Two Trades To Watch: EUR/USD, USD/CAD - Tuesday, Nov. 29

Image Source: Unsplash

EUR/USD rises with ECB talk & German inflation in focus

EUR/USD is rebounding, pushing towards 104 on the improved market mood and following hawkish comments from ECB President Lagarde.

Lagarde warned that peak inflation may not yet have been reached, suggesting that more interest rate hikes were on the way. Her comments were echoed by other ECB members Klaas Knot and Spain’s Hernandez.

Attention will remain on inflation with the release of German inflation figures, which are expected to cool from 11.6% in October to 11.3%. The data comes after German PPI data dropped sharply in October to 34.5% from above 40%.

Eurozone consumer confidence data is also due to be released. This is the second reading and is expected to confirm 23.9.

The USD is falling after choppy trade yesterday, following mixed messages from Federal Reserve speakers. Officials appeared to agree that more work was to be done to rein in inflation.

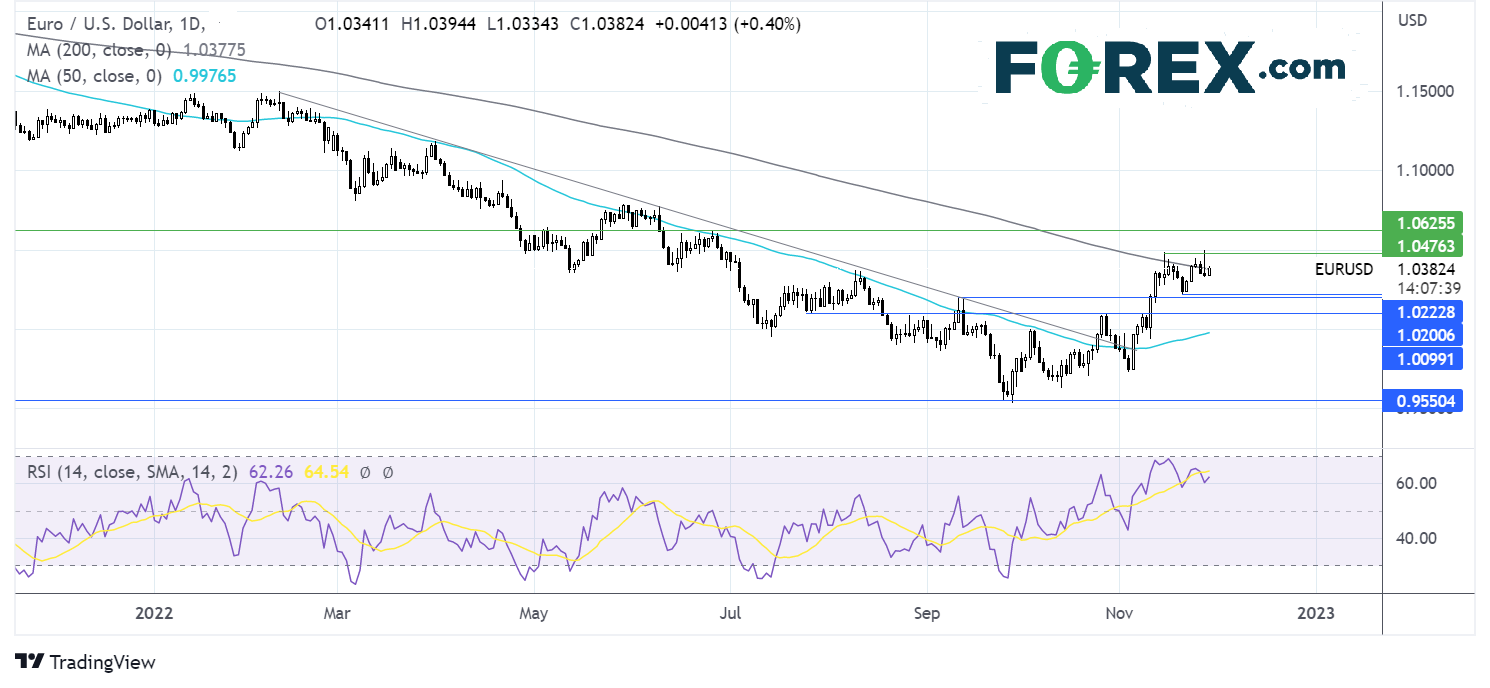

Where next for EUR/USD?

EUR/USD is attempting to push back above its 200 sma, which, combined with the RSI above 50 could keep buyers hopeful of further upside. Buyers would look for a rise over 1.04 round number to bring 1.05. Monday’s high into focus. A rise above here creates a higher high.

Should buyers fail to defend the 200 sma, sellers could look towards support at 1.0230, last week’s low, ahead of 1.02, the September high.

(Click on image to enlarge)

USD/CAD falls as oil rebounds, and GDP data is due

USD/CAD is falling after booking its biggest one-day gain in six weeks yesterday as the loonie tacks oil prices higher and as attention shifts to GDP data.

The market mood has improved despite the ongoing Covid situation in China. Hopes are rising that the outburst of protest could see a sooner end to zero-Covid, or at least some measures relaxed.

Oil prices are rebounding 3% as speculation grows that OPEC+ could cut oil production beyond the 2 million barrels already agreed upon when they meet later this week.

Canadian GDP data is due to be released and is expected to rise 3.5% in Q3 annualized, up from 3.3%.

The data comes ahead of US GDP data tomorrow and a speech by Jerome Powell. Today, the USD will look towards US consumer confidence data which is expected to edge lower to 100 from 102.5 in October.

Where next for USD/CAD?

After running into resistance once again at 1.35 USD/CAD has rebounded lower, remaining within a familiar band of 1.35 – 1.3315 last week’s low. The RSI is neutral at 50, giving away a few clues.

Buyers need to break back up over 1.35 to extend the bullish run, which is proving to be a big test.

Meanwhile, sellers could look for a move below 1.3315, to test the 1.3280 the 100 sma ahead of 1.3220 the July high.

(Click on image to enlarge)

More By This Author:

Two Trades To Watch: Oil, AUD/USD

Two Trades To Watch: DAX, AUD/USD - Friday, Nov. 25

Two Trades To Watch: EUR/USD, Oil - Thursday, Nov. 24

Disclaimer: The information on this web site is not targeted at the general public of any particular country. It is not intended for distribution to residents in any country where such ...

more