Two Trades To Watch: DAX, USD/JPY - Thursday, Dec. 1

Image Source: Unsplash

DAX rallies post-Federal Reserve Chair Jerome Powell's speech. USD/JPY falls to a 3-month low ahead of core-PCE.

DAX rallies post-Federal Reserve Chair Jerome Powell's speech

After surging 8% across the month of November, the DAX is showing few signs of slowing. The German index is pointing to a 1% jump o the open, continuing the upbeat mood from Wall Street.

Federal Reserve Chair Powell signaled that the Fed would slow the pace at which it raises interest rates from December. His comments come as expectations for a slower rate hike build in Europe as well.

After eurozone inflation came in cooler than forecast at 10%, down from the record high of 10.6% in October, the odds of a 50 basis point hike in December have risen. A slower pace of hikes would be beneficial for stocks.

German retail sales disappointed, falling -2.8% MoM in October, after rising 0.9% in September. This was below forecasts of a -0.6% decline. Sales fell as surging fuel bills mean that consumers spend less on non-essential items.

Looking ahead, German manufacturing PMI data is expected to confirm 46.7, an improvement from October’s 45.1.

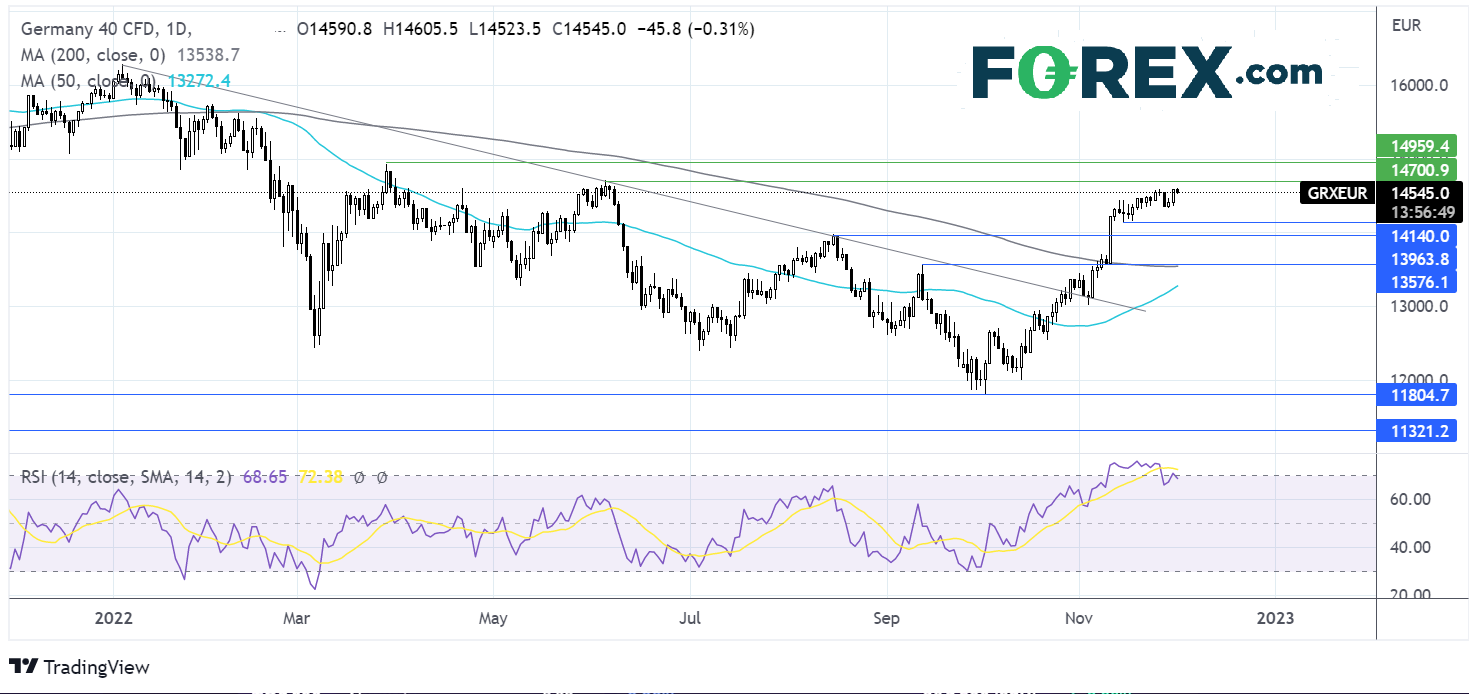

Where next for the DAX?

The DAX extends its runup towards 14700, the June high. The RSI is teetering on overbought territory, so buyers should be cautious. A rise above 14700 brings 14930, the March high, into play.

On the flip side, support can be seen at 14100 the mid-November low. A break below here opens the door to 13950, the August high, before exposing the 200 sma at 13570. A break below here negates the near-term uptrend.

(Click on image to enlarge)

USD/JPY falls to a 3-month low ahead of core-PCE

USD/JPY has fallen to a 3-month low after Federal Reserve Chair Jerome Powell's speech. The market has focused on the downshift in rate hikes rather than the comments that interest rates would need to rise higher.

Meanwhile, the yen is rallying after BoJ’s board member Noguchi prompted speculation that the BoJ could adopt a less dovish stance should inflation remain elevated.

Inflation will remain in focus with the release of US core PCE data. Expectations are for a tick lower to 5% from 5.1%.

A large than-expected decline could fuel the less hawkish Fed trades pulling the USD lower still.

US ISM manufacturing data is also due to be released. Expectations are for a fall below 50 to 49.3.

Where next for USD/JPY?

USD/JPY has fallen through support at 137.65 the previous November low, as the selloff extends towards the 200 sma.

The RSI is on the verge of oversold territory, so sellers should be cautious; some consolidation or a tick higher could be on the cards.

Sellers could look for a move below 134.40 the daily low to expose the 200 sma. A move below the 200 sma would be significant given that the price has traded above the 200 sma since February 2021.

On the flip side, buyers could look for a rise over 140.35 the September low to extend a recovery towards 141.60 last week’s high. A move over here creates a higher high.

(Click on image to enlarge)

More By This Author:

Two Trades To Watch: EUR/GBP, Gold - Wednesday, Nov. 30

Two Trades To Watch: EUR/USD, USD/CAD - Tuesday, Nov. 29

Two Trades To Watch: Oil, AUD/USD

Disclaimer: The information on this web site is not targeted at the general public of any particular country. It is not intended for distribution to residents in any country where such ...

more