Tuesday, April 4, 2023 2:12 PM EST

Yen. Image Source: Pixabay

The USD/JPY fell sharply after the release of US economic data pointed to a slowdown. The pair tumbled from 132.80 to 131.53, reaching the lowest since March 29.

The pair remains under pressure under 131.80, with the US Dollar weaker across the board. The DXY is falling 0.48%, trading at 101.57, on its way to the second-lowest daily close since May 2022.

The JOLTs report showed a decline to 9.9 million job openings, the lowest reading in two years. In a different report, Factory Orders dropped for the second month in a row, by 0.7% below the slide expected of 0.5%. The ADP Employment report and the ISM Service Sector PMI are due on Wednesday.

After the reports, US yields sank. The US 10-year yield dropped to 3.35% and the 2-year to 3.84%. The moves in the bond market boosted the Japanese currency which rose across the board.

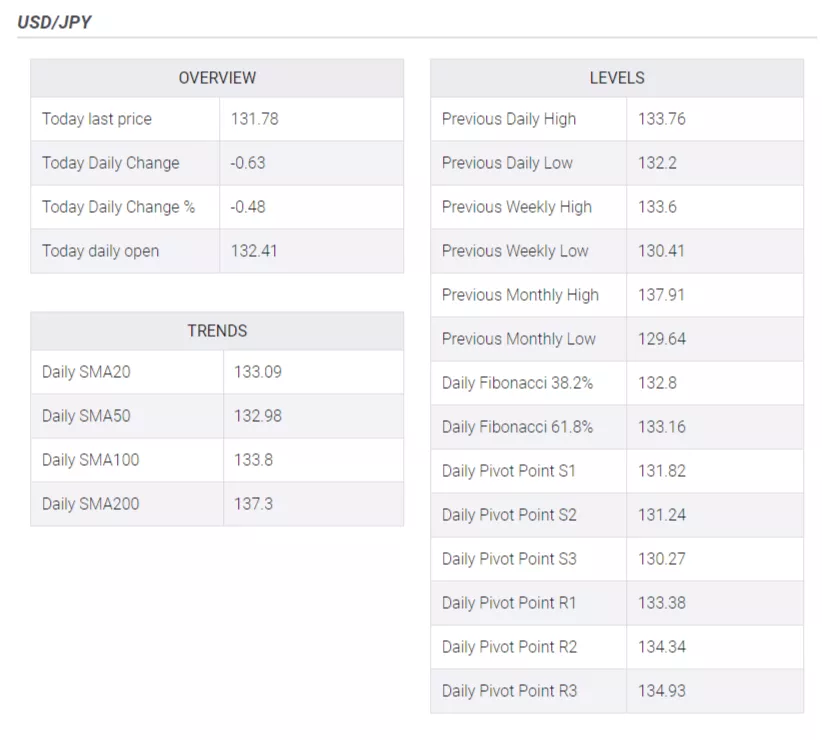

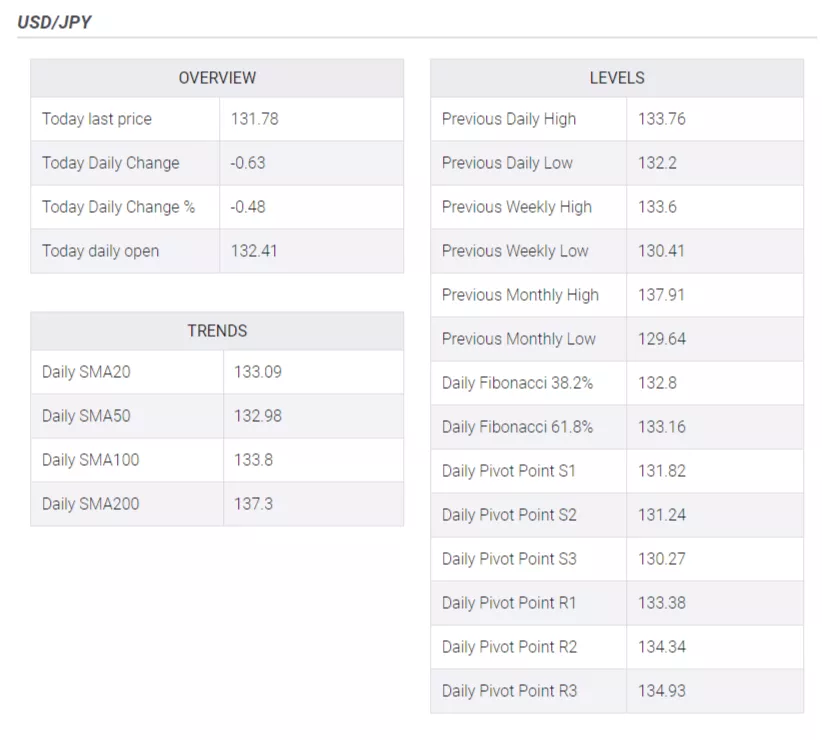

Technical indicators in USD/JPY 4-hour chart point to another test of the daily lows around 131.50. A break lower would expose the next support that is seen at the 131.10 area. The Dollar needs to regain levels above 132.50 to alleviate the bearish pressure.

Technical levels

More By This Author:

Silver Price Forecast: XAG/USD Stays Above $24 Despite Retreating From Weekly Highs

Silver Price Analysis: XAG/USD Keeps The Red Below $24.00, Downside Seems Cushioned

OPEC Producers Announce Voluntary Oil Output Cuts

Disclaimer: Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only ...

more

Disclaimer: Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

less

How did you like this article? Let us know so we can better customize your reading experience.