Friday, The Unofficial Start Of A Recession

The Fed said they anticipate further rate hikes, which could bring the short-term rate to 4.6% next year.

The meaning was obvious. The Fed will take whatever steps are necessary to reduce inflation from 40-year highs. And doing so will need a slowdown in the economy.

Powell didn't mention it specifically, but this is expected to involve a recession as well, not simply a “soft landing.”

GDP growth has been negative for two quarters, technically recessionary, with nearly all manufacturing surveys indicating a decline, and now there is mounting evidence of a downturn in the housing sector.

Although recessionary worries have been growing for months, persistently solid corporate earnings have helped to maintain the stock market.

The release of third-quarter corporate profits is just a few weeks away. They will, however, mostly reflect an economy that continues to see solid consumer spending and a robust employment market, despite the ongoing pressure from inflation.

Investors must keep in mind that the market has a propensity to generate very powerful bear market rallies while still being in a slump.

Eight notable rallies occurred between 2000 and 2002, when the dot.com bubble burst. Many investors entered the markets in the wake of the 2008 financial crisis, but all they have experienced are "V-shaped recoveries." The idea that everything is V-shaped has become deeply ingrained in people.

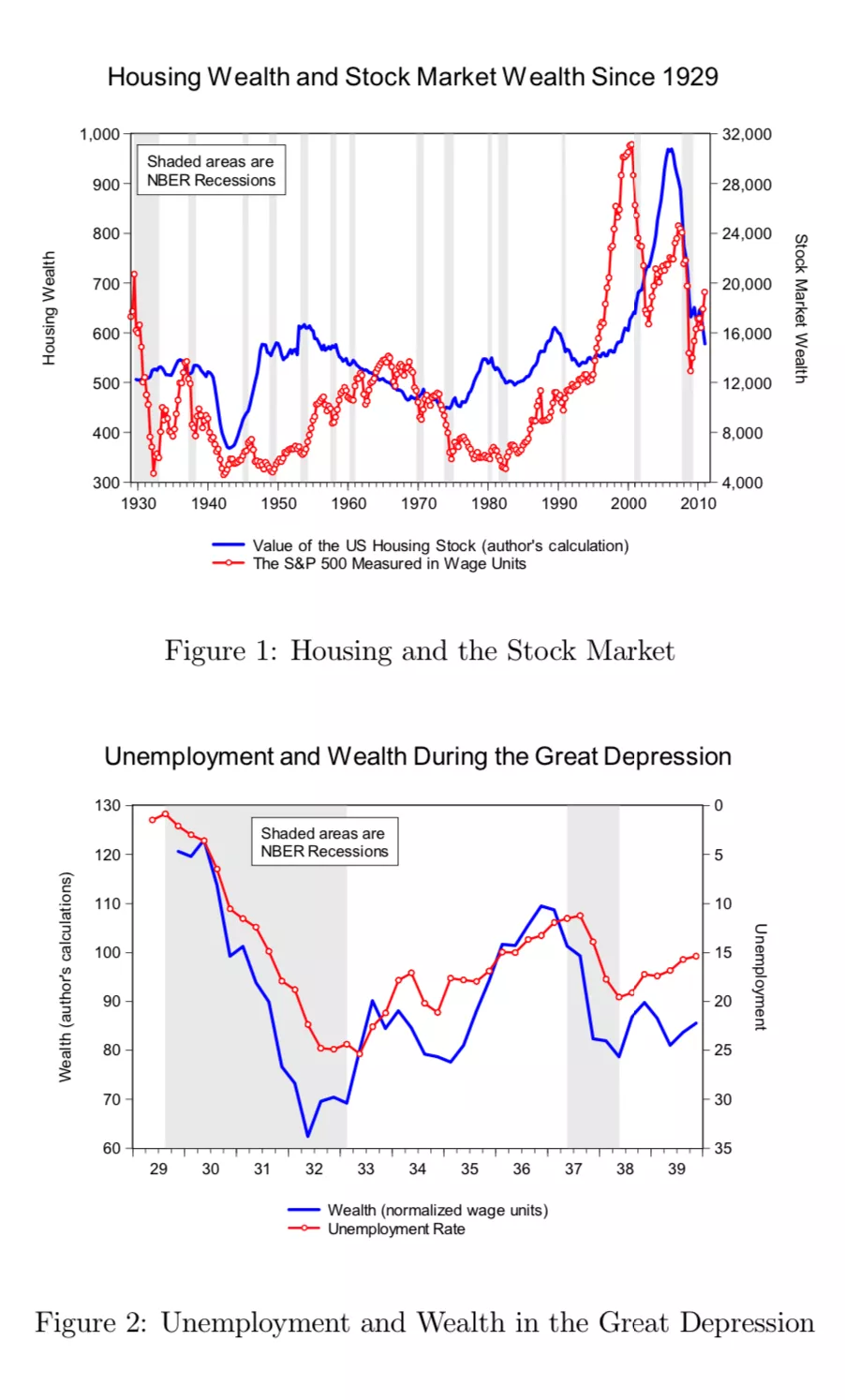

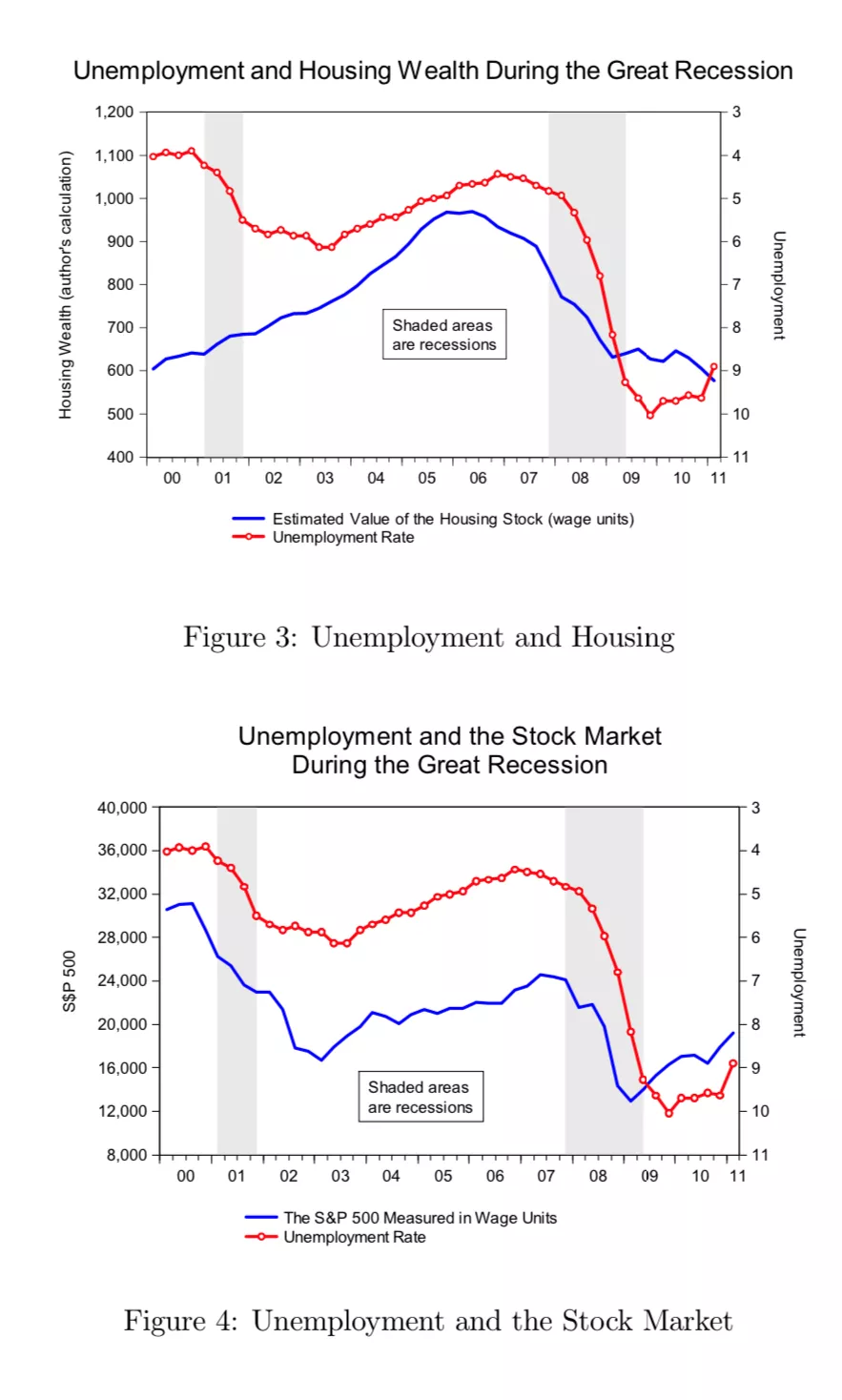

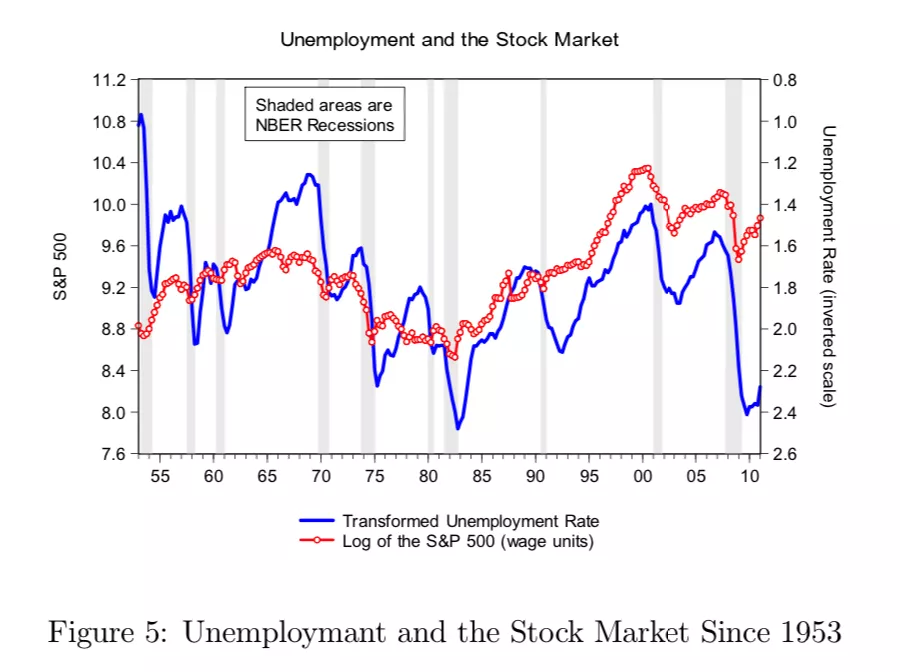

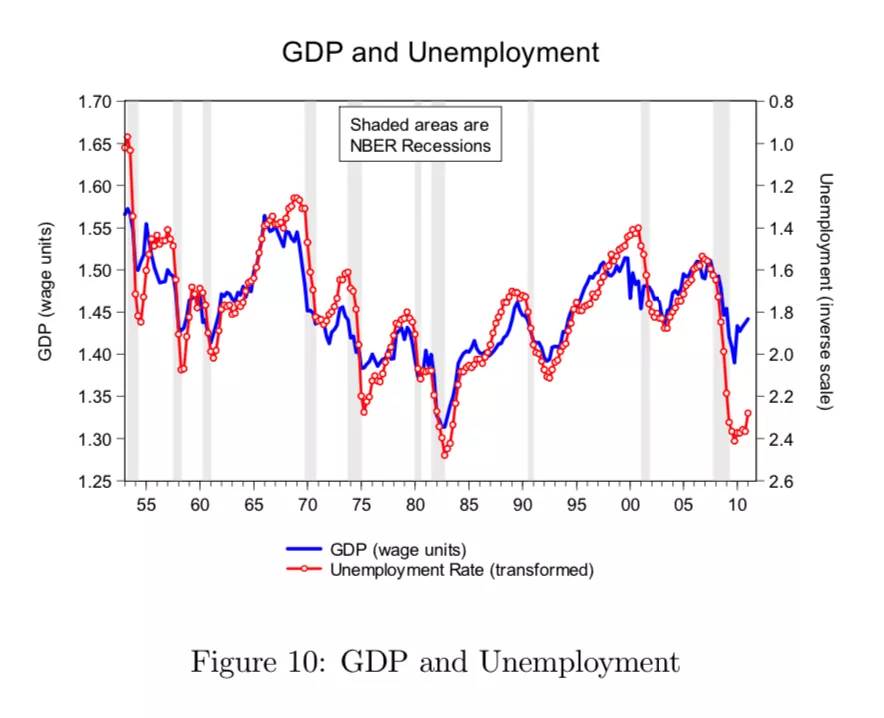

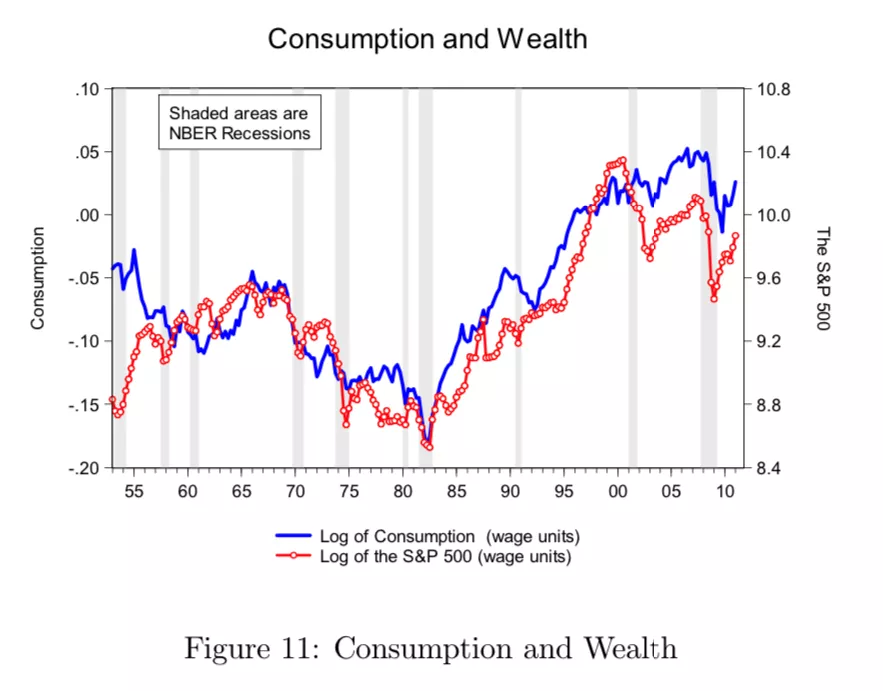

In UCLA professor Roger E.A. Farmer’s paper, The Stock Market Crash of 2008 Caused the Great Recession: Theory and Evidence, he contends that the Great Recession was brought on by the stock market crisis of 2008, which was brought on by a decline in housing values. It demonstrates the strong association between stock market value and unemployment rates in American statistics since 1929, the ineffectiveness of fiscal stimulus in achieving full employment, and the fact that aggregate demand is based on wealth rather than income.

SOME SELECT DIAGRAMS FROM THE PAPER:

More By This Author:

What Conditions Have Led To Economic Recessions?

The AI ETF Flagship Is Still Trying To Prove Itself

When Diversification Fails