EUR/USD Snaps Losing Streak Amid Fed Powell’s Testimony, Broad USD Weakness

Image Source: Unsplash

EUR/USD snaps three days of consecutive losses and rises toward the 1.0960 region as the US Federal Reserve (Fed) Chair Jerome Powell answers questions at the US House of Representatives on his first day of testimony. Risk aversion, and high US Treasury bond yields, drive the market’s narrative, though the EUR/USD pair climbs on broad US Dollar (USD) weakness. At the time of writing, the EUR/USD exchanges hands at 1.0961 after bouncing from 1.0905 lows.

ECB rate hike fuels rally despite divided views on further tightening

US equities are trading with losses amidst Powell’s testimony. The Fed Chair reiterated the Fed would continue to tighten monetary policy but stressed the central bank would make its decisions meeting-by-meeting based on incoming data.

The Federal Reserve (Fed) kept rates unchanged on June 14 while upward revising the Federal Funds Rate (FFR) peak at 5.6%. Even though it strengthened the greenback, Powell’s press conference struck a balanced tone,

Meanwhile, at the time of writing, Fed Chair Powell is answering questions at a hearing at the Capitol. He said that “it may make sense to move rates higher, at a moderate pace,” and emphasized the speed and level of rates “are separate.” He said inflation “has a long way to go” despite moderating somewhat “since the middle of last year,” and when asked about changing its 2% target, Powell said, “It’s our goal and will remain our goal.”

Although it capped the EUR/USD advance post-FOMC on June 15, the EUR/USD rallied sharply on the back of the European Central Bank (ECB), raising rates by 25 bps and opening the door for further tightening.

In the meantime, a raft of European Central Bank (ECB) speakers was featured during the day, with most of them expressing the need to get core inflation under control. Nevertheless, it has begun a split of points of view, with most hawks eyeing rate hikes in July and September, while others, like Kazimir, expressed that the continuation of tightening policy “is not certain.”

Upcoming events

The Eurozone (EU) economic docket would feature the ECB General Council Meeting. The US agenda will feature unemployment claims alongside further Federal Reserve speakers.

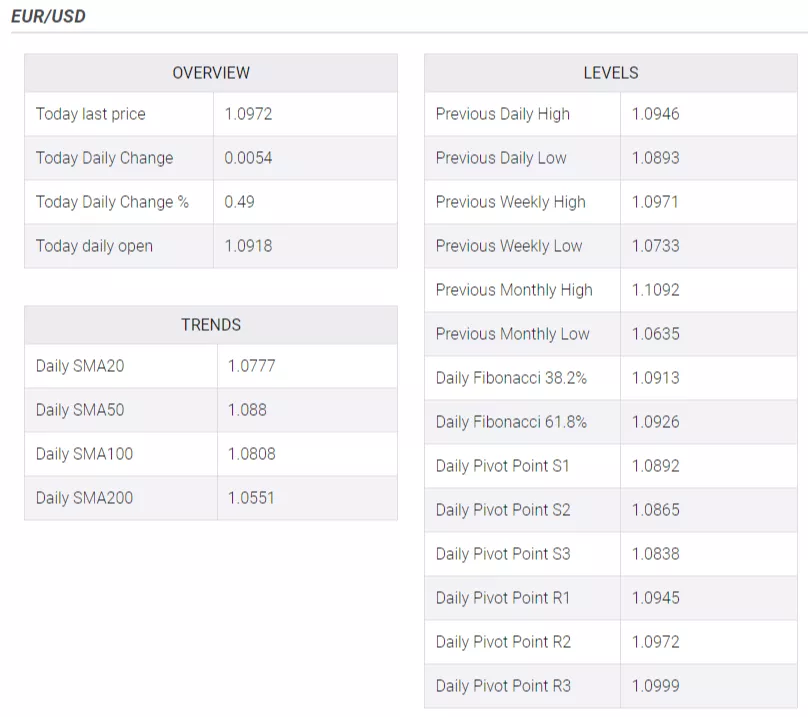

EUR/USD Price Analysis: Technical outlook

(Click on image to enlarge)

The EUR/USD remains trading sideways after dipping from year-to-date (YTD) highs reached on April 25 at 1.1095, towards the 1.0630s area. Even though the EUR/USD rallied from 1.0690 toward 1.0970s, buyers must reclaim 1.1000 to challenge the YTD high before breaching the 1.1100 mark. If EUR/USD reclaims 1.1100, that will clear the path to 1.1200. Otherwise, failure to conquer 1.1000 would keep sellers hopeful of lower prices. EUR/USD’s first support would be the 20-day Exponential Moving Average (EMA) at 1.0840, followed by the 50-day EMA at 1.0834. Once cleared, the next stop will be the 100-day EMA at 1.0784.

More By This Author:

USD/CAD Extends Downside To Near 1.3200 On Stellar Canadian Retail Sales

USD/JPY Hovers Around Cycle High On Low Volume Session

Gold Price Forecast: XAU/USD Bears Need A Break Of Current Daily Lows

Disclaimer: Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only ...

more