Two Trades To Watch: Oil, AUD/USD

Image Source: Pixabay

Oil tumbles to a 2022 low. AUD/USD falls on China fallout, retail sales miss.

Oil tumbles to a 2022 low

After booking the third week of losses last week, oil prices are heading lower, falling to and new 2022 low.

Oil is dropping as COVID cases in China continue to rise and after strict mobility curbs were implemented over the weekend, which threatens to slow economic activity in the country.

Data earlier this month highlighted the impact that the zero-COVID policy was having on the Chinese economy, the world’s largest oil importer. Without any major changes to the way that China approaches COVID, the outlook for the economy and for oil demand remains weak.

Regarding supply, OPEC+ is set to meet at the end of the week to discuss output levels. The group cut production by 2 million barrels in the October meeting to support the prices, which have continued to fall since then.

Where next for oil prices?

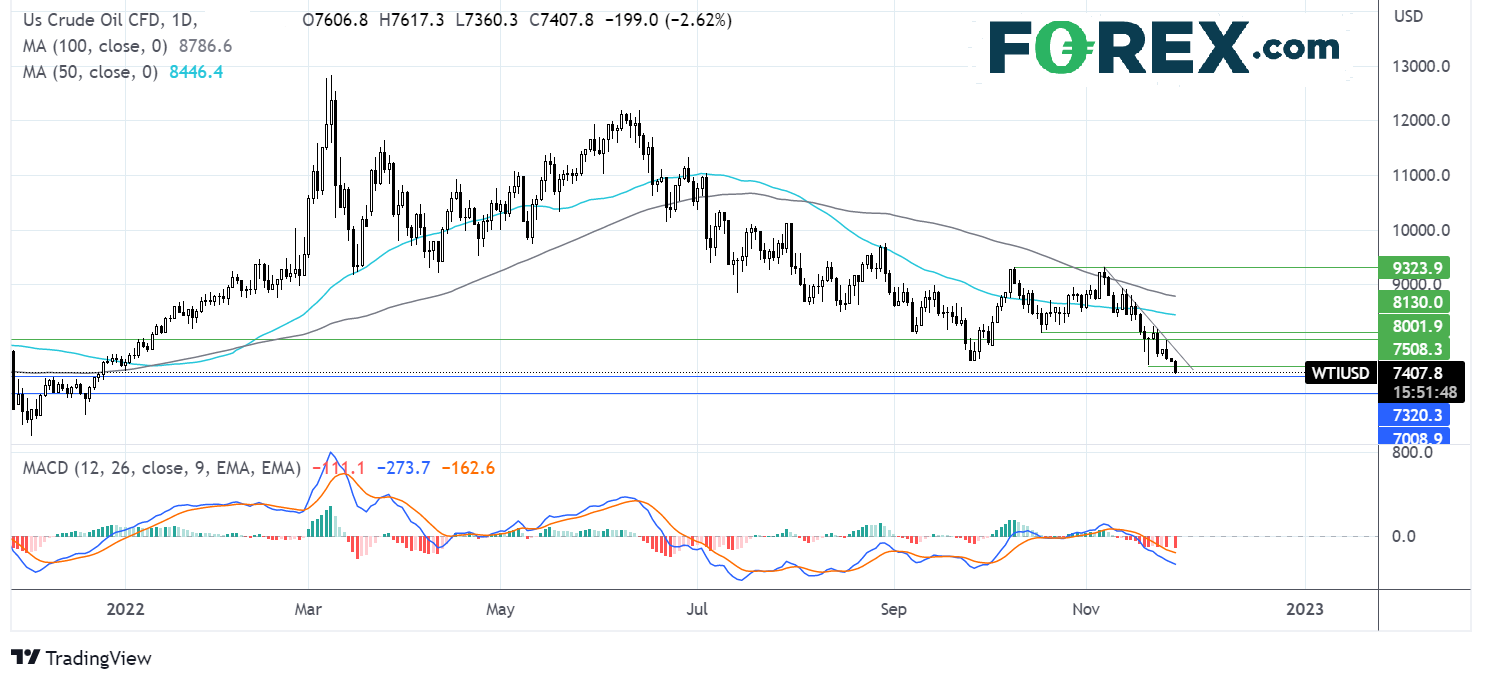

Oil hit resistance at 93.20 at the start of November and fell lower, dropping below the 50 & 100 sma. It also trades below a month-old falling trendline.

Sellers have broken below 75.25, the previous November low, and is heading towards 73.00, the early December ’21 high. A break below here opens the door to 70.00, the psychological level.

On the upside, buyers will look for a rise over 75.25, the previous November low, ahead of 80.00 the psychological level. A rise above here brings 81.20, the October 18 low, into focus, exposing the 50 sma at 84.30.

(Click on image to enlarge)

AUD/USD falls on China fallout, retail sales miss

AUD/USD has set off on the back foot, paring gains from the previous week. While optimism surrounding a dovish pivot from the Federal Reserve boosted the pair last week, today, the risk-off mood is hitting the commodity currency.

The civil unrest in China as COVID cases and unsustainable lockdown restrictions rise has hit the market mood. The latest developments highlight the headwinds that face China, Australia’s largest trading partner.

Australian retail sales were also disappointing. Sales unexpectedly fell -0.2% MoM in October after rising 0.6% in September. The decline in sales comes as consumer resilience falters amid high inflation and rising interest rates.

The RBA slowed the pace of rate hikes to 25 basis points in recent meetings on the back of concerns over the impact on households.

Meanwhile, the USD is rising on safe-haven flows. There is no high-impacting US data today. Instead, attention will be on Fed William for further clues over the outlook for interest rates ahead of Jerome Powell’s speech later in the week.

Where next for AUD/USD?

AUD/USD is falling away from the weekly high, dropping below 0.67 and the 100 sma. This, combined with the receding bearish bias on the MACD, keeps sellers hopeful of further downside.

Sellers will look for a fall below 0.66 last week’s low to create a lower low and expose the 50 sma at 0.6490. Below here, the falling trendline support at 0.6350 comes into play.

On the upside, should buyers successfully defend the 100 sma, buyers could look to rise to 0.6780, last week’s high, ahead of 0.68, the November high, and falling trendline resistance.

(Click on image to enlarge)

More By This Author:

Two Trades To Watch: DAX, AUD/USD - Friday, Nov. 25

Two Trades To Watch: EUR/USD, Oil - Thursday, Nov. 24

Two Trades To Watch: USD/JPY, FTSE- Wednesday, Nov. 23

Disclaimer: The information on this web site is not targeted at the general public of any particular country. It is not intended for distribution to residents in any country where such ...

more