Ignore PMI

PMI is purely emotional as it so often contracts the actual data

“Davidson” submits:

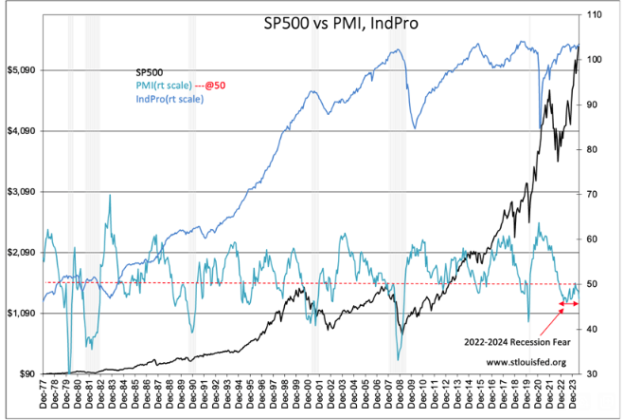

The PMI for manufacturing declined to 46.8 for July making this a straight 21mos of recession prediction for this indicator. My analysis indicates that the PMI below 50 is an excellent market sentiment indicator to use to buy well managed companies selling at a discount to their financial records. Today’s PMI is in stark contrast to the rise in Industrial Production recently reported which is based on measured economic output as opposed to a purchasing manager sentiment survey. A quick scan of the PMI history shows it calling for recession far more often than we have one. By my count, the PMI has indicated recession 27 of the last 9 recessions and often it called a recession after the fact. The most recent reads for IndPro have indicated an uptick after being flat for several months holding near record levels. Other economic indicators agree that the US economy remains in an uptrend and is still recovering from the COVID lockdown.

The PMI is a very good market sentiment indicator which should be acted upon with well-managed companies selling at decent discounts to their financial records. Some of these companies remain heavily discounted today. When we have such a disparity between sentiment vs economic trends, the investment opportunities presented can prove exceptionally attractive.

(Click on image to enlarge)

More By This Author:

Fed Cut? Not Now, But Soon

Sentiment And Reality Continue To Diverge

When Will The Fed Cut

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or ...

more