When Will The Fed Cut

Image source: Pixabay

“Davidson” submits:

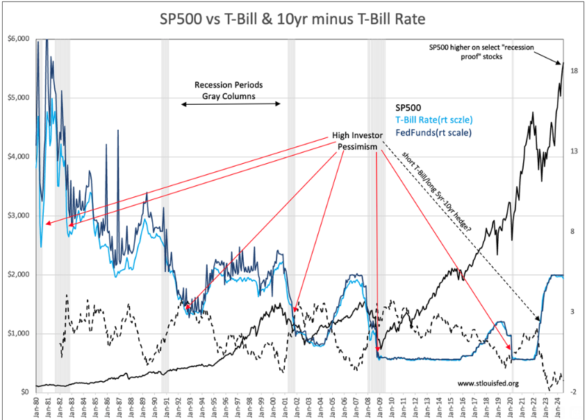

The question of the day and every day going back 18mos or so is, “When will the Fed cut rates?”. The Fed Funds rate is currently 5.33% with T-Bills priced at 5.2%. Fed Funds are above short-term rates by a margin the current Fed Chair believes is sufficient. Historically, the Fed keeps the Fed Funds rate above T-Bill market rates. My historical analyses shows that, but for Paul Volcker’s tenure when he actually led in setting rates to quash an inflationary spiral in the early 1980s, other Fed Chairs have followed the direction of T-Bill rates by several weeks once they were sure a trend had begun. They keep a net margin above T-Bill rates tomaintain flexibility and not act too quickly should rates rise suddenly. The Fed has never dissuaded investors from believing that they are in charge of rates and the overall direction of the economy even though history provides ample evidence that the Fed follows and rarely leads. The evidence of the Fed missing signals of excess in markets and the economy coincides with every unexpected recession the Fed did not see ahead of time. There is a long history of misses. The Fed believes, in my opinion, that fostering the belief that the “Fed is in charge” is positive for market psychology and it also keeps the politicians at bay from being overly critical.

The many calls for the Fed to cut rates are misplaced today. I see strong evidence of a recession hedge by institutional investors for which they have shorted T-Bills driving these rates to unusually high levels during a period of strong market pessimism. The Red Arrows point to periods when high pessimism in the past resulted in a drop in T-Bill rates as investors moved capital to safety. That pessimism has resulted in a T-Bill rise this time combined with over-crowding into ‘too big to be hurt by recession’ high tech issues indicates that we have a major recession bet by institutions. The shorting of T-Bills has been so dominant that it has offset the record influx of capital by retail investors seeking safety. The call for rate cuts will only be fulfilled should T-Bill rates decline enough for the Fed to lower the Fed Funds rate. One can see how closely in the chart Fed Funds tracks T-Bills. This is monthly data. It is in the detail of weekly data that shows Fed Funds lagging the direction of T-Bills both as rates rise and decline.

For the T-Bill rate to fall, we must see either a reversal of the institutional hedge or we must see retail investors panic enough to counter the current shorting by institutions. Once that occurs enough and seems to indicate a new lower rate we will see the Fed cut the Fed Funds rate. In taking off the hedge, the institutions must also sell the 10yr Treasury, meaning 10yr rates will rise. They will only do so if they have changed their outlook away from recession and towards a rising economy and believe that buying the industrial and energy stocks that they have shunned In recent years have become more attractive.

The Fed will cut its rate once the T-Bill rate declines and stabilizes long enough at a lower rate for the Fed to believe it can follow and not get ‘egg on its face’ with a sudden rate reversal. Watch T-Bill rates and it will be clear what direction the Fed will take ahead of time.

No Fed Funds rate cut till T-Bill rate declines enough to give the Fed cover. What is interesting is the wholesale shift higher the past week of industrials and energy issues without any headlines providing justification. This may be a major market turn Value Investors have been waiting for. This bears close watching.

More By This Author:

Sentiment Can Change… FastConstruction Spending Rises To Record

Self-Employment Collapses

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or ...

more