it’s likely that defensive factors will mitigate the damage to the portfolio’s return. Secondly, using a defensive factor for part of the equity allocation will reduce equity’s contribution to the balanced portfolio’s volatility. This means that the portfolio’s bond allocation can be reduced without adding to overall portfolio volatility. If interest rates continue to rise, reducing bond exposure may become an additional source of portfolio return.

More By This Author:

S&P U.S. Indices Mid-Year 2022: Analyzing Relative Returns To Russell

The Case For Dividend Aristocrats In Pan Asia

S&P 500 GARP Index: Growth at a Reasonable Price Anyone?

Disclaimer: See the full disclaimer for S&P Dow Jones Indices here.