USDCNH Double Or Triple Zigzag?

(Click on image to enlarge)

In the long term, the USDCNH pair is expected to form a large double zigzag consisting of cycle sub-waves w-x-y.

The actionary wave w took the form of a standard zigzag. The bearish intervening wave x has ended. This wave contains a double zigzag of the primary degree Ⓦ-Ⓧ-Ⓨ.

Thus, in the near future, prices could move higher in the actionary wave y. Perhaps it will take the form of a standard zigzag Ⓐ-Ⓑ-Ⓒ.

Most likely, we will see the end of the first primary wave Ⓐ at the maximum of 7.00, or a little higher.

(Click on image to enlarge)

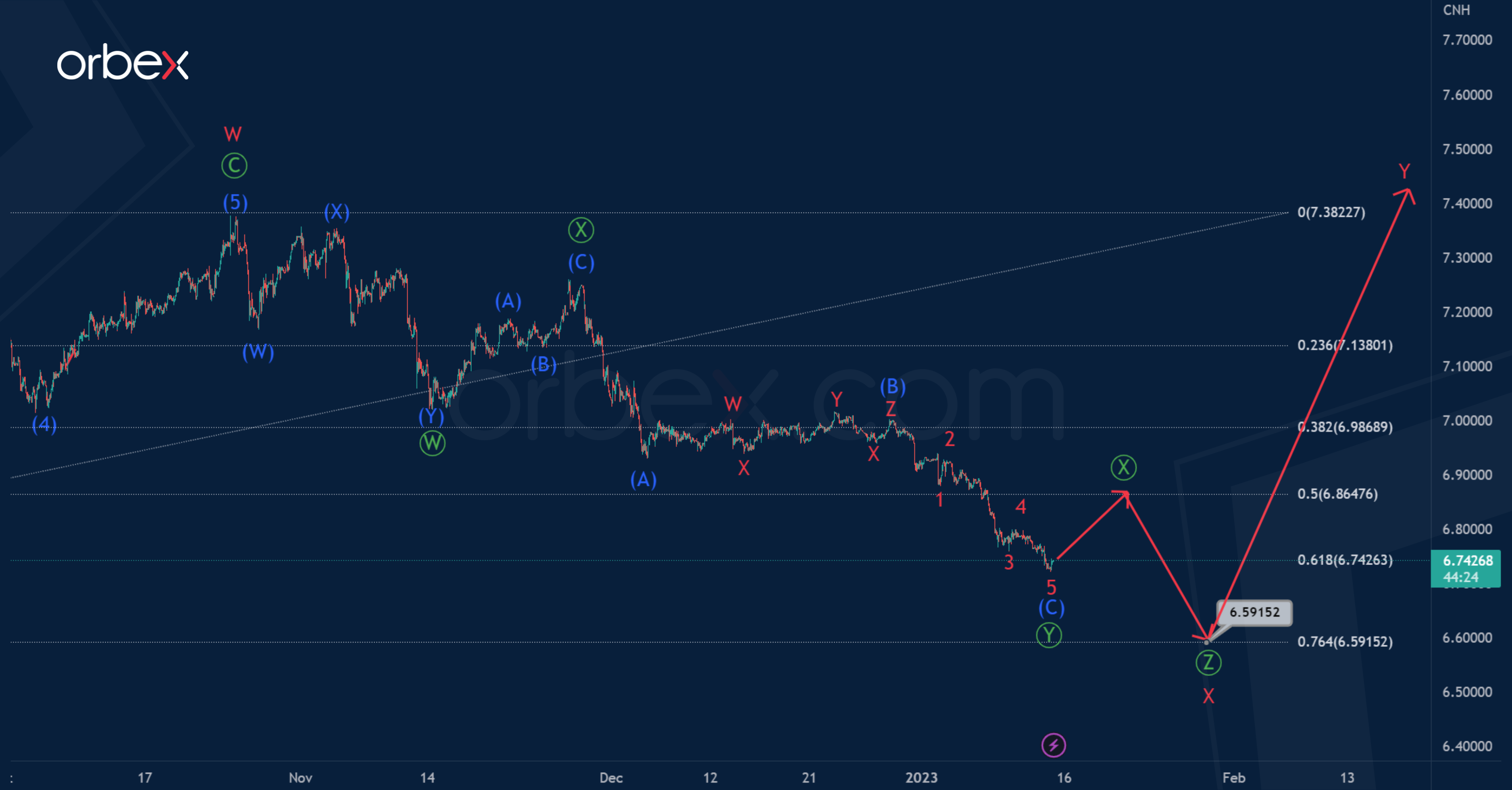

Let’s consider an alternative scenario where the price will move in a downtrend. Perhaps the cycle intervening wave x is not yet complete. Most likely it will take the form of a triple zigzag Ⓦ-Ⓧ-Ⓨ-Ⓧ-Ⓩ and not a double one.

If the actionary wave Ⓨ is completed, then a slight increase in the second intervening wave Ⓧ is likely. After which, the fall can be continued in the final primary wave Ⓩ.

The approximate level to which the market could collapse is 6.591. It is determined using Fibonacci lines. At that level, wave x will be at 76.4% of wave w.

More By This Author:

German GDP, Spanish CPI And Can Europe Avoid A Recession?

DXY Triple Zigzag To End Near 101.41

Intraday Market Analysis – USD Awaits Catalyst - Thursday, Jan. 12

Disclaimer: Orbex LIMITED is a fully licensed and Regulated Cyprus Investment Firm (CIF) governed and supervised by the Cyprus Securities and Exchange Commission (CySEC) (License Number ...

more