EUR/USD Outlook: Sellers Active As EU Hits Record High Inflation

- Eurozone inflation remains at a record high due to rising energy prices.

- Since July, the ECB has been fighting to bring inflation down to 2%.

- The US dollar is gaining ground on hawkish policymaker remarks.

Today’s EUR/USD outlook is slightly bullish. Final figures from the European Union’s statistics agency revealed on Thursday that although Eurozone inflation in October was slightly lower in year-on-year terms than previously thought, it remained at a record high due to rising energy prices.

Consumer inflation in the 19 countries that share the Euro increased 1.5% month on month in October, translating to an increase of 10.6% yearly, down from the previously reported 10.7% annual figure, according to Eurostat.

Rising energy prices, which were 41.5% higher in October than they were a year earlier, contributed 4.44 percentage points to the final year-on-year figure. Costlier food, drink, and tobacco contributed an additional 2.74 percentage points.

Since July, the European Central Bank has been significantly hiking interest rates to contain price growth and keep inflation at 2% over the medium term.

The St. Louis Fed President James Bullard indicated that for interest rates to be “sufficiently restrictive” to reduce inflation, they may need to reach a level between 5% and 7%. This statement sent the dollar surging higher overnight. That dealt investors who had bet that rates would peak at 5% a blow.

EUR/USD Key Events Today

ECB President Christine Lagarde is set to speak later today. Her speech might contain clues on future monetary policy. There will also be an existing home sales report from the US that will shed light on the housing market.

EUR/USD Technical Outlook: Buyers Struggling To Stay Upside

(Click on image to enlarge)

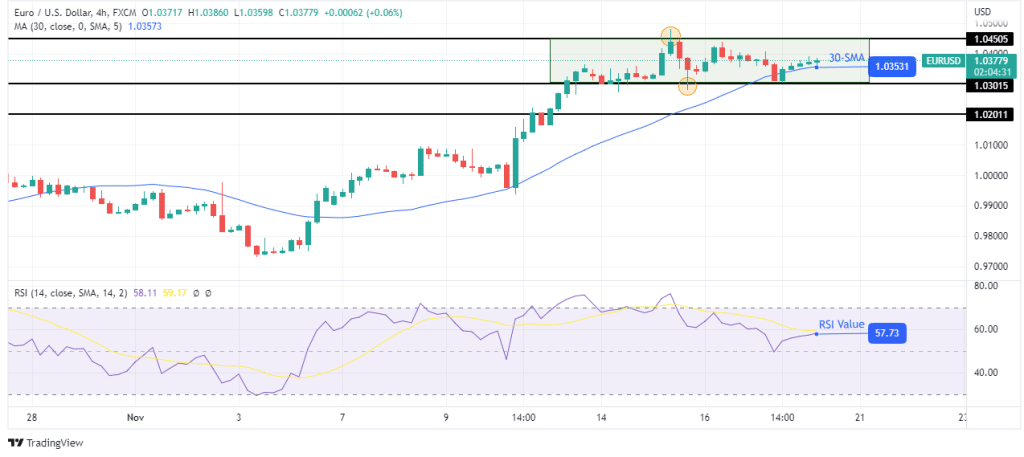

Looking at the 4-hour chart, we see the price trading at the 30-SMA and the RSI above 50, favoring bullish momentum. The price found it hard to break above the 1.0450 key resistance level and has been trading below it for some time with support at 1.0301.

Bears showed some strength when they pushed the price below the SMA. Although bulls have taken over since the move up seems to be a struggle. The price is making small-bodied candles. Bulls need to make bigger candles to retest and possibly break above 1.0450. If not, bears might push the price below 30-SMA and reverse the trend.

More By This Author:

EUR/USD Weekly Forecast: Bullish Ahead of Eurozone Inflation

USD/CHF Weekly Forecast: Cooling US Jobs Data Weighing Ahead of CPI

USD/CAD Weekly Forecast: Plummets on US Jobs Data, Eying US CPI

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more