Speculators Edged US Dollar Index Bullish Bets Higher. Euro & GBP Bets Jump

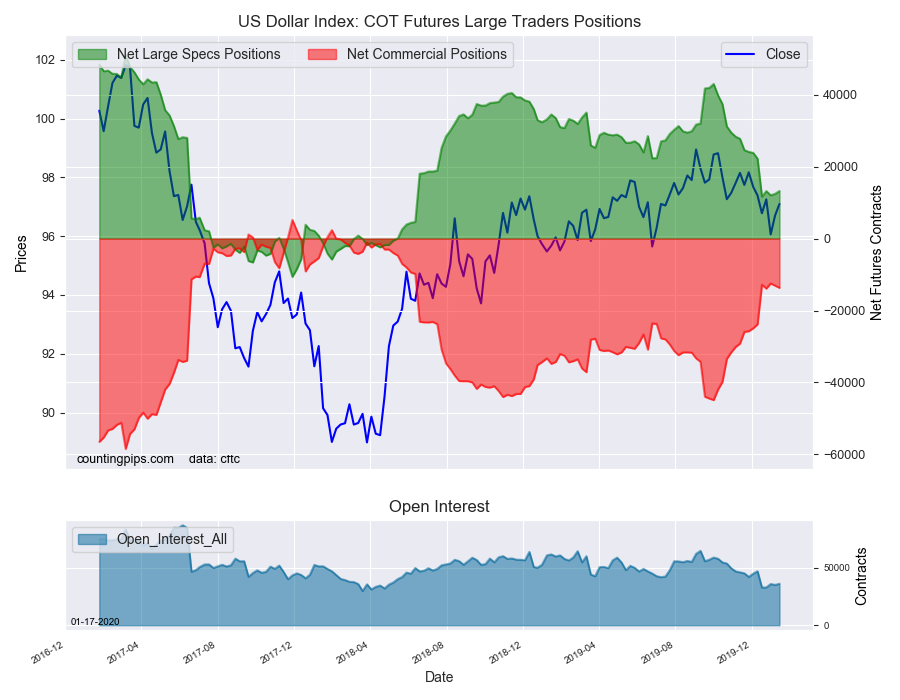

US Dollar Index Speculator Positions

Large currency speculators added to their bullish net positions in the US Dollar Index futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of US Dollar Index futures, traded by large speculators and hedge funds, totaled a net position of 13,263 contracts in the data reported through Tuesday, January 14th. This was a weekly increase of 795 contracts from the previous week which had a total of 12,468 net contracts.

This week’s net position was the result of the gross bullish position (longs) rising by 1,765 contracts (to a weekly total of 25,590 contracts) compared to the gross bearish position (shorts) which saw a lesser gain of 970 contracts on the week (to a total of 12,327 contracts).

US Dollar Index speculators slightly added to their bullish bets for a second week in a row. Previously, speculator positions had fallen for twelve out of the prior thirteen weeks and by a total of -30,974 contracts over that period. The current level of net speculator positions has now been below +15,000 contracts for five consecutive weeks for the first time since the May/June time-frame of 2018.

Individual Currencies Data this week:

In the other major currency contracts data, we saw three substantial changes (+ or – 10,000 contracts) in the speculators category this week.

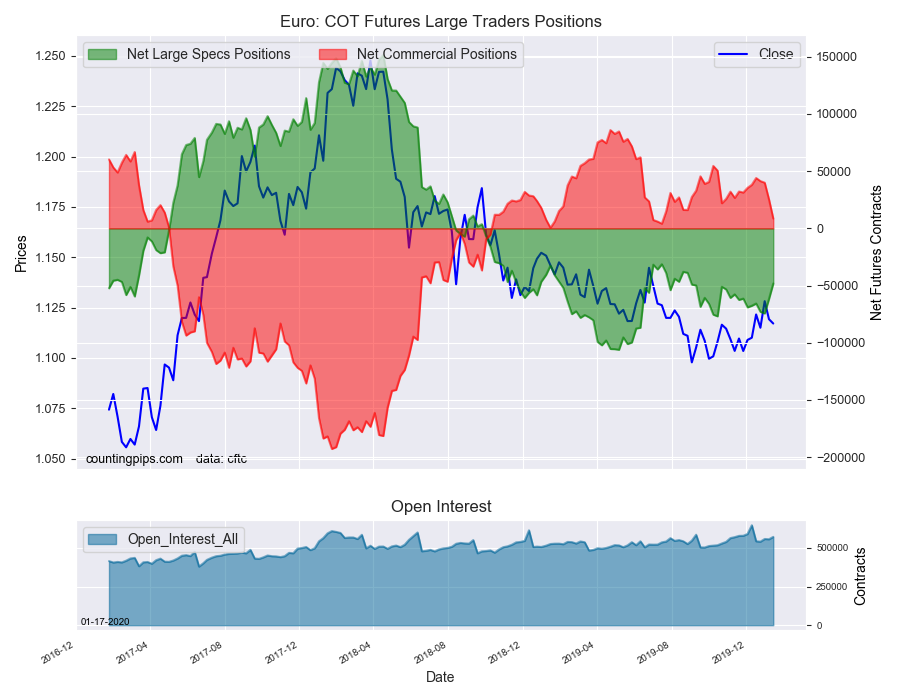

Euro positions improved sharply this week by over +13,000 contracts and have now risen by over +25,000 net contracts in the past two weeks. Despite the recent gains, the euro positions remain in bearish territory at a total of -48,182 net contracts. Overall, euro positions have now been in bearish territory for sixty-eight consecutive weeks, dating back to October of 2018.

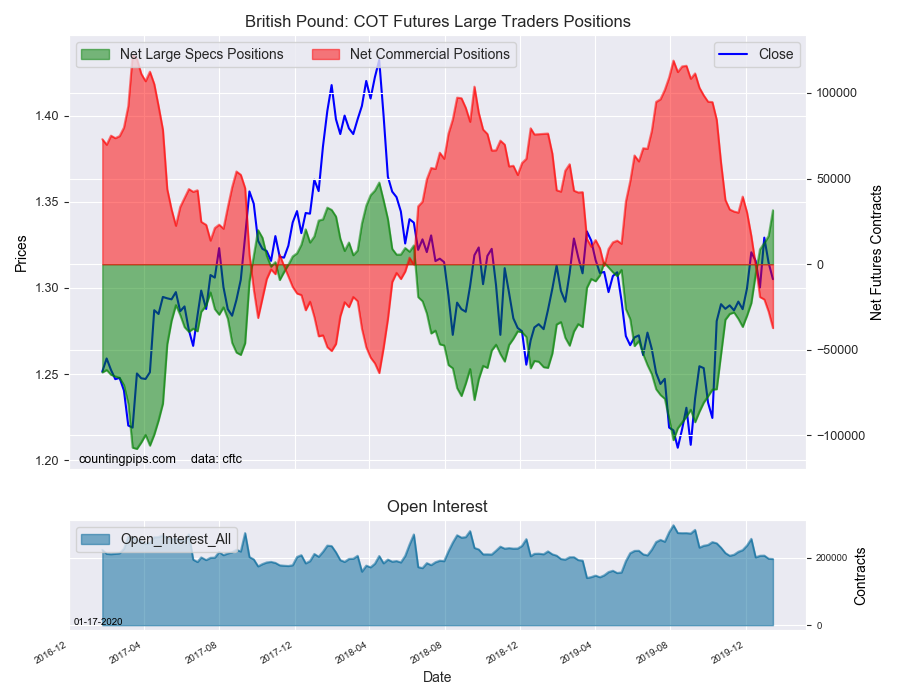

British pound sterling positions jumped this week by over +15,000 contracts and have now gained for seven straight weeks. Speculator bets have increased by a total of +68,108 contracts in the past seven weeks as the position has gone from a bearish position of -30,050 contracts on December 3rd to a bullish position of +31,532 contracts this week.

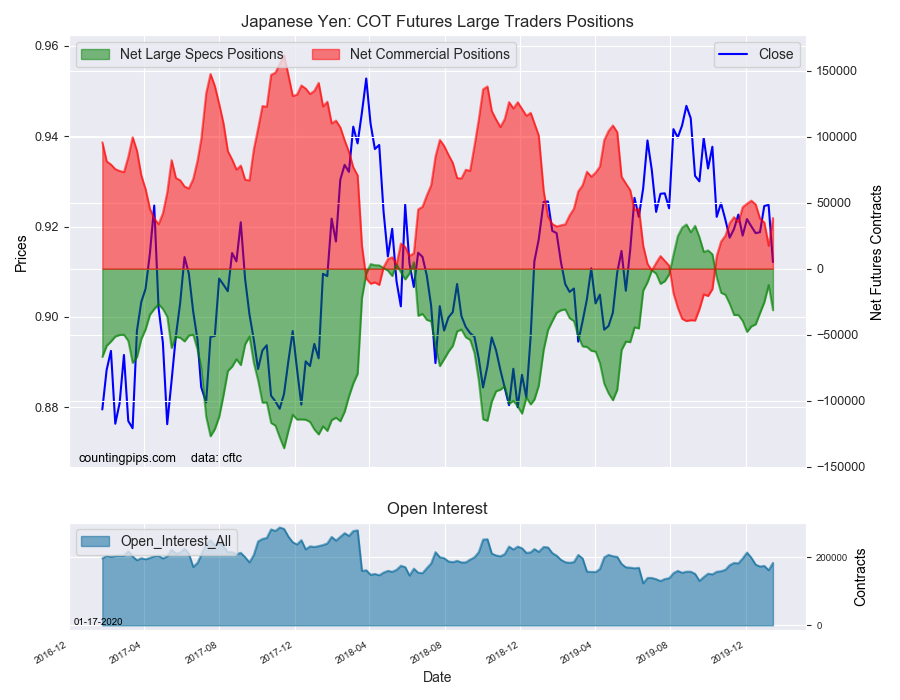

Japanese yen bets this week dropped by over -19,000 contracts following five weeks of improving positions. The decline pushed the overall net position to a total of -31,430 contracts which marks the fourteenth straight week the yen positions have now been in short or negative territory.

Overall, the major currencies that saw improving speculator positions this week were the US dollar index (795 weekly change in contracts), euro (13,482 contracts), British pound sterling (15,022 contracts), Swiss franc (4,277 contracts), Canadian dollar (6,485 contracts), Australian dollar (6,700 contracts), New Zealand dollar (1,127 contracts) and the Mexican peso (8,322 contracts).

The only currency whose speculative bets declined this week was the Japanese yen with a -19,182 weekly change in contracts.

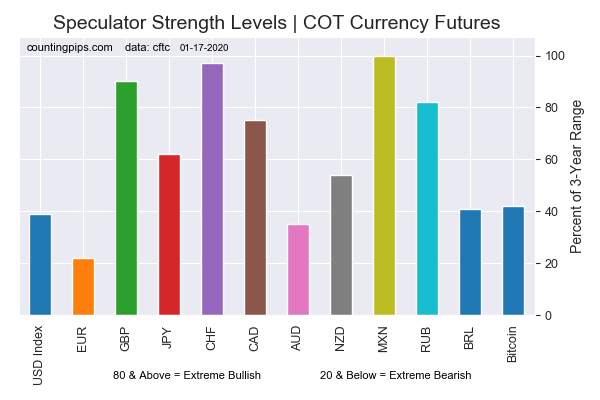

Chart: Current Strength of Each Currency compared to their 3-Year Range

The above chart depicts each currency’s current speculator strength level compared to data of the past 3 years. A score of 0 percent would mean speculator bets are currently at the lowest level of the past three years. A 100 percent score would be at the highest level while a 50 percent score would mean speculator bets are right in the middle of the data (a neutral score). We use above 80 percent (extreme bullish) and below 20 percent (extreme bearish) as extreme score measurements.

Please see the data table and individual currency charts below.

Table of Large Speculator Levels & Weekly Changes:

| Currency | Net Speculator Position | Specs Weekly Change |

| USD Index | 13,263 | 795 |

| EuroFx | -48,182 | 13,482 |

| GBP | 31,532 | 15,022 |

| JPY | -31,430 | -19,182 |

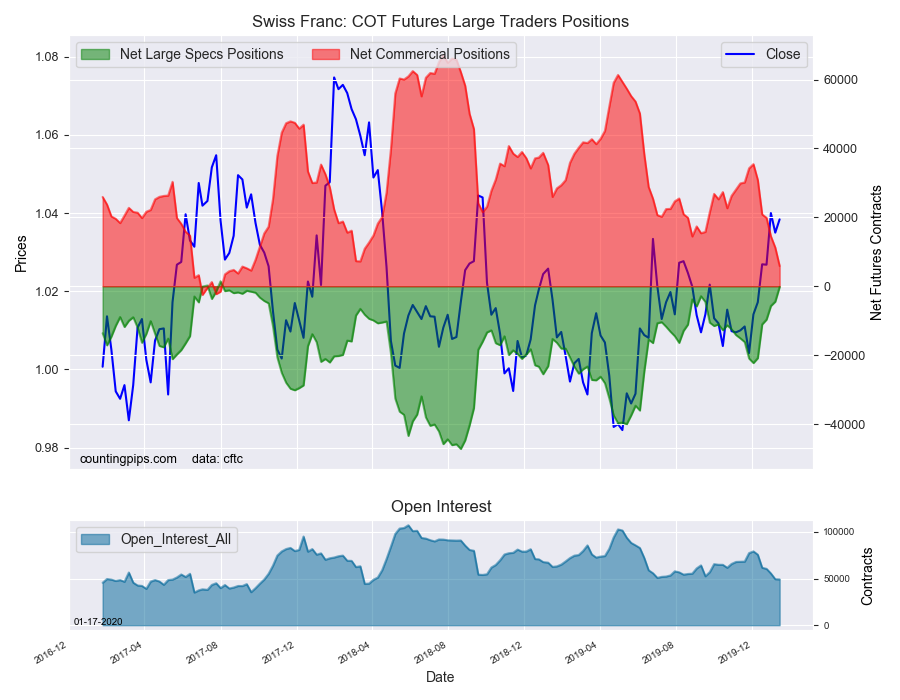

| CHF | -192 | 4,277 |

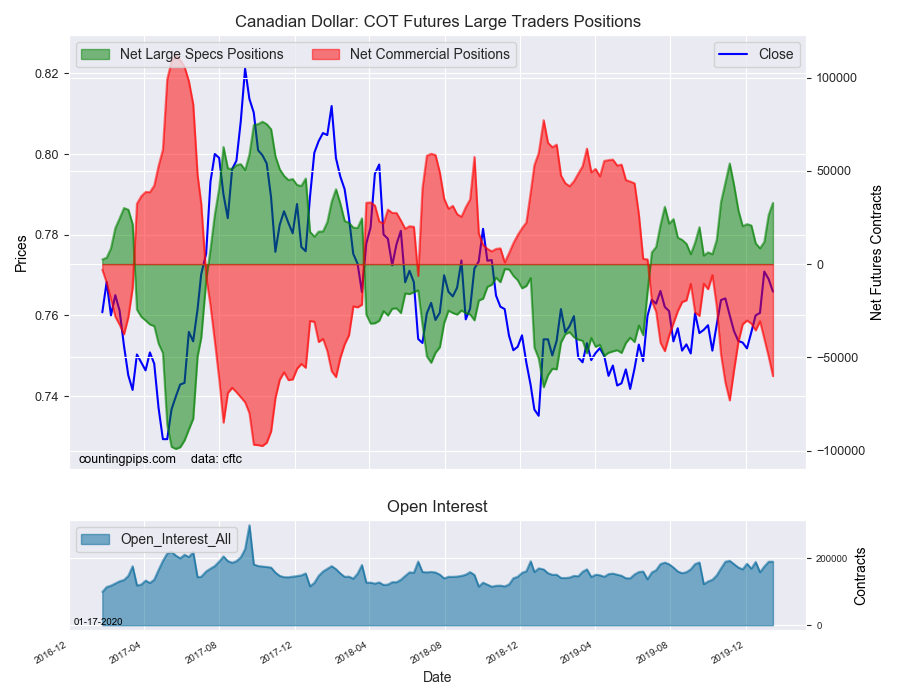

| CAD | 32,852 | 6,485 |

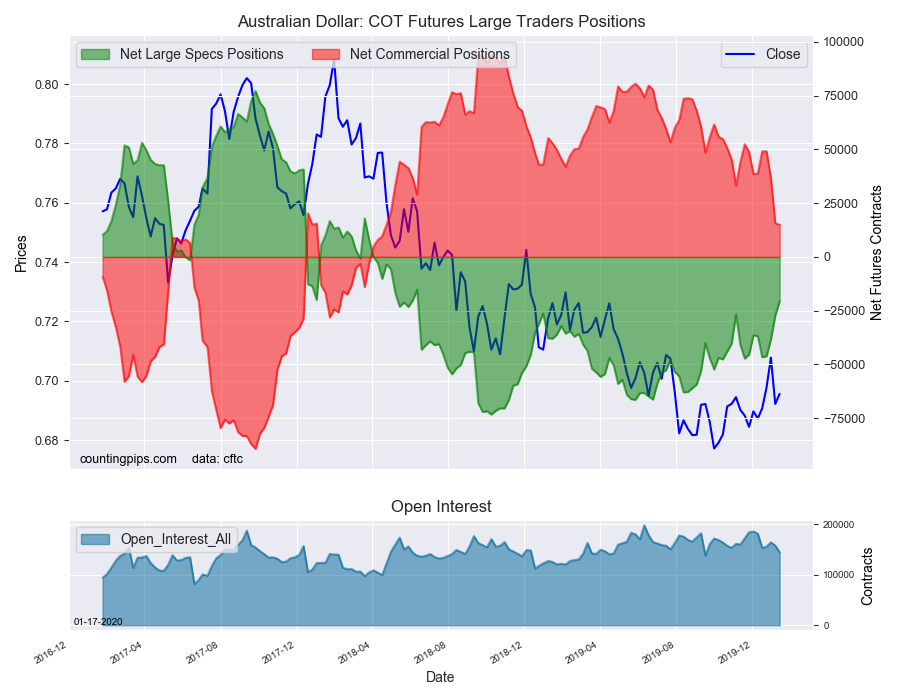

| AUD | -20,549 | 6,700 |

| NZD | -361 | 1,127 |

| MXN | 165,640 | 8,322 |

This latest COT data is through Tuesday and shows a quick view of how large speculators or non-commercials (for-profit traders) were positioned in the futures markets. All currency positions are in direct relation to the US dollar where, for example, a bet for the euro is a bet that the euro will rise versus the dollar while a bet against the euro will be a bet that the dollar will gain versus the euro.

Weekly Charts: Large Trader Weekly Positions vs Price

EuroFX:

The Euro large speculator standing this week reached a net position of -48,182 contracts in the data reported through Tuesday. This was a weekly lift of 13,482 contracts from the previous week which had a total of -61,664 net contracts.

British Pound Sterling:

The large British pound sterling speculator level totaled a net position of 31,532 contracts in the data reported this week. This was a weekly lift of 15,022 contracts from the previous week which had a total of 16,510 net contracts.

Japanese Yen:

Large Japanese yen speculators came in at a net position of -31,430 contracts in this week’s data. This was a weekly fall of -19,182 contracts from the previous week which had a total of -12,248 net contracts.

Swiss Franc:

The Swiss franc speculator standing this week was a net position of -192 contracts in the data through Tuesday. This was a weekly lift of 4,277 contracts from the previous week which had a total of -4,469 net contracts.

Canadian Dollar:

Canadian dollar speculators reached a net position of 32,852 contracts this week. This was a boost of 6,485 contracts from the previous week which had a total of 26,367 net contracts.

Australian Dollar:

The large speculator positions in Australian dollar futures recorded a net position of -20,549 contracts this week in the data ending Tuesday. This was a weekly increase of 6,700 contracts from the previous week which had a total of -27,249 net contracts.

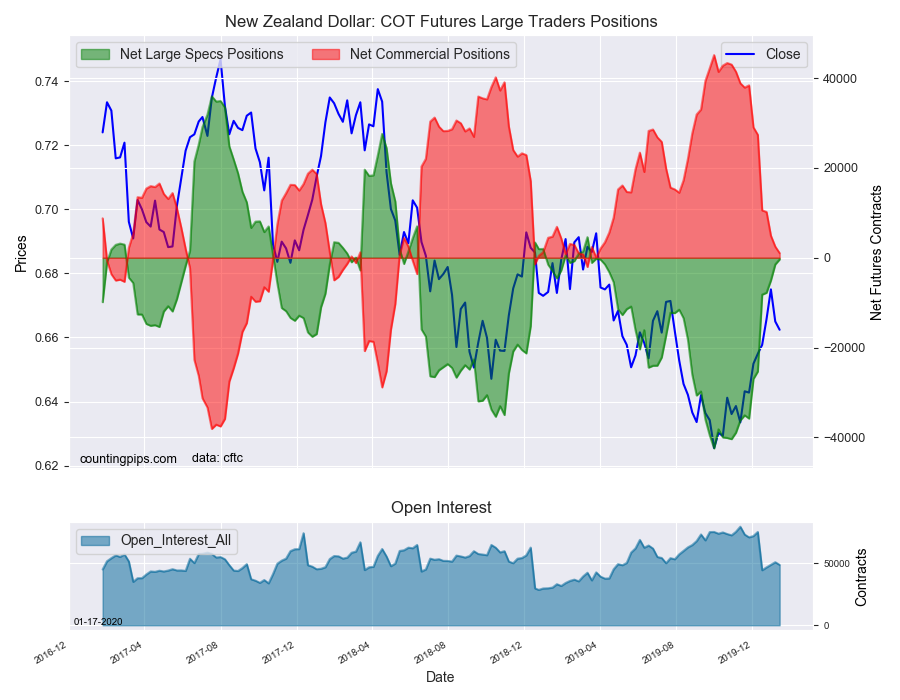

New Zealand Dollar:

The New Zealand dollar speculative standing resulted in a net position of -361 contracts this week in the latest COT data. This was a weekly gain of 1,127 contracts from the previous week which had a total of -1,488 net contracts.

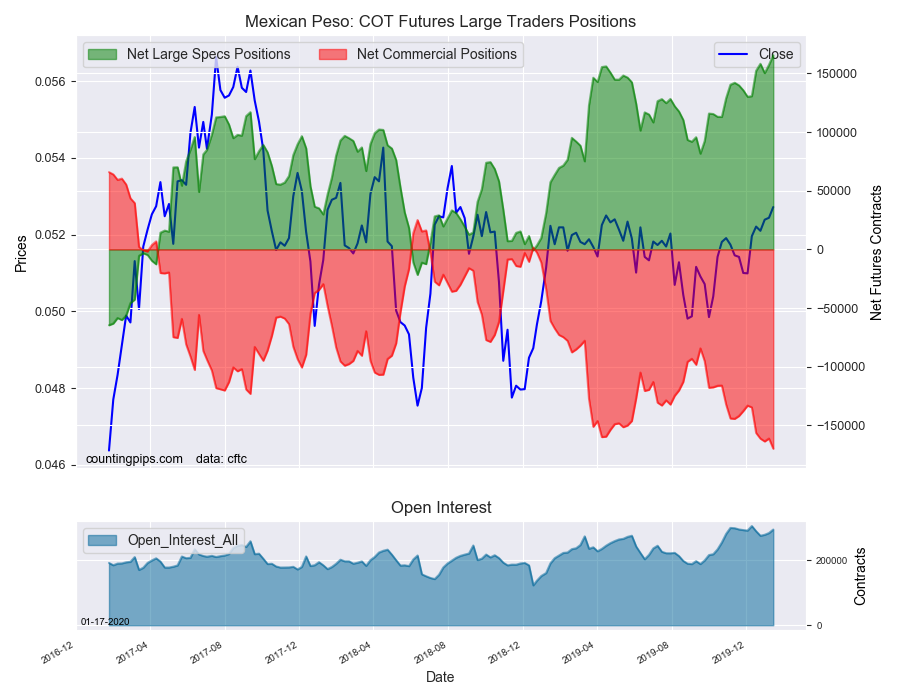

Mexican Peso:

Mexican peso speculators reached a net position of 165,640 contracts this week. This was a weekly boost of 8,322 contracts from the previous week which had a total of 157,318 net contracts.

*COT Report: The COT data, released weekly to the public each Friday, is updated through the most recent Tuesday (data is 3 days old) and shows a quick view of how large speculators or non-commercials (for-profit traders) were positioned in the futures markets.

The CFTC categorizes trader positions according to commercial hedgers (traders who use futures contracts for hedging as part of the business), non-commercials (large traders who speculate to realize trading profits) and nonreportable traders (usually small traders/speculators).

Find CFTC criteria here.

Disclosure: Foreign Currency trading and trading on margin carries a high level of risk and can result in loss of part or all of your investment.Due to the level of risk and market volatility, ...

more

I liked your old profile pic better Zachary!

ThX! It's getting an update