This Week: EURUSD, AUDUSD And USDInd In Focus

- EURUSD tracks Eurozone inflation for trend cues on

- AUDUSD hinges on GDP as momentum shows mixed tone!

- USDInd awaits PCE to guide dollar bias amid shifts

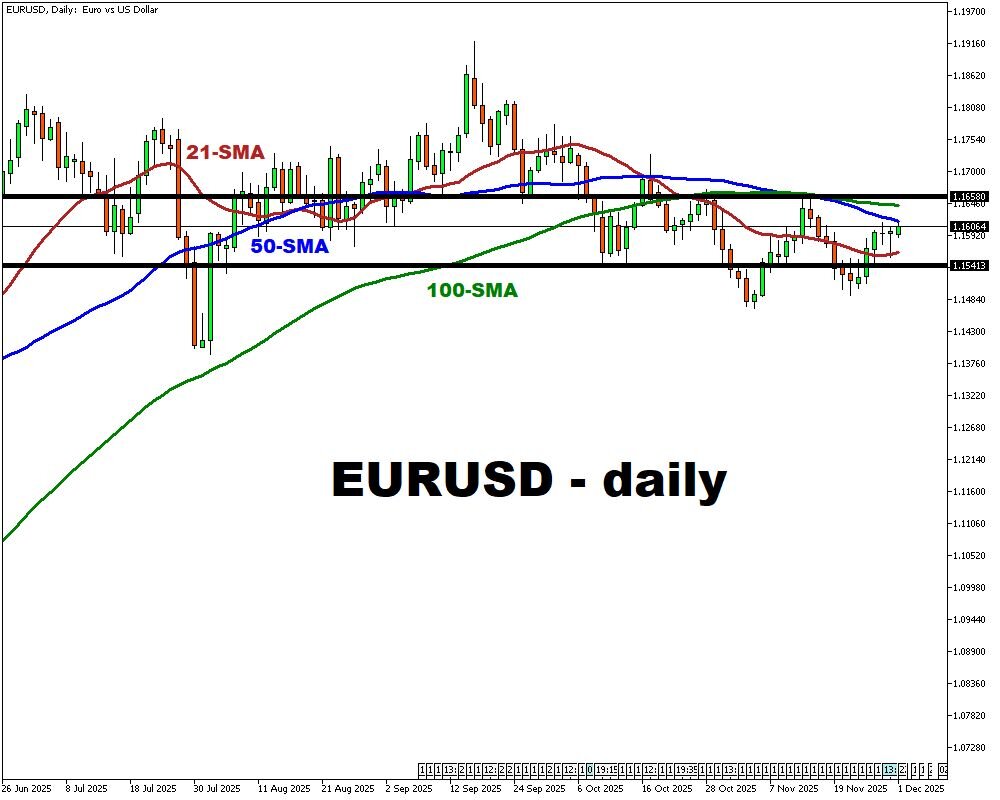

For EURUSD, the focus shifts to the latest Eurozone inflation update as markets watch how price trends evolve into year-end. For AUDUSD, Australia’s upcoming GDP release offers insight into whether economic momentum is stabilizing after a period of uneven growth.

For USDInd, the U.S. PCE reading will help clarify how consumers and prices are progressing, a key consideration for how broad dollar sentiment forms. Also note, with liquidity thinning into December and global activity indicators sending mixed signals, many retail traders may notice sharper intraday reactions around major data releases.

Events Watchlist:

Tuesday, Dec 2: Eurozone Inflation Rate – EURUSD

Eurozone inflation recently eased, though certain service components have remained firm.

A stronger reading could lead market participants to view the euro’s backdrop as more stable, which may influence EURUSD toward 1.1658. A softer reading could nudge EURUSD toward 1.1541.

Wednesday, Dec 3: Australia GDP Growth Rate – AUDUSD

Australia’s economy has shown modest resilience despite ongoing cost pressures and uneven household demand. A firmer GDP outcome could shape sentiment in a way that supports AUDUSD toward 0.6581. A weaker figure could highlight slowing momentum, potentially guiding AUDUSD sentiment toward 0.6471.

Friday, Dec 5: U.S. PCE Reading – USDInd

The PCE gauge remains an important reference point for understanding U.S. consumer conditions and price trends. A hotter PCE result could lead markets to lean toward a firmer outlook for the dollar, which may influence USDInd toward 100.327. A cooler reading could strengthen expectations of easing price pressures, potentially aligning USDInd sentiment toward 99.033.

Other major events this week:

Monday, Dec 1

- JPY: BoJ Governor Ueda Speech

- CNY: China RatingDog Manufacturing PMI (Nov)

- CHF: Swiss procure.ch Manufacturing PMI (Nov)

- USD: ISM Manufacturing PMI (Nov); Manufacturing Employment (Nov)

Tuesday, Dec 2

- JPY: Japan Consumer Confidence (Nov)

- SPN35: Spain Unemployment Change (Nov)

- EUR: Eurozone Inflation Rate (Nov); Unemployment Rate (Oct)

- MXN: Mexico Business Confidence (Nov)

- WTI: US API Crude Oil Stock Change (w/e Nov 28)

Wednesday, Dec 3

- AUD: Australia GDP Growth Rate (Q3)

- CNY: China RatingDog Services PMI (Nov)

- CHF: Swiss Inflation Rate (Nov)

- SPN35: Spain HCOB Services PMI (Nov)

- USD: ISM Services PMI (Nov); ADP Employment Change (Nov)

- WTI: EIA Crude Oil Stocks Change (w/e Nov 28)

Thursday, Dec 4

- AUD: Australia Balance of Trade (Oct)

- CHF: Swiss Unemployment Rate (Nov)

- GBP: UK S&P Global Manufacturing PMI (Nov)

- EUR: Eurozone Retail Sales (Oct)

- US500: US Initial Jobless Claims (w/e Nov 29)

- CAD: Canada Ivey PMI s.a. (Nov); Balance of Trade (Sep, Oct)

- JP225: Japan Household Spending (Oct)

- USD: US Balance of Trade (Sep)

Friday, Dec 5

- EUR: Germany Factory Orders (Oct)

- GBP: UK Halifax House Price Index (Nov)

- FRA40: France Balance of Trade (Oct)

- MXN: Mexico Consumer Confidence (Nov)

- CAD: Canada Unemployment Rate (Nov)

- USD: US PCE Price Index (Sep); Michigan Consumer Sentiment (Dec); Personal Income and Personal Spending (Sep); Factory Orders (Oct)

Sunday, Dec 7

- JPY: Japan Current Account (Oct)

More By This Author:

Brent Touches Below $63 As Glut Looms

Gold's Bullish Surge Amid Fed Easing Bets

This Week: US500 Index In Focus