Did New Age Beverage Shareholders Get Duped In The Morinda Transaction?

Company: New Age Beverage Corp.

Ticker: NBEV

Industry: Beverages – Soft Drinks

Exchange: NASDAQ

Price (as of June 26th 2019) $4.56

Shares Outstanding: 75.2m

Daily Volume: 5,136,000

Projected Downside: 60%

- In December 2018, New Age Beverage (NASDAQ:NBEV) competed its merger with multi- level firm (MLM) Morinda, to help reverse losses NBEV has sustained since completing its reverse merger in 2016. NBEV paid Morinda $75 million in cash and $10 million in stock to complete the transaction.

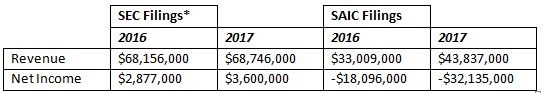

- While Morinda reported 2016 revenue from China of $68m in 2016, SAIC filings show that real revenue of Morinda was only $33m in that year.

- Financial filings from China also show that Morinda had a big net loss of $32m in 2017 from its China operations.

- National filings show that Morinda’s European operations gave up their headquarters in 2017 and was in the process of winding down the company. The winding down process was expected to be completed less than three months of the completion of the merger.

- NBEV’s CEO boosts that $46 million in cash came along with Morinda. However, we don’t believe investors clearly understand that over $50 million will have to be paid out to Morinda shareholders.

- In short, we believe NBEV got duped by buying a dying business with inflated financials.

- We believe that Morinda’s China business is in jeopardy of being totally shut down, supporting our conclusion that any growth Morinda is claiming it has experienced in China, or that NBEV is expecting to realize from China is in the rear-view mirror and irrelevant.

- Our research combined with our on-the-ground research proves that Morinda is conducting illegal MLM operations in the majority of China provinces/cities that it operates in. Specifically, it is doing business in regions where it does not have a direct selling license to operate in.

- The number of MLM companies that China regulators have forced to suspend their China operations now stands at 5 in 2019, including NHTC. Morinda’s Primary product (90% of sales), appears to have the similar Chinese name of the product that was the subject of a China Central Television (CCTV) scathing 2019 expose on NHTC.

- We believe NBEV’s CEO is highly promotional, but has proven to be unable to successfully build companies for extended periods of time, as evidenced by the two previous public companies he was the CEO of that ended badly for shareholders.

- A shady auditor and a lack of checks and balances set NBEV up for failure

- We believe the stock will collapse and see immediate downside of 60%

Introduction

New Age Beverage Co. (NASDAQ:NBEV) is a manufacturer and distributor of beverages. We believe NBEV's recently closed merger with a multi-level marketing (MLM) company, Morinda, for $85 million will be a disaster for NBEV shareholders. We see immediate downside of at least 60%. But we believe the picture will get much worse, leading to a scenario where NBEV will become insolvent. NBEV lost $12 million in 2018, but it appears that management is expecting that the addition of Morinda will change that. Management has clearly stated that the Morinda transaction will be a transformational event for the company:

CFO:

Clearly, the financial combination is transformative for New Age, and we believe the level of acceleration from the transaction for shareholders will be outstanding. "

CEO

Now we should start to see why Morinda makes so much sense for us, especially from our CBD-infused beverage portfolio and the Health Sciences Division."

So clearly Morinda brings the attractive financial implication, organizational underpinning and strengthening,"

While it appears on paper that NBEV executed a "too good to be true" deal by thinking it paid less than 1.5 times 2017 sales (as well as the 2018 implied revenue run-rate at the time of the transaction) for a seemingly profitable company, we will show why we believe Morinda is not as advertised. For example, we found that Morinda's European operations are in the process of being wound down and that Morinda sold itself to NBEV just months after it was expected to formally close all European corporate matters.

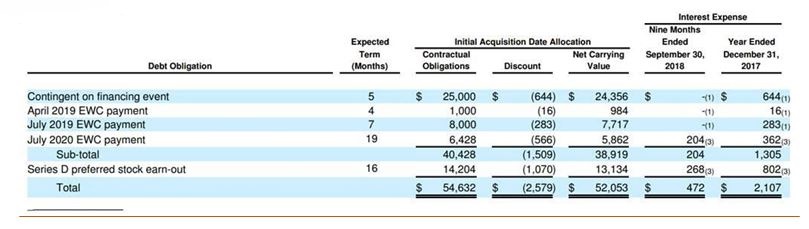

Furthermore, while during a conference call, NBEV’s CEO boasts about $46 million in cash & cash equivalents that came with the Morinda merger, he failed to comment that over $50 million in contractional obligations are owed to Morinda shareholders.

Most importantly, Morinda derives a substantial amount of its revenues from its China MLM business. Knowing this, we deployed our on the ground team in China to find out two things:

- Does the company have the licenses as an MLM business to operate in the China provinces in which it sells its products?

- Are Morinda’s financials that were disclosed to NBEV and shareholders in SEC filings accurate?

The answers to these two questions are why we are short the stock.

Inadequate Licenses

Regarding its China business, we found that Morinda is operating illegally in 60% of the provinces it is running its business in. This is a very important point. The regulatory framework in China on this matter is so strict that just the mere fact that a company would have an office in a particular province that it does not have a license to operate in is a violation. There was a time when this kind of evidence would not be a big deal and thought of as boilerplate. However, it's no secret that China is finally cracking down on illegal MLM activity.

In early 2019, China regulators forced Natural Health Trends Corp. (NASDAQ: NHTC) to suspend its operations in China, shortly after China Central Television (CCTV) aired a critical report on the company. Shares fell as much as 32% on the day the story aired and are now down around 60%. Interestingly, Morinda’s primary product (90% of sales), appears to have the similar Chinese name of the product that was the subject of a China Central Television (CCTV) scathing 2019 expose on NHTC.

We are still waiting for China regulators to release its “blacklist” of untrustworthy MLM companies and participants operating in China. We believe there is a high probability that Morinda or its main operating entity in China, Tahitian Noni Beverage (China) Co., Ltd., will be on this list. Regardless, we believe that the crackdown on NHTC along with the bad press on Noni Juice cannot be good for Morinda’s near-term sales prospects.

What we do know is that China regulators were reported to have suspended handing out any new licenses amid a nationwide crackdown on wrongdoing in the health products market. Thus, even if Morinda were still permitted to operate its China business, it appears that it would need to at least cease operations in 6 out the 10 provinces/cities it currently operates in.

So far, according to numerous reports in China, Chinese regulators have tried to crack down at least 4 big scale MLM companies with direct-selling licenses in China -Hualin Group (report link), Quanjian Group (report link), Infinitus (China) (report link), and Tianshi Group (report link). Arrests have already been made in some cases.

Overstated Financials

Like has been done numerous times in the past with regards to uncovering discrepancies between financial information recorded in China and SEC filings, our evidence reveals that Morinda’s financials that were disclosed in SEC filings are meaningfully higher than what were reported in China. In Morinda’s, case, we estimate that Morinda’s revenues from China are inflated by 36% in 2017 and 51% in 2016.

Game Set Match

From whatever perspective we look at NBEV, any of the two China related issues will wipe away the profit contribution NBEV had hoped to realize from Morinda. The research we're about to present to you is brand new and has not been touched upon in other short thesis reports written about the company. We believe the Morinda issues we have highlighted will soon become evident, serving as THE catalyst to send shares sharply lower, with the company ultimately experiencing the same fate previous companies run by NBEV's CEO have met.

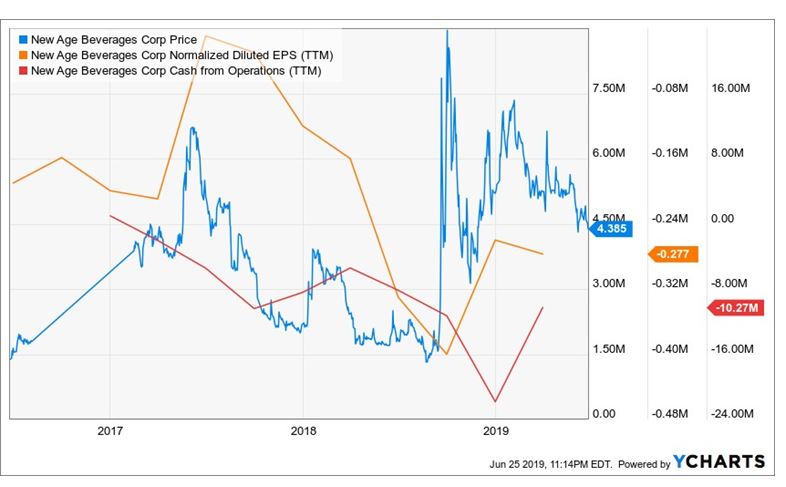

Under the helm of CEO Brent Willis, NBEV has engaged in an aggressive roll-up strategy fueled by a series of equity raises where shares outstanding have risen more than 100% to 75 million shares. Morinda is the sixth transaction (including its initial reverse merger) that NBEV has made since completing a reverse merger to go public in 2016. While we are doubtful about a roll-up strategy that has resulted in cumulative negative operating cash flows of $17.8 million since it became a public company in 2016, racking up losses every year. Morinda is NBEV’s biggest transaction to date, and the one that we think will break the camel’s back.

The evidence we collected leans on our expertise of performing on-the-ground due diligence in China to bring transparency to U.S. investors that invest in China based companies or companies doing business in China.

NBEV’s CEO recently sold 300,000 shares, netting him proceeds of $1.6 million, and we think we know why.

Some Background on Morinda

Morinda is a multilevel marketing company. Founded in 1996, Morinda sells various health products, but 90% of its revenue is generated from its Tahitian Noni Juice product. While the juice is portrayed to have several health benefits, none were ever substantiated in scientific studies. This didn’t stop Morinda from making bold claims about its products in order to recruit more people into their multi-level marketing structure. From the very beginnings, Morinda had run ins with the law.

As early as 1998, Morinda was charged by multiple states and settled for making bold claims regarding its Tahitian Noni juice including treating, curing, or preventing numerous diseases such as diabetes, depression, hemorrhoids and arthritis. As part of the settlement, Morinda had to refrain from making unfounded health claims about its products.

Similar to other multi-level marketing companies with a mediocre product, Morinda soon sought international expansion until it merged with NBEV in 2018.

More To The Morinda Transaction Than Meets The Eye

China Financials Don’t Add Up

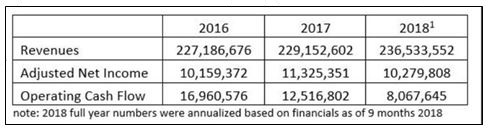

Referencing SEC disclosures, Morinda’s financials through the first nine months of 2018, endedSeptember 31:

- sales were $177.4 million, which works out to be $236.5 million on an annualized basis

- adjusted net income was $7.7 million ($10.3 million annualized) and

- operating cash flow was $6.1 million ($8.1 million annualized)

Combined with NBEV’s 2018 revenue of $52 million, NBEV revenue would be tracking at annual run-rate of $280 million. We can understand why investors got interested in the stock – In 2018, NBEV only produced revenues of $52 million, a net loss of $12 million and negative operating cash flow of $21.8 million. At an $85 million total consideration, the Morinda transaction seemed like a steal. $75 million was paid in cash which was previously raised in a November 2018 secondary offering,.

The Morinda merger seemed almost too good to be true.

Morinda’s second biggest market by revenue is China. According to NBEV’s CEO, Brent Willis, Morinda is experiencing great success:

“That business has grown about 20% per year and eclipsed -- this year it eclipsed more than $80 million in revenue, and that's one of the overall growth engines for the overall company” (Morinda CC Call 12/4/2018)

NBEV’s 8K/A filed on 03/01/2019 provides more color on Morinda’s financials. According to these filings, China made up approximately 35% and 30% of overall sales for the nine-month periods ended September 30, 2018 and 2017, respectively. Notably, China is also where Morinda’s biggest cash balance is allegedly sitting, totaling over $20 million as of September 2018.

We have our on the ground team in China to pull financial filings on Morinda from the State Administration for Industry and Commerce (SAIC). SAIC filings have proven to be a one of the primary tools to discovering fraud in China.

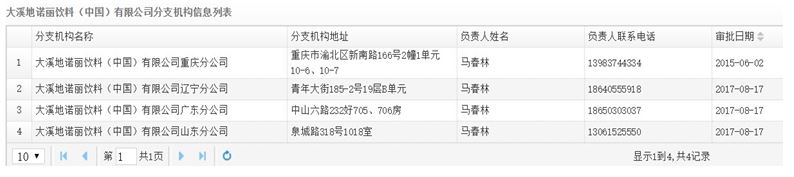

In China, Morinda has been operating through two entities named Tahitian Noni Beverage (China) Co., Ltd. Rongchang Factory, and Tahitian Noni Beverage (China) Co., Ltd. (大溪地诺丽饮料(中国)有限公司 荣昌工厂 and 大溪地诺丽饮料(中国)有限公司 respectively). Rongchang Factory is where the Noni juice is processed, and Tahitian Noni Beverage (China) is the main operating entity of Morinda in China.

The financials we sourced from SAIC filings in China showed staggering differences:

*assumes China was 30% of revenue in both years. Assumes China profitability is 30% of Morinda’s total profitability..

The deviations are staggering. When compared to SEC filings, Morinda’s revenue disclosed in SEC filings are inflated by 51% and 36% in 2016 and 2017, respectively.

Another thing that strikes us as remarkable is how unprofitable China operations are according to SAIC filings, with a combined net loss of $32m in 2017. We wonder how the overall company can show $12m in net profit when China alone lost $32m.

Even if you want to ignore our SAIC analysis and put faith in NBEV’s SEC filings, things are not looking good for its legacy business and/or Morinda. According to SEC filings, NBEV lost $12.1 million on a GAAP basis in 2018 and $15.8 million after adjusting for a tax gain, one time gains/losses and non-cash items. On May 9, 2019 NBEV reported 2019 Q1 financial results which showed that the company is still bleeding money, even after including the contribution of one full quarter of Morinda. NBEV lost $1.6 million on a GAAP basis and $5.3 million after adjustments. The Q1 press release fails to mention that

NBEV’s legacy business is falling sharply, contracting 13% in Q1. Furthermore, the highly touted Marley brand assets, acquired in June 2017, is already facing challenges:

“Net revenue for the New Age segment decreased by 13% from $11.6 million for the three months ended March 31, 2018 to $10.1 million for the three months ended March 31, 2019. The decrease in net revenue for the New Age segment was primarily attributable to an increase in discounts and allowances of $0.9 million which was driven by the increase in billbacks and discounts from two of our major distributors where we were impacted by significant charges on shipments we shorted because of our inventory challenges, and we faced a high level of changeover charges related to one of the products in the Coco-Libre brand and one of the products in the Marley brand which we are discontinuing to focus on products with higher future sales potential.” - 2019 Q1 SEC filing

Also, even the SEC filings, which we believe are inflated, show that Morinda’s revenue growth has stagnated, while its net income and operating cashflow are contracting.

Finally, based on NBEV 2019 Q1 financial results, which broke out Morinda’s revenue contribution,

Morinda generated revenue of $48.2 million, implying an annualized run-rate of $192.9 million.

Any way you slice it, it looks like NBEV bought Morinda at the peak of its growth cycle and that Morinda

is not on track to eliminate the losses NBEV is experiencing. But, we think it’s about to get much worse.

Filings show Morinda is operating illegally 6 out of 10 Provinces/Cities

According to the website of Ministry of Commerce in China, Tahitian Noni Beverage (China) Co., Ltd. (大 溪地诺丽饮料(中国)有限公司) obtained its direct-selling license approval in December 2014.

According to the website, the registered service locations of Tahitian Noni Beverage (China) Co., Ltd. (大 溪地诺丽饮料(中国)有限公司) are in the following regions (please refer to Appendix 2 for detailed service locations in each region):

- City of Chongqing

- City of Shenyang, Liaoning Province

- Cities of Jinan, Weihai, Rongcheng and Rushan, Shandong Province

- City of Guangzhou, Guangdong Province

However, the SAIC records (Appendix 3) show that the company has branches in other regions that are not among the above list. For example, those regions are:

- City of Beijing

- City of Shanghai

- City of Nanjing, Jiangsu Province

- City of Hangzhou, Zhejiang Province

- City of Taiyuan, Shanxi Province

- City of Fuzhou, Fujian Province

One note to clarify for the regions regarding provinces and cities in this case is that, in China, there are 4 cities that are on the same governmental administration level as provinces, and they are the cities of Chongqing, Beijing, Shanghai, and Tianjin. Thus, when we put “provinces/cities” together, the “cities” within this context are referring to these 4 cities.

On the conference call, Brent Willis confirms that Morinda conducts business in 10 provinces:

“The company has already got offices in at least 10 different provinces and a major organization really focused in those 10 provinces”

In other words, the company has opened branches and has probably done business in cities that are not registered & approved by the government, which should be considered a violation of the rules for direct-selling in China. Regardless, the mere fact of setting up an office in an unapproved province is a violation.

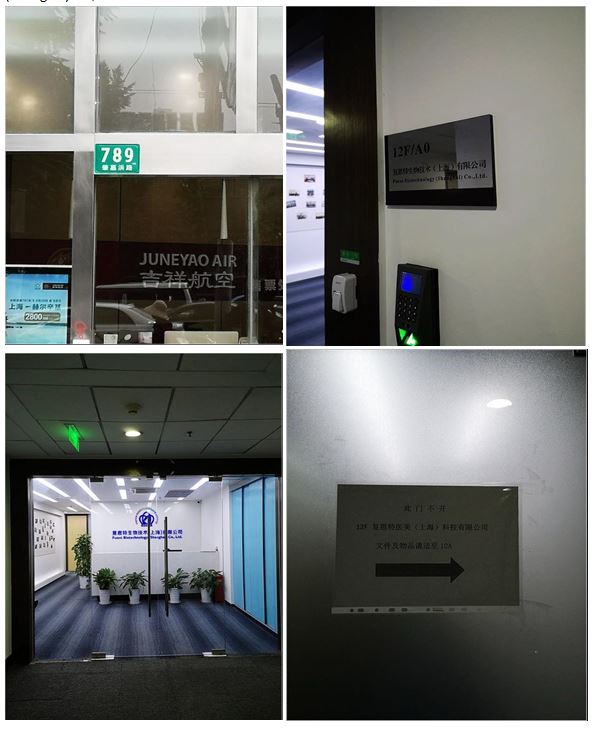

Our On-The-Ground Due Diligence (OTGDD) Confirms Illegal Activities

Our on the ground due diligence confirms our suspicions. Our on the ground team visited branches/offices in the city of Shanghai, city of Hangzhou, Zhejiang Province, and the city of Nanjing, Jiangsu Province. Remember, these are offices in jurisdictions where Morinda does not have registered service locations and is not allowed to conduct direct selling businesses and sell products in any manner.

During the investigation, except for one office in city of Shanghai that appeared to be occupied by another company other than Morinda or Tahitian Noni Beverage (China) Co., Ltd., the rest of the offices/branches our on the ground team visited seem to be in operation during normal business hours in China.

Furthermore, our on the ground team was told by sales people in one of the branches in city of Shanghai that people interested in the products could place orders at that branch and they needed to fill out their personal information and mailing addresses so that products could be delivered to the buyers. In another branch during the visit, our on the ground team was told that an order could be placed online.

All these branches/offices that our on the ground team visited are not within the list of the service locations that are registered on the Chinese Ministry of Commerce’s direct-selling industry management website. Thus, we believe that this is in clear violation to the direct-selling rules in China. Below are some of pictures at each of the branches/offices we visited.

1.Tahitian Noni Beverage (China) Co., Ltd Shanghai Jing'an Branch (void of license)

Address: Nanjing West Rd. No.819, Room 1009-1011, Jing'an District, City of Shanghai, China

2.Tahitian Noni Beverage (China) Co., Ltd Shanghai Branch (void of license)

Address: Tibet Middle Rd. No.18, 12th Floor, Room 1403-1405, Huangpu District, City of Shanghai, China

3.Tahitian Noni Beverage (China) Co., Ltd Shanghai Office

Address: Zhaojia Bang Rd. No.789, 12th Floor, Room A, City of Shanghai, China

It is found that this address was actually occupied by a biotech company called Fuent Biotechnology (Shanghai) Co., Ltd.

4. Tahitian Noni Beverage (China) Co., Ltd Jiangsu Branch (void of license)

Address: Changjiang Rd. No.188, 15th Floor, Room D, Xuanwu District, City of Nanjing, Jiangsu Province, China

5. Tahitian Noni Beverage (China) Co., Ltd Zhejiang Branch (void of license)

Address: Zhaohui Rd. No.203, Room 1001&1002, Xiacheng District, City of Hangzhou, Zhejiang Province

One possible outcome of Morinda doing business in locations that are not registered by the government is that the company runs into big risk of being added into the blacklist of untrustworthy direct selling companies, which could be detrimental to the company’s operating business in China. According to an article published by Caixin global in February 2019:

Chinese authorities suspended the registration and approval of direct selling amid a nationwide crackdown on wrongdoing in the health products market.

The Ministry of Commerce will establish a “blacklist” of untrustworthy direct selling companies and participants, ministry spokesperson Gao Feng said Thursday at a routine press conference.

Gao said the Ministry of Commerce would conduct a thorough, nationwide sweep of the direct selling industry and will take actions against any illegal businesses.

The article stated that:

“the Chinese authorities suspended the registration and approval of direct selling amid a nationwide crackdown on wrongdoing in the health products market”,

And this means Morinda and other direct-selling companies in China are not expected to increase their presence in cities/provinces any time soon.

Another recent case that comes to mind is Natural Health Trends Corp (NHTC)

How NBEV is linked to Natural Health Trends Corp (NHTC)

Natural Health Trends Corp (NHTC) is a NASDAQ listed company, with their main business involved in direct selling to consumers in China. Similar to Morinda, NHTC also operates through multi-level marketing arrangements.

NHTC saw its stock price plummet from over $20 per share to less than $8 per after negative news coverage in China.

On January 5, 2019, CCTV Channel 13 (China Central Television is the predominant state television broadcaster in China) aired an 18 minute program that alleged NHTC was a pyramid scheme in China. The program interviewed former NHTC members who subsequently lost money or saw their lives reach points of turmoil, including divorce, as a result.

The program also aired conversations where senior members of the company exaggerated the effects of the company’s products, including one called Noni Juice (with full name of Premium Noni Juice in English). According to the program, NHTC’s Noni Juice does not have domestic approval and registrations related to wellness foods.

An investor with the Twitter handle @unemon1, who runs a website at www.unemon.com/, covered the NHTC case excellently.

One thing investors may not have noticed is that Morinda’s primary product is also named Noni Juice (the full Chinese name is 大溪地诺丽牌大溪地诺丽加蓝莓果汁, which can be translated to Tahitian

Noni Brand Tahitian Noni Plus Blueberry Juice). And both of the “Noni Juices” have the same Chinese characters of “诺丽果汁” as their product name. Why is this important? Because the CCTV program made the "诺丽果汁” very well known (in a bad way) during their NHTC coverage. And the fact that Morinda’s main product is sold in China under the same Chinese name (in short) as NHTC’s product could make the customers/members hesitant or even unable to purchase or promote Noni juice, thus hurting Morinda’s business prospects in China substantially. This is the exact scenario that played out in the case of NHTC.

We found the following report in China, published in 2018, that had strong allegations regarding Morinda’s business conduct. Below are excerpts from this report, followed by their English translations (paraphrased) accordingly:

“……大溪地却涉嫌跨区域直销、超范围销售产品的违法违规行为,同时其采用的奖金制度也涉嫌多层次计酬。”

……Tahitian [Noni] is suspected to conduct direct-selling business and sell products in areas that are not allowed by the rules, and in the meantime the reward compensation system is suspected as calculating compensation in multiple levels.

“根据中国消费者报 2017 年 3 月 15 日的报道,“大溪地诺丽饮料(中国)有限公司在国内热土上辛勤耕耘直销业务,版图迅猛扩张,已在北京、山西、山东、辽宁、上海、浙江、江苏、 福建、广东、重庆设立了分公司。”

According to the China Consumer News report on March 15, 2017, “Tahitian Noni Beverages (China) Co., Ltd has been developing its direct-selling business and expanding its geographic areas, and [it has] set up branches in Beijing, Shanxi Province, Shandong Province, Liaoning Province, Shanghai, Zhejiang Province, Jiangsu Province, Fujian Province, Guangdong Province, and Chongqing.”

“然而第一直销网查询商务部直销行业管理信息系统发现,大溪地诺丽的分支机构只有四个,分别是辽宁、山东、广东、重庆。而上述报道中,大溪地诺丽已经在十个省市设立了分 公司。”

However, according to zhixiao001.com’s findings from China’s Ministry of Commerce direct-selling industry management information system, there are only 4 branches for Tahitian Noni, and they are Liaoning Province, Shandong Province, Guangdong Province, and Chongqing. But according to the China Consumer News report, Tahitian Noni has already set up branches in 10 provinces/cities.

“这明显违背了《直销管理条例》的规定:直销企业从事直销活动,必须在拟从事直销活动的省、自治区、直辖市设立负责该行政区域内直销业务的分支机构。商务部直销行业管理信 息系统也明示,直销企业的直销地区以信息系统查询为准,未经审核公布的地区不得开展直 销业务。”

This is an obvious violation to the <Direct-selling Management Rules>: Direct-selling companies that conduct direct-selling activities must set up the branches in the designated provinces, autonomous regions, or municipalities directly under the central government. The Ministry of Commerce direct-selling industry management information system also clearly shows that direct- selling companies’ designated regions should be based on the information system search, and they shall not conduct direct-selling business in the regions that are not reviewed and approved [by the Ministry of Commerce].

“公开资料显示,根据大溪地诺丽公司的奖金制度,二级特约经销商赚取佣金可至八层,一 级特约经销商赚取佣金七层,特约经销商赚取佣金六层,优惠顾客赚取四层佣金,达到 40 箱的优惠顾客赚取五层佣金。每月超过一箱部分有 20%的佣金。此外,经销商还能获得其它 红利、机动性进级奖金、批发商奖金等等。”

Public information shows that, according to Tahitian Noni’s compensation system, second tier special distributor’s earned commission could be 8 levels, and first tier special distributor’s earned commission could be 7 levels, and special distributor’s earned commission could be 6 levels, discounted customer could make 4-level commission, and discounted customer who reached 40 boxes could make 5-level commission. Every month over 1 box people could have 20% commission. In addition, distributors could also obtain other dividends, advancing bonuses, wholesale bonuses, etc.

“《直销管理条例》第二十四条规定,直销企业支付给直销员的报酬只能按照直销员本人直接向消费者销售产品的收入计算。如此看来,大溪地诺丽的佣金抽成最多的已经达到八层, 显然不符合规定,涉嫌多层次计酬。”

No.24 of the <Direct-selling Management Rules> says that, the compensation that direct-selling companies pay to their sales people should be based on the revenues generated from the products sales people sell to the consumers. Whereas Tahitian Noni’s commission reaches up to 8 levels, which is obviously not abiding by the rule and suspected as a multiple-level compensation calculation.

Morinda’s European Operations just Closed Down

Another aspect of Morinda struck us as particular. When we looked into its European operations, we found a business that was in the process of winding down. We obtained the financial records for Morinda UK Ltd. This entity consolidates all European operations of Morinda:

“Morinda Uk Limited (“the Company”) is a wholly owned subsidiary of Morinda Inc., a US company. The Company served as a regional headquarters and principal company for Europe and also directly operates a foreign branch in Russia and all the results of this branch are included within these financial statements.”

However, the company was in the process of entirely winding down operations.

“In July 2016, the Company’s office in London was closed in connection with worldwide group restructuring efforts to reduce loss-making activities. Effective December 1, 2016, the Company ceased it’s primary trading activities. The Company is now in the process of winding down its affairs will continue to wind down during the course of 2017. It is expected that all final corporate matters will be formally resolved by September 30, 2018”

Remember that Morinda sold itself to NBEV in December 2018, just months after it was supposed to formally resolve all European corporate matters.

The European filings also paint the picture of a hugely unprofitable company, citing this as the reason why the company has to wind down. The financials confirm this, as Morinda UK lost over £1 million on slightly over £14 million of revenue in 2016. We actually did not find a single Morinda entity that showed positive net income. However, SEC filings disclose that Morinda reported over $11m in net income in 2017. Something is clearly off.

European filings strengthen our opinion that Morinda is not a thriving business, but is indeed falling apart on many fronts. This is contrary to news NBEV has issued about expanding in Europe:

On May 16th 2019 and on January 30th 2019 NBEV, issued a press release announcing the roll out of a new Noni Collagen product. Amongst other things, NBEV mentions:

“Plans in place to rollout in Europe, Latin American, and other Asia Pacific markets throughout 2019”.

In light of the European filings we uncovered, we are highly suspicious of Morinda’s product roll-outs in Europe.

We also encourage readers to look into web traffic statistics, which overall paint the picture of a declining company. Morinda.com saw its daily traffic declining from a high of almost 900,000 to currently around 100,000.

Hidden Liabilities in the Morinda Transaction

Although CEO Brent Willis stated on the conference that Morinda had $46m in cash and cash equivalents at the closing of the transaction by NBEV, he failed to mention the >$50 million in contractional obligations owed to Morinda shareholders. These were disclosed much later in the 8K/A filed on 03/01/2019.

The $25m payment due upon a financing event is noteworthy. NBEV notes that:

“The Company believes it is probable that this event will occur in the second quarter of 2019.”

We view this as a lack of transparency towards NBEV shareholders when a big cash balance is discussed on the conference call, but big liability items are simply disregarded.

Another shady aspect that increases profits to Morinda insiders is an old Executive Compensation plan. This unfunded plan was established by Morinda in 2009 and all “financial performance targets” under the plan were achieved as of December 31, 2018, and a long-term liability of $4.1 million was acquired with Morinda. After the executives retire, the deferred compensation obligation is payable over a period up to 20 years.

Remember that the biggest portion (about half) of Morinda’s cash is supposedly sitting in China, and we have previously laid out why we believe Morinda’s China financials are not to be trusted.

Investors beware! In our experience, liabilities tend to almost always be real, but not the assets.

Are Auditors Just Bad or Complicit?

It has been repeatedly noted that issues relating to information access remain a key hurdle for outside investors in China. Top 10 auditors, all the way down to lower quality auditors, continue to be duped by Chinese companies. Still, it’s hard for us to believe that auditors are unable to detect some of the type of fraud that firms like ours can expertly identify. We can only assume that they just don’t care.

You might be wondering who signed off on all these fake financials. Utah based Deloitte & Touche LLP verified the financial statements of Morinda, Inc. and NBEV’s auditor has been Accell Audit & Compliance, P.A. since 2016.

Accell Audit & Compliance is a small Florida based firm with only 8 clients. Their PCOAB report outlines significant deficiencies as the firm-issued reports without yet having obtained sufficient evidence to

support their opinions. Deloitte seems to find itself on the wrong end of many international scandals this year: for example, the Malaysia fine the South China Morning Post reported, and the $8.0 million fine Deloitte had to pay in Brazil.

It is interesting to find big divergences between Chinese and US filings, but this challenge is not new to auditors. It has been repeatedly noted that issues relating to information access remains a key hurdle for outside investors in China. We have not found indications of outright wrongdoing from the auditors. Frankly, we simply believe they are not in a position to detect this kind of fraud. For a fraudulent company, it just seems easiest to hide fake financials in China; For example, a $20m cash balance that does not exist…

A Few Words Regarding The CBD Hype

Marley deal is terrible

NBEV’s CBD related licensing deal with the Marley brand has terribly economics for NBEV. NBEV ends up paying 50% of revenue for the licensing deal, yet our research indicates that standard rates for this industry are around 25%. It will be hard to turn a profit on such unfavorable economics. However, on June 20th 2019 NBEV announced that the Marley licensing deal would be extended globally.

CBD Products in the News

- NBEV announced that they will be selling CBD beverages in Colorado, Oregon, Washington, and Michigan starting in March 2019. On Fox Business News CEO Brent Willis said that people can already buy these CBD drinks in certain stores and soon in the 4 states.

- Their press release from January 2019 claims “pharmaceutical grade CBD”.

- Is CBD in food legal? In short, probably not. After the Farm bill was passed, the FDA posted a memo that said putting CBD in food is not legal, if moved intrastate. It is unclear if the FDA is allowing CBD in food within the cannabis legal states.

- We note that under the FD&C Act, it’s illegal to introduce drug ingredients like CBD into food. Our research indicates that Michigan (one of NBEV’s target states), will default to FDA rules. California also defaults to FDA rules (no CBD in food).

- Bruce Linton, the CEO of Canopy Growth acknowledged in a recent interview on CNBC’s M ad Money that the FDA has been clear that food including CBD it is not ready for human consumption.

We also believe that investors might be vastly overestimating near term potential from CBD infused drinks. Through channel checks, we have found that currently the largest, most established US distributor of sparkling CBD beverages (in 16 states), Sprig, is making <$15 million in revenue. In light of New Age’s 50/50 profit share on Marley infused products, we believe there will be minimal impact to GP even if NBEV matches sales of the current market leader, Sprig.

Highly Promotional CEO with a History of Business Failures

CEO Brent Willis had allegations of being highly promotional, and has been involved in multiple public companies that failed. Some have even considered them to be pump-and-dump schemes.

Willis’ track record for running public companies has not been impressive prior to NBEV. He served as Executive Chairman the IPO of XFit Brands (XFITB) during its decline from $1.10 per share to currently less than 1 cent per share.

Even more spectacular was the failure of Electronics Cigarettes International Group, Ltd. (currently ECIGQ). Brent Willis was CEO from 2013 until 2015, and in 2017 the company finally filed for bankruptcy.

Brent Willis is also currently Chief Operating Officer of Voyageur Minerals, a TSX traded exploration stage mining company that currently sports a stock price of CAD 0.06.

We see a pattern of Brent Willis getting involved in the latest hot business ventures that seem to sell on Wall Street (E-Cigarettes, CBD Drinks) that temporarily reach a high market capitalization. But the ultimate outcome seems always the same for shareholders: A near complete loss of their capital.

Executive Compensation and Insider Selling is Accelerating

NBEV had some juicy salary increases beginning 2019. Brent Willis’ base salary more than doubled from

$312,500 to $650,000. CFO Gregory Gould also saw his base salary double to $500,000 per year.

Insiders have also been selling their shares. Form 4 filings from April 2019 show Brent Willis locked in over $1.6 million by disposing of a 300,000 NBEV shares. This has been the biggest insider sale for years. Did Brent Willis start to realize that something is substantially wrong with the Morinda transaction?

Dilution & Cash Burning Machine

NBEV’s transaction spree has been largely fueled by continuous equity raises. The company more than doubled its share count in 2018 from 35m shares to over currently over 75m shares.

This is not the end of it, as NBEV has filed a new registration statement to sell an additional 18m shares.

A key problem we see with this strategy is that NBEV’s roll-up has resulted in a company that is notoriously unprofitable and does not generate cash flow. In other words, NBEV is reliant on equity raises to keep the business afloat.

We uncovered what we believe may have been fraud in NBEV’s biggest transaction to date. This does not only warrant scrutiny on Morinda itself, but also on NBEV’s overall strategy. We believe that once investors and stakeholders start to understand the truth about Morinda, NBEV will have a harder time approaching the public market for equity investments.

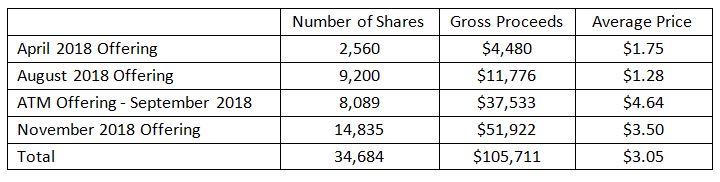

The company conducted numerous equity financings in 2018. According to its 2018 10K, it had 4 equity raises throughout 2018:

It seems like the majority of the money raised, was used to fund the Morinda transaction.

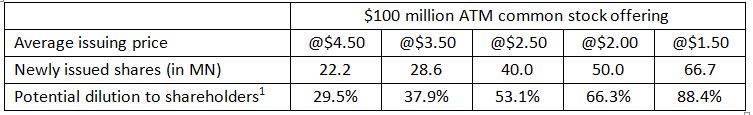

However, it appears that there is no sign of stopping on the equity financing front, even after Morinda. On April 30, 2019, NBEV entered into a sales agreement with Roth Capital Partners, LLC, to sell up to

$100m worth of shares of the company’s common stock for an “at the market offering” (ATM offering).

Wikipedia explains:

An at-the-market (ATM) offering is a type of follow-on offering of stock utilized by publicly traded companies in order to raise capital over time. In an ATM offering, exchange-listed companies incrementally sell newly issued shares into the secondary trading market through a designated broker-dealer at prevailing market prices.

NBEV completed an ATM offering in 2018, when the stock was offered at an average price of about $4.64 per share, for an aggregate of about $37.5 million. However, since the offering price is not fixed on ATM offering, and if NBEV is really fleeced in the Morinda transaction and will not do well in the coming future as we predict, the ATM offering could cause much more dilution than investors anticipated. For example, at current price of $4.50 a share, a $100m offering at this price would result in 22.2 million new shares, but if the stock price is $3.50, then the newly issued shares would amount to 28.5 million. It would be 50 million shares at an average price of $2.00, and 66.7 million shares at an average price of $1.50.

Note 1: dilution was calculated based on 75.393 million common stocks outstanding as of May 6, 2019 according to the company’s most recent 10Q

Conclusion

We have laid out our case for why we believe Morinda’s financials that were presented to the SEC and NBEV shareholders can simply not be relied upon. This report once again proves that the times of the “China Hustle” are long from over. The opaqueness and issues relating to information access still leave plenty of room to defraud US investors. Therefore, it has been our mantra that enhanced scrutiny is warranted when dealing with companies that conduct a substantial part of their operations in China. We can only conclude that NBEV management seemingly failed to conduct the necessary due diligence.

We believe investors and other stakeholders will start to share our negative opinion about Morinda and rightfully lose faith in NBEV’s roll-up strategy. Accounting issues, financial restatements, or worse could lay ahead. A key problem for NBEV is that the company needs equity raises to keep its current business afloat, and might have to conduct these at inopportune times under toxic terms. We set our intermediate price target at $2.00 but believe that in the long run, NBEV shareholders will ultimately meet the same fate as the investors in Brent Willis’ previous public companies: A near total loss of their capital.

----------------

Appendix 1: Approved 4 Branches of Tahitian Noni Beverage (China) Co., Ltd. on China Ministry of Commerce Website

Source: screenshot from China Ministry of Commerce website.

For additional appendices, please see our full research report here.

Disclosure: We are short NBEV.

Ouch! What does $NBEV have to say about this report?

The company did respond. They are denying the allegations but the evidence does not look good for them. It will be interesting to see how this plays out for $NBEV.

Grizzly Research Reports, is it true the company reached out to you directly about your report? What did they say, and how did you respond?

This is one of the most thorough, eye opening articles I've read in a long time. A definite red flag for $NBEV shareholders (and that's being generous)!

Wow, major expose here on #NewAgeBeverage. I would say if you have $NBEV stock, it's time to sell!

Liked!

Very impressed! I followed you to be notified of your next report.

Excellent! I want more.

If all this is true about $NBEV, it's BAD NEWS with a capital B.

This is insane! This needs to be required reading for $NBEV shareholders.

This is incredibly thorough. How did you get all this information? And how did you first come to suspect something was amiss?

Yes, this article is incredibly damning, if true. Can anyone who knows Chinese confirm that these translations are accurate?

Yes, how is it that this story hasn't broken before? And why is it being broken by a contributor I've never heard of? I know TM vets its authors and I've NEVER seen fake news on this site like I've seen on Seeking Alpha and so many others. But does anyone know anything about this Grizzly company?

I agree. No fake news here. And besides, this is a very thorough report and all the proofs and evidence are clearly in the article or in the included links. So I have no reason to doubt it. I want to learn more. @[Grizzly Research Reports](user:98590), please tell us more about yourselves. Are you really so large that you have a team on the ground in China?

Wow!