EUR/USD Weekly Forecast: Bullish Ahead Of Eurozone Inflation

- US consumer inflation increased 7.7% year on year in October, below expectations for 8%.

- Consumer sentiment in the United States declined in November.

- Consumer inflation expectations in the eurozone increased in September.

The EUR/USD weekly forecast is bullish as the Euro continues to rise on dollar weakness stemming from downbeat US CPI data.

Ups And Downs Of EUR/USD

On Friday, the Euro climbed for a second straight day as investors favored riskier currencies in response to indications that US inflation is slowing. This strengthened the case for the Federal Reserve to scale down its significant interest rate increases.

The move started after data released on Thursday revealed that US consumer inflation increased 7.7% year on year in October, below expectations for 8% and the smallest pace since January.

Data from a survey released on Friday showed that consumer sentiment in the United States declined in November due to ongoing concerns about inflation and rising borrowing costs. This further hurt the dollar and boosted the Euro.

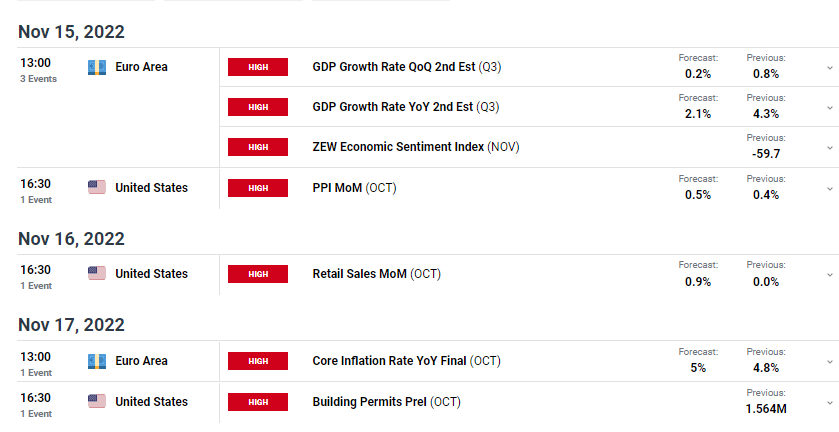

Next Week’s Key Events For EUR/USD

Investors will be keen on the eurozone inflation report next week. Luis de Guindos, vice president of the European Central Bank, outlined potential threats to financial stability on Friday and suggested that financial markets may be underestimating the “persistence of inflation.”

He continued by saying that for expectations regarding future ECB interest rate hikes to stabilize, there had to be a discernible slowdown in both the headline and underlying inflation rates.

According to a new European Central Bank survey released Wednesday, consumer inflation expectations in the eurozone increased in September. Month after month, inflation has set new records, increasing concerns that wages, which are still only expanding slowly, may soon follow and trigger an unstoppable wage-price cycle.

EUR/USD Weekly Technical Forecast: Bulls Face Strong Resistance At 1.0351

The daily chart shows the price trading well above the 22-SMA and the RSI close to the overbought region. The price has moved from the 0.9740 support level through the 1.0081 resistance level and is now facing resistance at the 1.0351 level. Such a move shows strong bullish momentum.

The price might consolidate at the current level before breaking above and seeking higher levels. However, if the resistance holds strong, bears might return for a retracement move to retest the 1.0081 level as support. The bullish bias will remain as long as the price keeps trading above the 22-SMA.

More By This Author:

USD/CHF Weekly Forecast: Cooling US Jobs Data Weighing Ahead of CPI

USD/CAD Weekly Forecast: Plummets on US Jobs Data, Eying US CPI

GBP/USD Price Analysis: BoE Hikes By 75bps, Warns Of Recession Ahead

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more