USD/CAD Weekly Forecast: Plummets On US Jobs Data, Eying US CPI

The USD/CAD weekly forecast is bearish as the pair will likely extend Friday’s losses into next week. The downside was triggered after mixed US jobs data.

Ups And Downs Of USD/CAD

The U.S. central bank raised interest rates on Wednesday for the fourth consecutive time by three-quarters of a percentage point. The pair pushed higher when Powell said it was too early to consider a pivot as inflation was still high.

More jobs were created in the United States in October than was anticipated. Still, the rate is slowing, and the unemployment rate increased to 3.7%, suggesting that labor market conditions may loosen. If this is the case, the Federal Reserve will be able to switch to smaller interest rate increases beginning in December.

On the other hand, the Canadian economy posted massive job growth in October, ten times larger than expected, while the unemployment rate remained unchanged. The big surprise increased market calls for another massive interest rate increase. These job reports sent the pair falling to close lower on Friday.

Next Week’s Key Events For USD/CAD

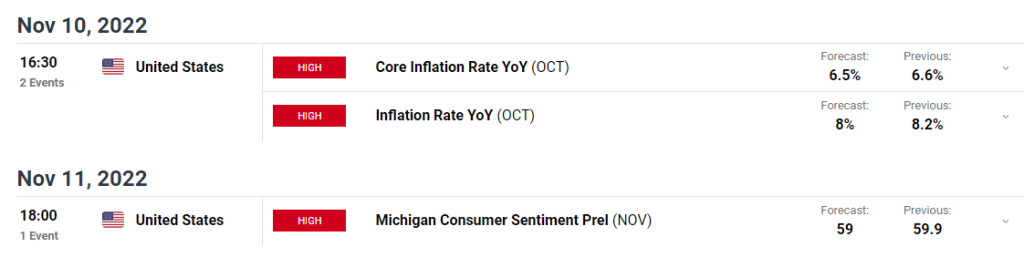

(Click on image to enlarge)

Investors will pay close attention to the US inflation reading in the coming week. This will show whether the Fed is succeeding in reigning in sky-high inflation. Markets are expecting inflation to ease. However, a higher reading could send USD/CAD higher.

USD/CAD Weekly Technical Forecast: Bears Take Control After Bearish Divergence

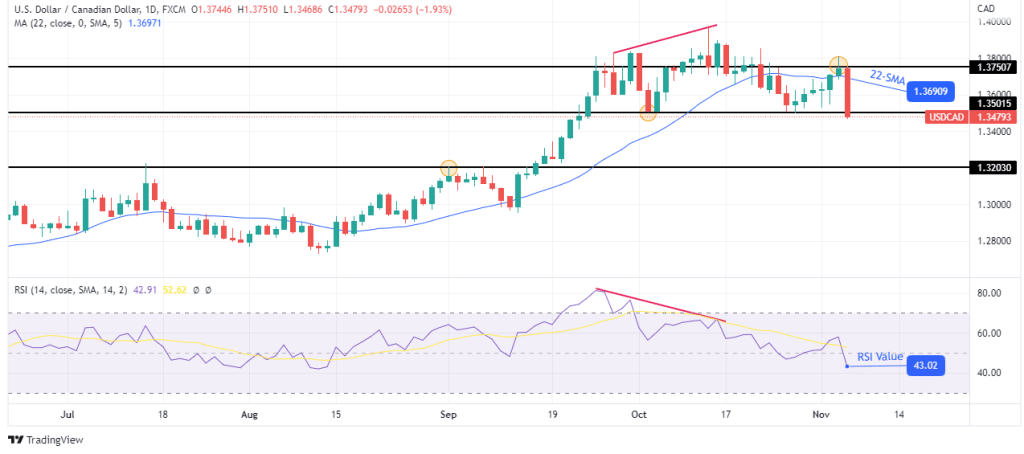

(Click on image to enlarge)

The daily chart shows the price trading well below the 22-SMA and RSI below 50. This is a sign that bears are in charge. The previous bullish trend showed weakness after reaching the 1.3750 key resistance level. At this point, the RSI made a bearish divergence with the price.

Bears took over when the price broke below the 22-SMA. The price then retested the 1.3750 level, making a lower high, further confirming the reversal. The final confirmation of the new bearish trend came when the price made a bearish engulfing candle that went on to break below the previous low at 1.3501.

This level offers strong support, and the price might consolidate before breaking below. The bears will be looking to hit the next support level at 1.3203 next week.

More By This Author:

GBP/USD Price Analysis: BoE Hikes By 75bps, Warns Of Recession AheadEUR/USD Price In The Sellers’ Territory Ahead Of FOMC Meeting

USD/CHF Weekly Outlook: Investors Await Fed’s Stance on Hikes

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more