What Conditions Have Led To Economic Recessions?

Image Source: Pexels

Researchers at the World Bank summarized in their paper:

Depressed financial markets and business confidence:

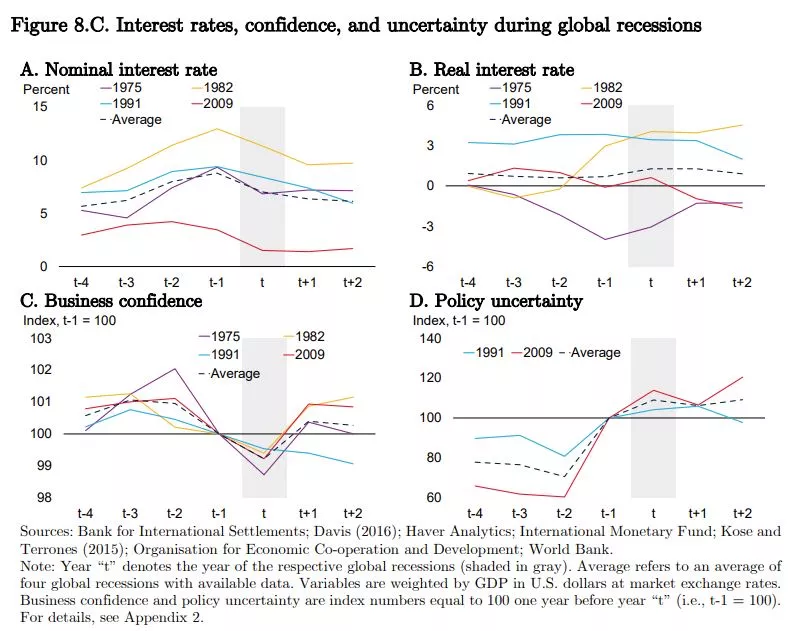

Asset prices and credit on average began decelerating about two years ahead of each global recession. The average annual rate of credit growth during the global recessions was about two-fifths of the average observed in non-recession years, while both house and equity prices fell, with the decline in the former on average three times larger than the latter. Financial conditions often tightened before the global recessions but then quickly loosened as monetary policy became accommodative. Inflation typically fell during global recessions, which gave further license for central banks to reduce interest rates (Figure 8.C).

(Click on image to enlarge)

Conclusion:

The year 2019 was the tenth anniversary of the last global recession. Yet 2019 also marked intensifying speculation about whether another such episode was looming. During 2019, global growth forecasts were repeatedly downgraded as a broad-based slowdown enveloped both advanced economies and EMDES. Trade tensions between major economies led to unprecedented policy uncertainty and took a heavy toll on global industrial production and trade.

Marc Lamont from the CRC summarized in his paper:

Recessions are notoriously hard to predict even a few months beforehand.

What will bring this to an end? In the words of Janet Yellen, "it's a myth that. expansions die of old age." Instead, the historical record points to a few culprits that have killed off an expansions-an overheating economy that results in accelerating price inflation, a financial bubble, or an external "shock" to the economy, such as an oil price spike. The longer an expansion lasts, the more likely it will fall victim to one of these killers.

Links To Papers

World Bank: https://documents1.worldbank.org/curated/en/185391583249079464/pdf/Global-Recessions.pdf

CRS: https://crsreports.congress.gov/product/pdf/IN/IN10853

More By This Author:

The AI ETF Flagship Is Still Trying To Prove Itself

When Diversification Fails

Inflation Has Peaked

This is very interesting. But every single word of this was simply copied from the two papers you cited. Do you have any incite of your own, or anything to add at all?