An Inflation Downtrend Quickly Evaporates

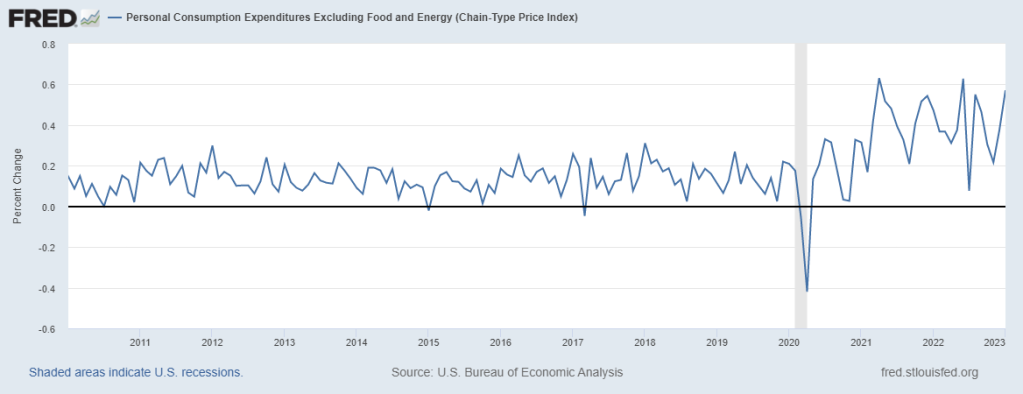

Some inflation analysts have enthusiastically contorted the inflation data to dismiss today’s inflation problem and/or conclude that inflation’s run came to an end months ago (since last year’s peak). One method of dismissal came in the form of a downtrend in the monthly change in the core Personal Consumption Expenditures (PCE) starting conveniently at the peak as far down as November’s relatively benign reading. (Alan Binder used a related method dividing inflation into different time periods). Suddenly, with two consecutive up months that inflation downtrend has evaporated. The mist leaves behind what essentially looks like a random walk in the land of higher for longer.

Source: U.S. Bureau of Economic Analysis, Personal Consumption Expenditures Excluding Food and Energy (Chain-Type Price Index) [PCEPILFE], retrieved from FRED, Federal Reserve Bank of St. Louis; February 24, 2023.

The chart above shows how the pandemic disrupted a serene post financial crisis range for monthly core PCE largely between 0.0% to 0.2%. Since PCE’s breakout two years ago (which the Fed ignored as transitory), core PCE has effectively settled into a higher range from 0.2% to 0.6%. Inflation may have indeed peaked, but it remains stubbornly high in the aggregate. The eagerly anticipated pre-pandemic serenity remains as elusive as ever.

Higher for longer inflation aligns with the Federal Reserve’s insistence on maintaining restrictive monetary policy higher for longer. The stock market may finally be catching on to the notion of higher for longer for inflation. When the core Consumer Price Index (CPI) came in hotter than expected in the previous week, the S&P 500 (SPY) wavered from intraday highs to lows and even increased the next day. Sellers took over the next 5 of 6 trading days with today’s 1.0% loss seemingly confirming a change in sentiment.

The S&P 500’s loss would have been worse except traders decided to defend support at the 200-day moving average (DMA) (the blue line above). This important trend line separates the index from more churn and a continuation of selling back down to the bear market line (20% down from the all-time high).

The bond market sniffed out the hotter inflation environment ahead of the stock market. Bond yields have steadily risen all month. For example, the iShares 20+ Year Treasury Bond ETF (TLT) is down 5.8% month-to-date (lower TLT means higher yields). The hot PCE brought an abrupt end to a 2-day relief rally in TLT.

Of course, the inflation story does not end here. The recent experience with inflation surprises suggests inflation will continue to confound the over-confident. A humbled Federal Reserve seems validated in taking a “risk management” approach to monetary policy in this haze of uncertainty. Still, if monthly core PCE takes a fresh drop next month, I am guessing a chorus will resume the inflation dismissals. If monthly core PCE continues higher from here, I will ring fresh alarm bells. I am watching the bond market’s next moves for potential clues. Moreover, I cannot wait to hear what the Federal Reserve and Chair Jerome Powell have to say about these developments in next month’s meeting!

Be careful out there!

More By This Author:

Kashkari Acknowledges The Fed's Inflation Miss; Will The Fed Catch Easing Financial Conditions?

Did Alan Blinder Suggest The Fed Should Have Done Nothing About Inflation?

Bullard Ready To Declare Partial Victory Over Inflation