Forecasting Real Activity Using Cross-sectoral Stock Market Information

Today, we are fortunate to present a guest contribution written by Arthur Stalla Bourdillon, economist at the Banque de France. The views expressed herein are those of the author and should not be attributed to the Banque de France, Eurosystem or NBER.

In a new NBER WP, Nicolas Chatelais (Banque de France), Menzie Chinn (Univ. of Wisconsin) and I use sectorally disaggregated equity variables within a factor model to predict future US economic activity.

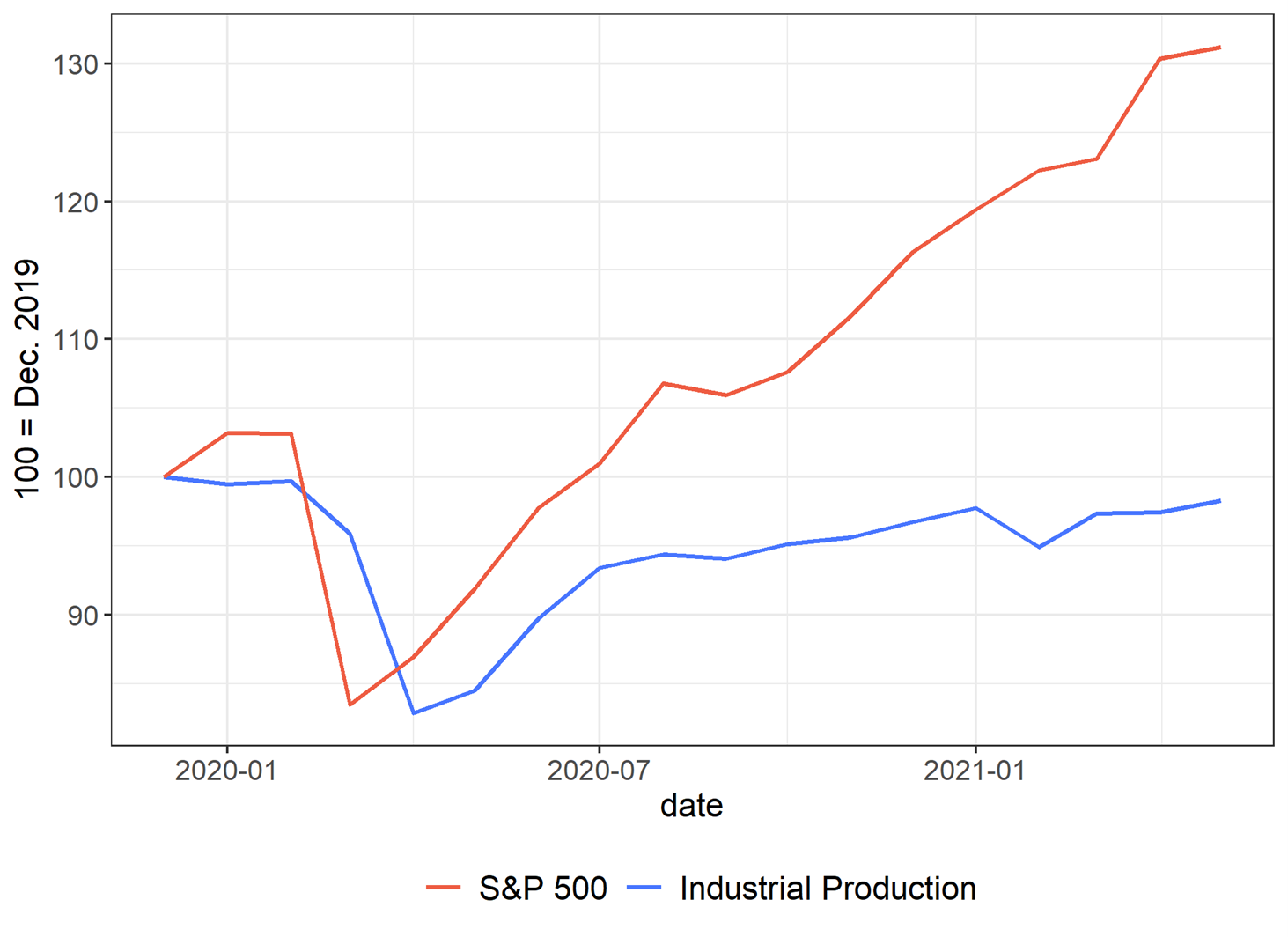

The idea of the project originated during the Covid-crisis. At that time, aggregate equity indices disconnected from real macro-variables. As a consequence, an econometrician trying to forecast economic activity, here Industrial Production (IP) growth, with aggregate equity variables such as the market dividend yield (DY) would have obtained poor results (Figure 1).

Figure 1: S&P 500 and US Industrial Production (100 = Dec.2019)

Note: The graph represents the evolution of the US Industrial Production and of the S&P 500 Index. Both indices are set to 100 in December 2019. Sources: Federal Reserve Economic Data, Refinitiv Datastream.

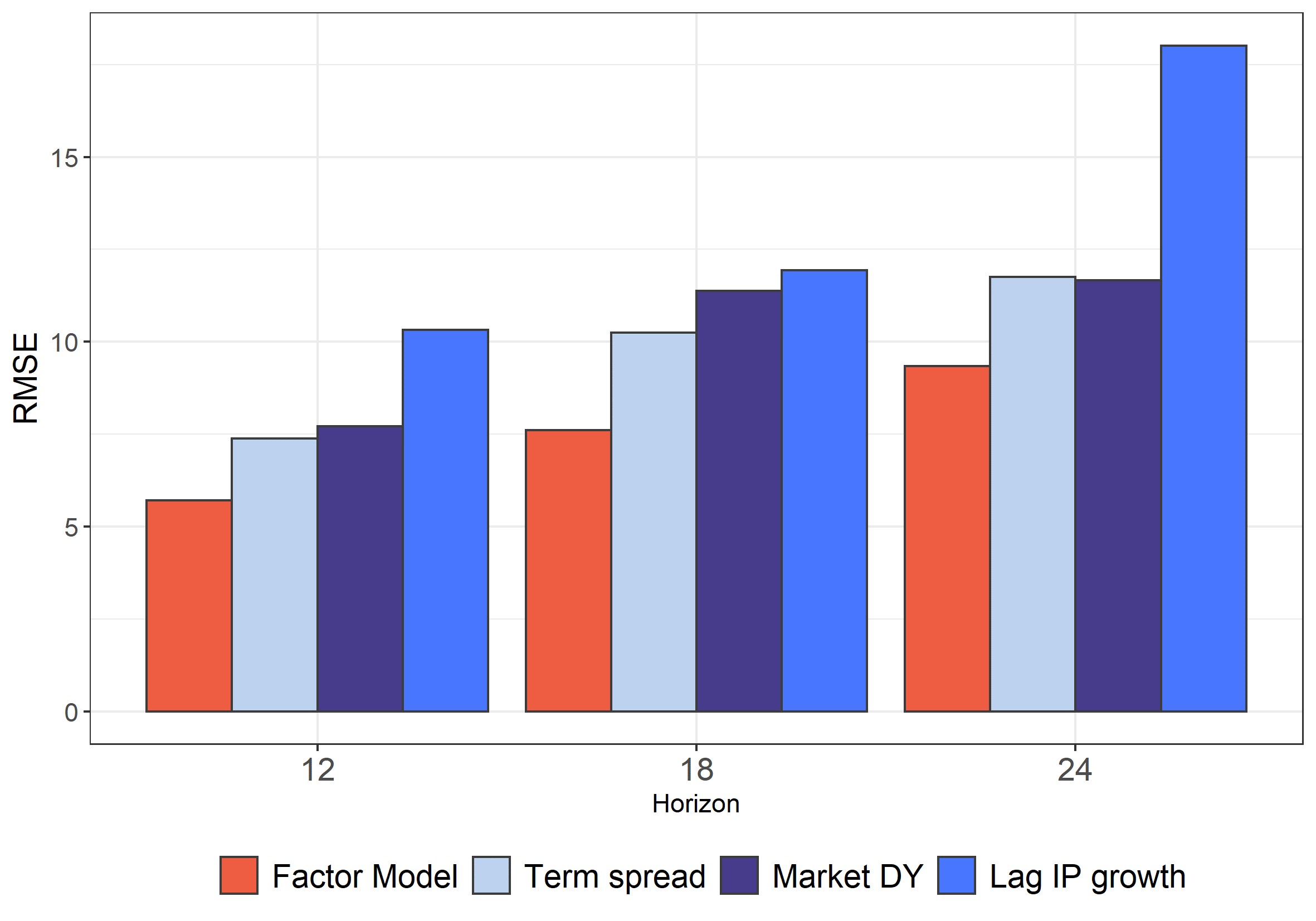

However, we show in the paper that relying, within a factor model, on sectoral rather than aggregate DYs sharply improves our forecasting accuracy when we compare the performance of our model against classic benchmarks (like the term spread, the lag of IP growth, or the Market DY), both in-sample, and out-of-sample (Figure 2).

Figure 2: Out-of-Sample RMSE from the different estimated models

Note: On the graph are represented the Out-of-Sample RMSE of different models (the factor model or univariate regressions relying either on the aggregate DY, on the lagged IP growth or on the term spread). The predicted variable is the IP growth over 12, 18 and 24 months.

Why is it the case?

It occurs mainly because equity variables reflect not only expectations of future economic activity, but also changes in investors’ discount rates. Therefore, a regression of future IP growth on the aggregate DY is very likely misspecified. In contrast, our factor built on sectoral DYs appears to be purged from this “discount rate” component, and reflects more accurately future economic activity, compared to the raw aggregate stock market variables.

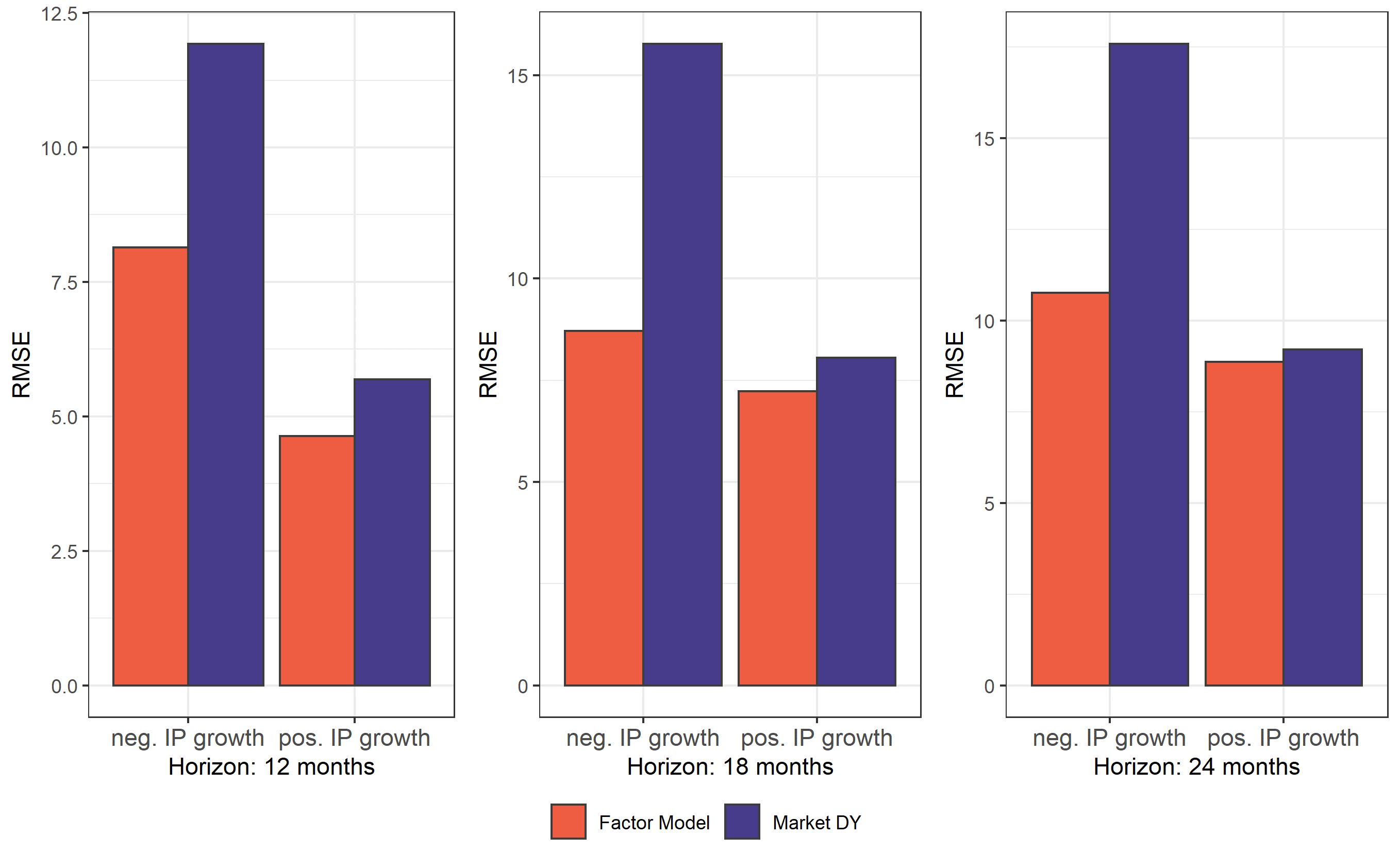

This forecasting outperformance is, intuitively, especially strong in times where discount rates are very volatile (recession, Covid-crisis) and thus obscure the signal stemming from aggregate equity indices. It therefore appears that the outperformance of our factor model is mainly concentrated in period where IP growth is already negative (Figure 3).

Figure 3: Out-of-Sample RMSE from the different estimated models, by period

Note: On the graph are represented the Out-of-Sample RMSE of the factor model and of a univariate regressions relying on the aggregate DY. Note that we segment here our estimation according to the dates in which the forecasts are made. In other words, if we consider here a forecast horizon of 12 months, the “Negative IP growth” period refers to predictions made when the annual IP growth was negative (and not predictions made 12 months before the contraction in economic activity). The predicted variable is the IP growth over 12, 18 and 24 months.

Where do we stand at the moment in terms of recession risk? As of July 2022, the signals stemming from the different financial variables appear quite mixed. Rolling window regressions based on the term spread or on the market DY estimate that the 12-month ahead (annual) IP growth will amount to +1.1% and +2.7%, respectively. In contrast, our factor model appears more pessimistic, and forecasts a negative IP growth for next year: -2.2%.

More By This Author:

Four Pictures Of The Labor Market In August

When Lacking Policy Proposals, Attack Diversity

US Private Nonfarm Payroll Employment – What Does the Revamped ADP Series Tell Us?