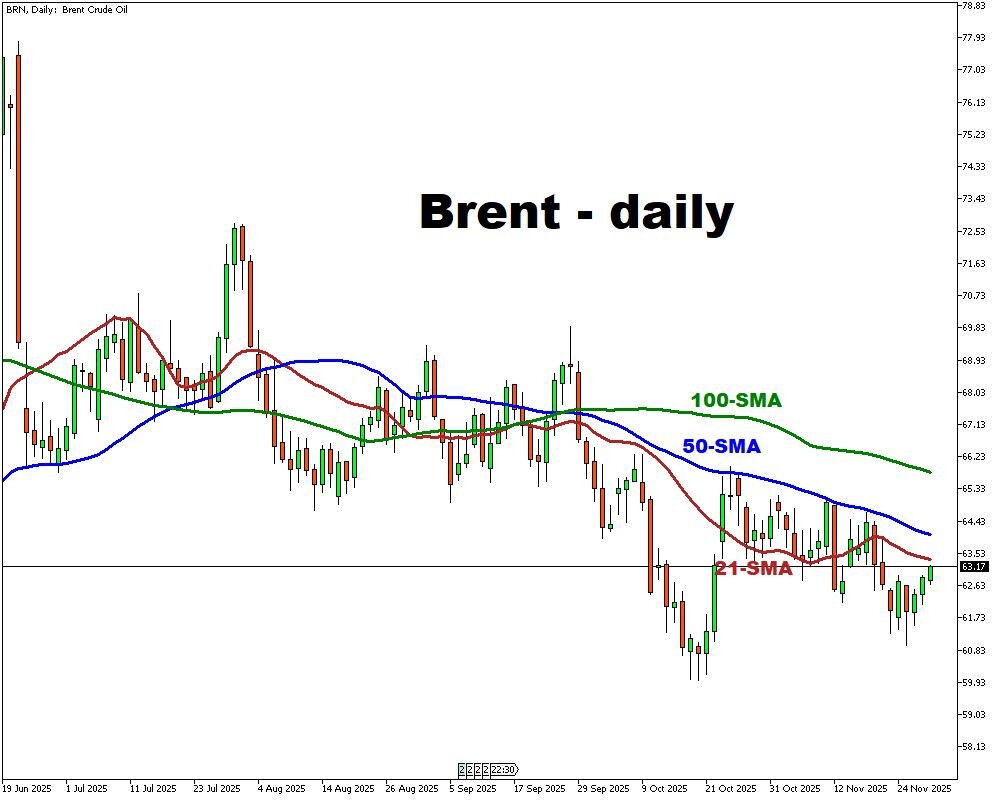

Brent Touches Below $63 As Glut Looms

- Brent < $63 amid fourth monthly drop

- Oversupply grows as OPEC+ adds barrels

- Peace talks are in focus

- OPEC+ to pause hikes, audit quotas

- 2026 surplus may push Brent to $60

Brent touched below $63 per barrel on Friday, November 28, 2025, heading for a fourth consecutive monthly decline – the longest losing streak in over two years.

Persistent oversupply fears dominate, with OPEC+ gradually restoring capacity and non-OPEC nations pumping more oil, while demand from China and other Asian economies remains subdued.

Geopolitical hopes offered only fleeting support: President Putin endorsed Trump’s peace proposals, raising the possibility that Western sanctions on Russian oil could eventually ease and release additional barrels onto an already saturated market.

Attention now turns to Sunday’s virtual OPEC+ meeting, where the group is widely expected to confirm its plan to pause planned output increases into early 2026 and launch a lengthy review of members’ production quotas instead of tightening supply.

With markets pricing in global surplus next year, analysts see Brent vulnerable to a drop toward $60 unless significant demand surprises or geopolitical disruptions emerge.

More By This Author:

Gold's Bullish Surge Amid Fed Easing BetsThis Week: US500 Index In Focus

Gold And Oil Slide On Shifting Market Forces