Fed Cut? Not Now, But Soon

Image source: Pixabay

Remember, the Fed actually follows rates contrary to what most believe.

“Davidson” submits:

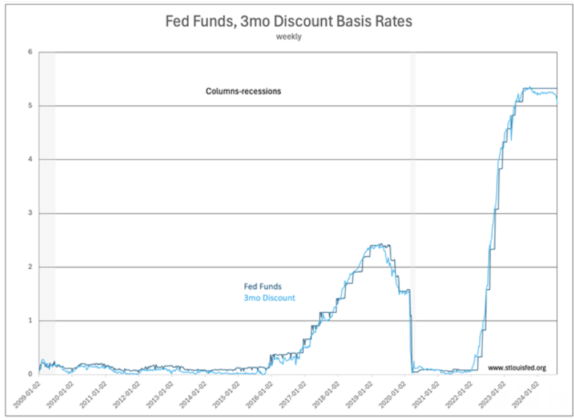

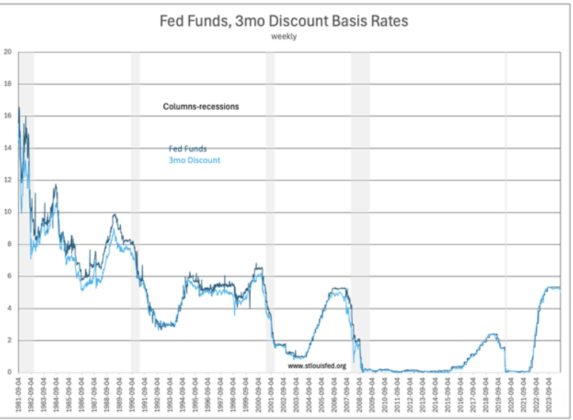

The relationship between the Fed Funds rate and market rates has long been misunderstood by my analysis. We have many decades of belief that the Fed adjusts the Fed Funds rate to maintain economic stability/activity. The data does not support this belief. Two charts weekly from Sept 1981(the longer picture) and from Sept 2009(the detailed picture) show the Fed’s history of rate shifts vs the 3mo Treasury rate quoted on a discount basis. Long-term, the Fed keeps Fed Funds above the 3 month Treasury rate. It is how the Fed adjusts Fed Funds in detail that reveals that the Fed follows the 3mos changes with a lag of several weeks. As the 3mos Treasury shifts, the Fed steps up or down Fed Funds clearly with a lag as can be seen in the detailed history.

Currently, with Fed Funds at 5.33% and the 3 month Treasury discounted rate at 5.05%, Fed Funds rate is a 0.27% premium or barely a single cut of 0.25% away. This is too close for the Fed to act In my experience. The 3 month Treasury needs to decline to 4.75% before the Fed will lower rates closer to 5% and still keep Fed Funds rate near the traditional premium it desires. My experience indicates that despite many who are panicked by the current market decline calling for a rate cut by the Fed, it will more likely act according to the level of the 3 month Treasury, a market-determined rate.

If the 3 month Treasury declines to 4.75%, then expect the Fed to follow with lower Fed Funds rate, not before.

More By This Author:

Sentiment And Reality Continue To DivergeWhen Will The Fed Cut

Sentiment Can Change… Fast

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or ...

more