Don’t Blame The Fed: The Fed Gives Us What We Want

The Fed’s risk management strategy was ostensibly designed to keep pushing rates higher until the Fed slayed the inflation dragon or something in the economy forced it to stand down, whichever came first. Unfortunately for the Fed, the dice rolled in favor of the latter. Instead of a soft landing or even a mild recession, bank failures landed on the Fed’s collective lap in the form of SVB Financial Group (SVB), the parent company of Silicon Valley Bank, and Signature Bank (SBNY). It is very easy to blame the Fed for this mess (today’s chorus is pretty emphatic on this point). However, the problems in Silicon Valley Bank (SVB), which was the strongest catalyst for the Panic of 2023, started well before the Fed belatedly decided to start tightening monetary policy. ABC News confirmed reports from the New York Times and the Wall Street Journal on the following timeline:

- Starting in 2019: The Federal Reserve warned Silicon Valley Bank about risks in the bank.

- 2021: “The Fed identified significant vulnerabilities in the bank’s containment of risk, but the bank did not rectify the weaknesses.” Ironically enough, one of the six fines issued to SVB included “a note on the bank’s failure to retain enough accessible cash for a potential downturn.”

- July 2022: a full supervisory review revealed the bank as “deficient for governance and controls.”

- Fall 2022: the Federal Reserve of San Francisco met with “top officials at the bank to address the lack of accessible cash and the potential risks posed by rising interest rates.”

In other words, tight monetary policy was not the root problem of the bank’s problems. Tighter monetary conditions finally forced the issue of disciplining the bank. Tighter monetary policy is supposed to mop up excesses in the economy, and Silicon Valley Bank is starting to look like yet one more egregious example of the excess enabled by the prior era of easy money. It will be interesting to see whether the Fed’s review of its regulatory supervision includes claims that it lacked the authority to force SVB to change its ways.

The Fed Gives Us What We Want

Regardless, as I continue to see blame heaped on the Fed for this latest episode of financial instability, I have surprisingly adopted a more sympathetic view of the Fed’s work. The Federal Reserve has a nearly impossible job. It seems every major change in monetary policy sets the seeds for the next financial drama. Every financial drama raises the Fed’s prominence yet higher as a centralized economic planner, never able to return to the background of a free market. The Fed now must constantly tinker with interest rates with no clear terminal point. In particular, the economy has set up the Fed to bias toward keeping monetary policy as accommodative as possible for as long as possible. The Fed gives us what we want: a policy that supports higher asset prices from stocks to real estate.

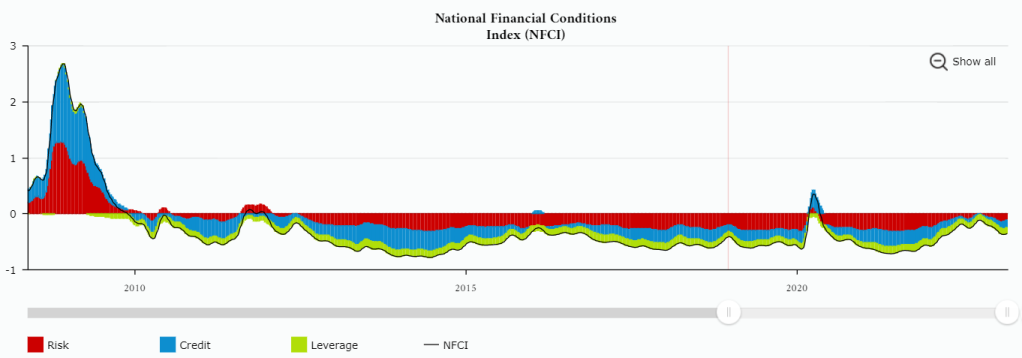

The index of financial conditions, as measured by the National Financial Conditions Index (NFCI), since the Great Financial Crisis (GFC) shows extended periods of very easy financial conditions. It is remarkable how little time the economy has been stuck with a positive index, or even a component on the positive side of danger…even in the aftermath of the economic shutdowns from the pandemic.

(Click on image to enlarge)

The Fed’s balance sheet is an even better example of how the Fed gives us what we want in the form of an accommodative monetary policy. The Fed was never able to reduce its balance sheet after the GFC. The current tightening cycle barely put a dent in the Fed’s balance sheet. I have a sneaking suspicion that the Fed will never get its balance sheet back to pre-pandemic levels either. Note how the balance sheet ticked up as of last Wednesday in the wake of the rescue programs rolled out to backstop failing banks.

(Click on image to enlarge)

Board of Governors of the Federal Reserve System (US), Assets: Total Assets: Total Assets: Wednesday Level [RESPPANWW], retrieved from FRED, Federal Reserve Bank of St. Louis, March 21, 2023.

Before the GFC, this kind of balance sheet expansion was considered unthinkable. Surely, such a growth in the balance sheet would cause dangerous inflation levels. Given the ongoing duration and size of this expansion, I am guessing economic theories will slowly but surely normalize the existence of this balance sheet. Yet, the longer this largesse continues, the more the economy will depend on sustaining these high levels. Thus, the economy will remain vulnerable to instability whenever economic conditions force the Fed into tightening policy. (Recall how the previous tightening cycle moved at a snail’s pace but still eventually forced the entry of a “Plunge Protection Team” to put a floor under the stock market).

What We Want Is Not Free

In a July 2022 interview on Bloomberg’s Odd Lots (starting at the 14:35 point), famous short-seller Jim Chanos presciently claimed (emphasis mine):

“The one thing people are not prepared for is interest rates resetting meaningfully higher…It just hasn’t happened in most investors’ lifetimes…the idea that actually interest rates are not going to be 2 or 3% for the foreseeable future is going to be hard for a lot of investors to deal with. If we go back to what I would think are more reasonable rates based on what we’re seeing in the economy…this market will not be able to handle 5 or 6% 10-year. It just won’t. So many business models that we look at are extremely low return on invested capital because capital has been so plentiful for the past 12 years.”

The subtext here is that the Fed’s bias has been to leave monetary policy as accommodative as possible for as long as possible. Deflation was the great imperative chasing the Fed into monetary corners. The response to the pandemic was the logical conclusion of this policy as the Fed decided it had the luxury to keep driving unemployment ever lower by holding rates lower for longer. The economy appeared to be in another era where liquidity and massive stimulus could be conjured up for free. The pandemic’s inflationary pulse eventually turned the tables. What we want can actually be quite costly.

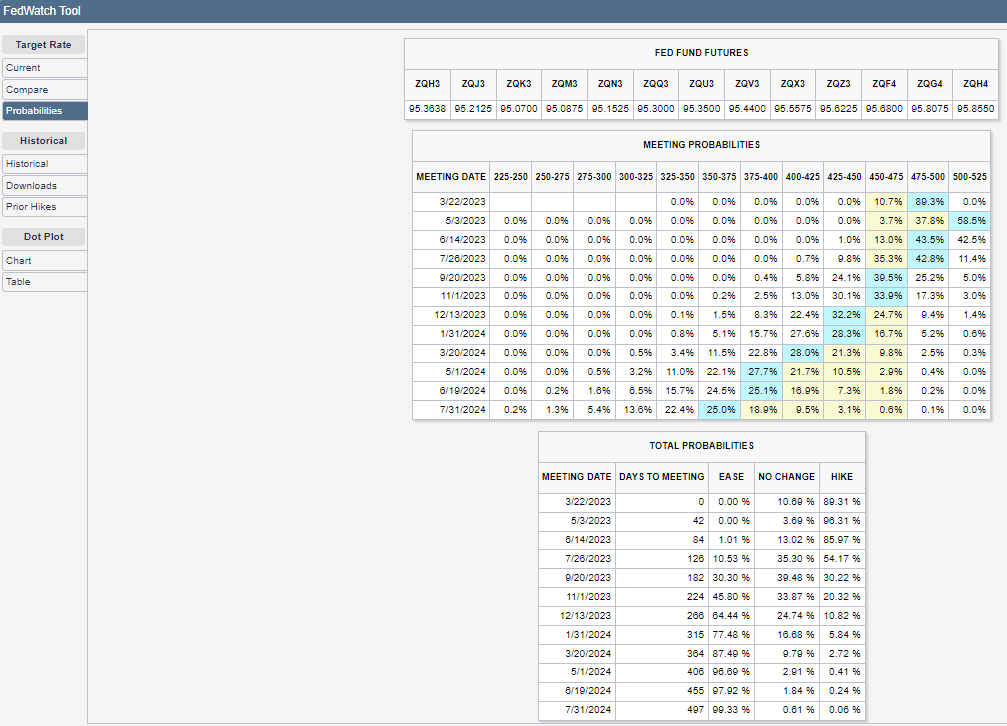

Thus, the Fed finds itself in a new trap. I feel for the Fed, but I don’t blame them…we prefer easy money…and many eagerly await the Fed getting disciplined back into cooperation by the Panic of 2023. The Fed Fund futures suddenly expect a long string of rate cuts to follow peak rates in May. I sure hope inflation cooperates as well!

(Click on image to enlarge)

Source: CME FedWatch Tool as of March 21, 2023

A Golden Epilogue

Gold received a new burst of life thanks to the Panic of 2023. As soon as the Fed blinks, I expect gold to rally further. I am keeping the buy button close as we go into the next several decisions on monetary policy starting with March’s. The Sprott Physical Gold Trust ETV (PHYS) broke out to an 11-month high. Today’s 2.0% pullback from over-extended price action looks like it is setting up the next buying opportunity.

(Click on image to enlarge)

Source: TradingView.com

Be careful out there!

More By This Author:

An Inflation Downtrend Quickly Evaporates

Kashkari Acknowledges The Fed's Inflation Miss; Will The Fed Catch Easing Financial Conditions?

Did Alan Blinder Suggest The Fed Should Have Done Nothing About Inflation?

![Board of Governors of the Federal Reserve System (US), Assets: Total Assets: Total Assets: Wednesday Level [RESPPANWW], retrieved from FRED, Federal Reserve Bank of St. Louis, March 21, 2023.](https://inflationwatch.files.wordpress.com/2023/03/fed-balance-sheet.png?w=1024)