Gold Price Forecast: XAU/USD Bears Need A Break Of Current Daily Lows

- Gold bears are licking their lips as price is technically coiled and biased lower.

- A break of resistance opens risk of higher highs.

Gold dropped from a high of $1,967 on Friday's US session and cleaned up the prior session's length, creating a fresh low of the day down at $1,953.32.

The focus has been on the Federal Reserve which issued a hawkish outlook for interest rates on Wednesday even as it ended its two-day meeting without hiking rates. The Fed forecast 50 basis points of additional increases prior to year-end.

''It’s likely the Fed will need to see softening in the labour market to be confident that inflation is sustainably on its way down. Little guidance was offered for upcoming meetings, with Fed Chair Powell noting decisions will be made meeting to meeting. We continue to expect a 25bp hike in July,'' analysts at ANZ Bank argued.

Meanwhile, the dollar rose early following three losing sessions. Bond yields were also higher, with the US two-year note last seen paying 4.733%, up 8.2 basis points and the 10-year note up 4.9 basis points to 3.772%. DXY traded 0.13% higher form a low of 102.006 to a high of 102.427.

'' As trend signals improve, CTA trend followers have already begun adding to their length in silver, where current prices could spark a buying program totaling +6% of this cohort's max size. In gold markets, the bar for algo buying activity is also razor-thin. Prices need only break the $1980/oz mark to spark the first marginal buying program, and the risk for subsequent buying flows is elevated above the $2000/oz range,'' analysts at TD Securities argued.

Gold technical analysis

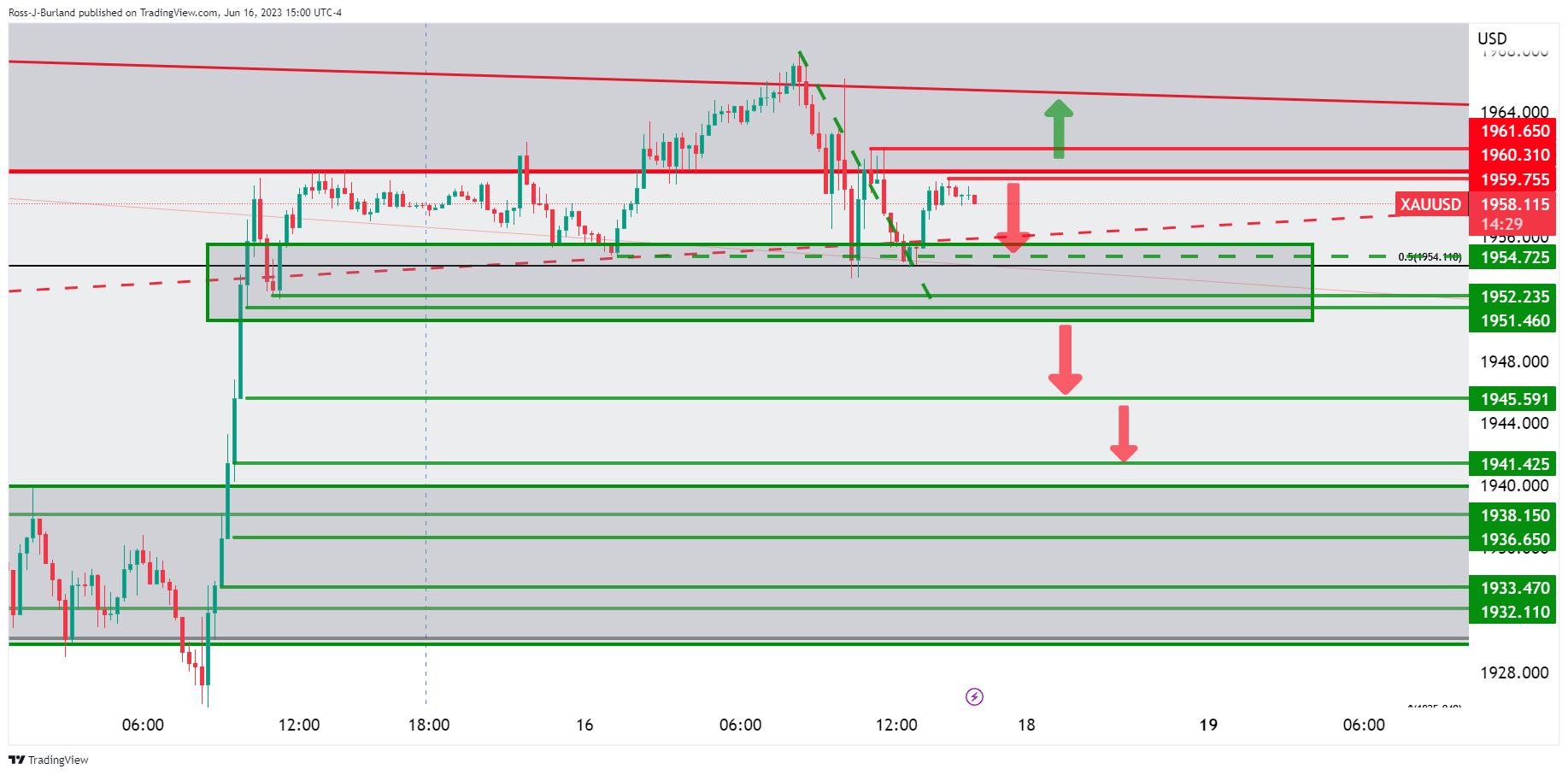

The 15min chart shows a number of levels to the downside to break while the daily offers a bearish bias while below trendline resistance and a break out of the channel:

With that being said, there will be prospects of a move higher if bulls stay committed and break trendline resistance.

More By This Author:

Forex Today: Dollar Tumbled, Showed Few Signs Of Life

EUR/GBP Drops To Nine-Month Lows, Eyes 0.8500

USD/JPY Price Analysis: Climbs Firmly Above 141.00 As BoJ Continues Ultra-Dovish Policy Stance

Disclaimer: Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only ...

more