EUR/USD Faces Further Decline Amid Market Jitters And Trump’s Tariff Threat

Image Source: Unsplash

Key drivers weighing on EUR/USD

The latest sell-off is driven by heightened trade war fears. On Wednesday, US President Donald Trump announced a 25% tariff on all imported cars and light trucks, set to take effect on 2 April. The move, seen as retaliation against foreign tariffs on US goods, escalates trade tensions. Markets view this as a major risk, with potential consequences including slower US economic growth and higher inflation.

Adding to the bearish sentiment, fresh economic data revealed:

- US consumer confidence plunged to a four-year low

- Core capital goods orders (excluding defence and aircraft) declined, breaking a three-month growth streak – a worrying sign for business investment

Investors now await Friday’s Core PCE Price Index – the Fed’s preferred inflation gauge – and the revised US Q4 2024 GDP estimate, which could set near-term market direction.

Technical analysis of EUR/USD

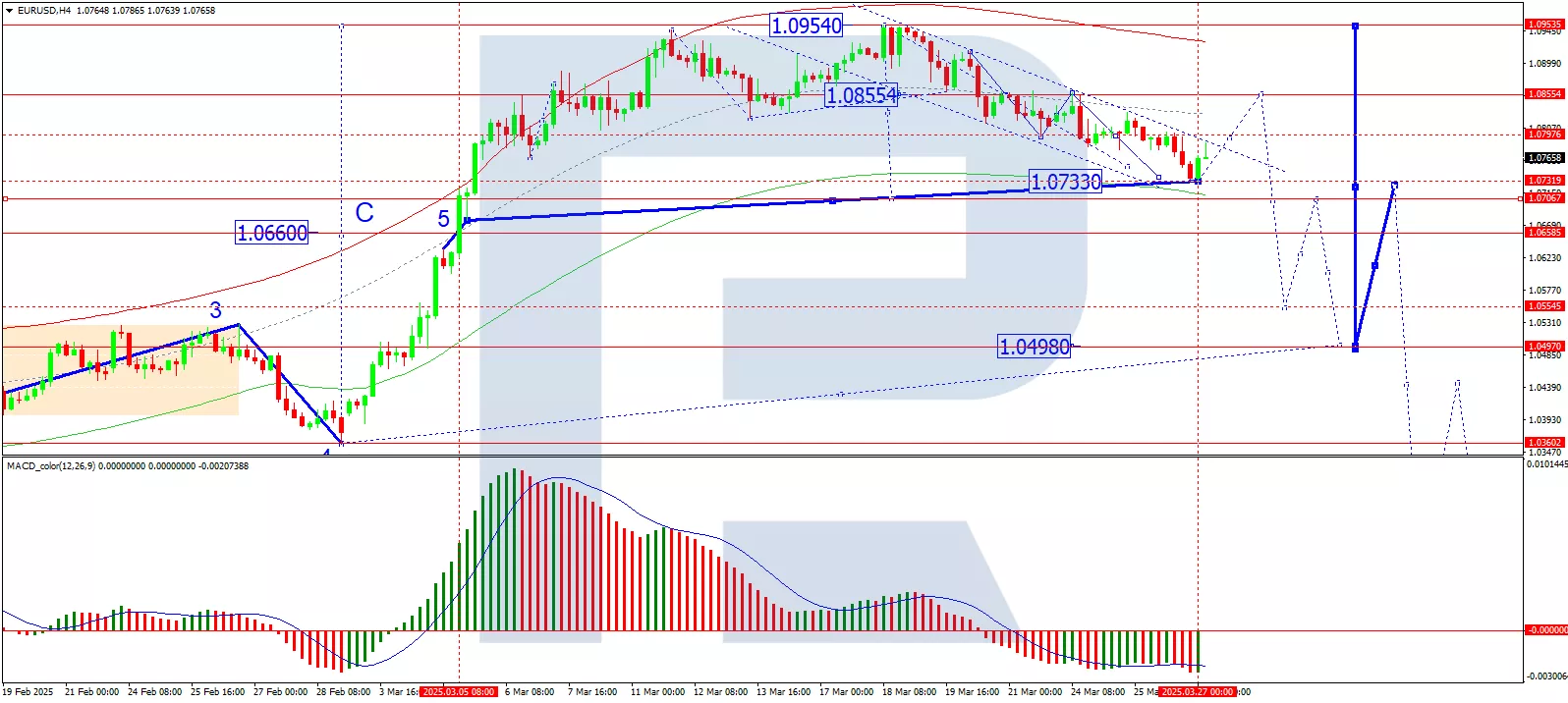

(Click on image to enlarge)

On the H4 chart of EUR/USD, the market completed a downward move to 1.0733. A correction towards 1.0855 is likely today. Once this correction ends, a new decline towards 1.0707 may begin. Technically, this scenario is confirmed by the MACD indicator: its signal line is below zero and pointing downward to new lows.

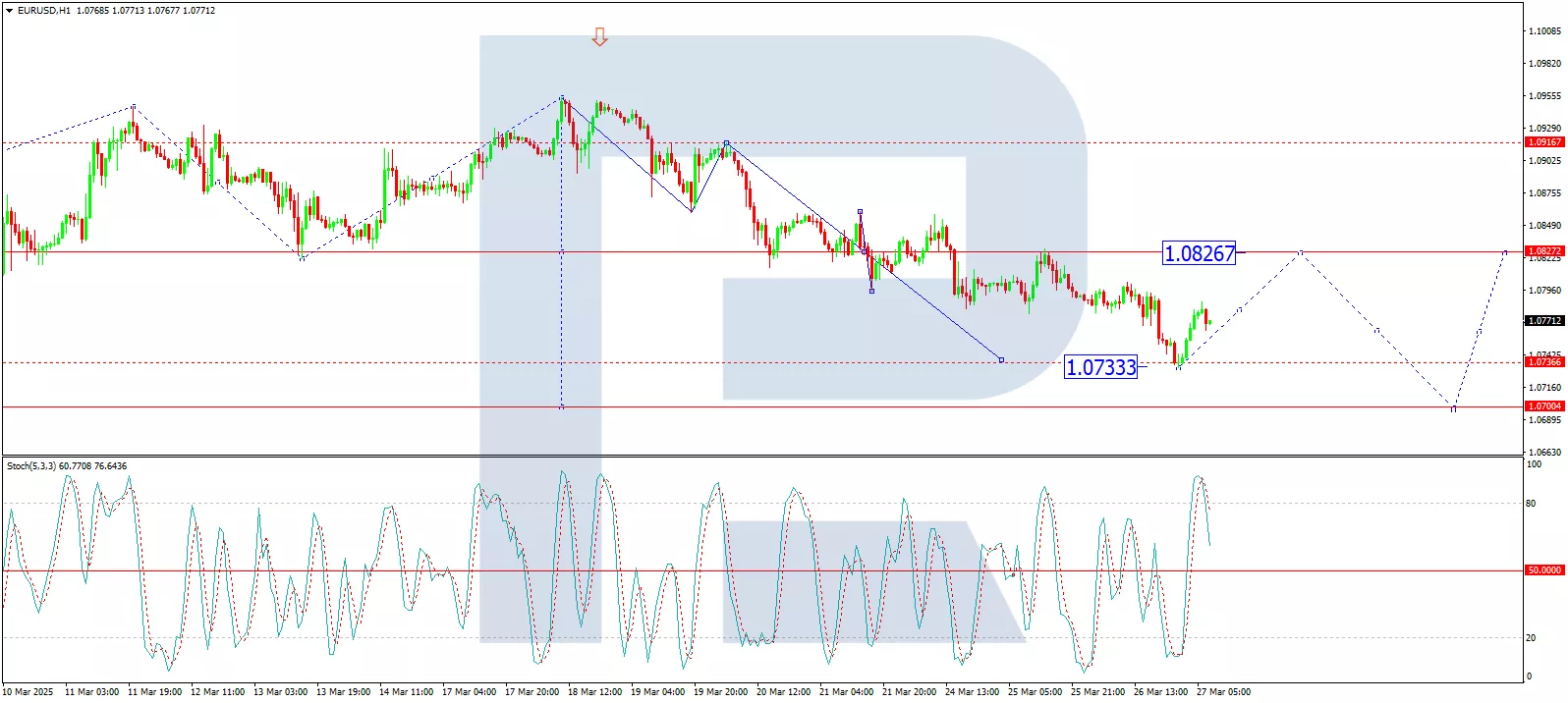

(Click on image to enlarge)

On the H1 EUR/USD chart, the market has formed a consolidation range around the level of 1.0826 before breaking lower to 1.0733. This move has nearly met its local downside target. Today, a corrective pullback towards 1.0826 (testing from below) is possible. Once this correction ends, a renewed decline towards 1.0700 could unfold. This move is viewed as the first wave of a broader downtrend. If this level is reached, another bounce towards 1.0826 cannot be ruled out. Technically, this scenario is confirmed by the Stochastic oscillator: its signal line is above 80 and preparing to drop towards 20.

Conclusion

With trade war risks weighing on sentiment and technical indicators pointing to continued downside, EUR/USD could test 1.0700 in the coming sessions. Traders should monitor US inflation data and GDP revisions for confirmation of the next major move.

More By This Author:

USD/JPY Rises Again: Yen Lacks Support As Bulls Take Control

EUR/USD Loses Momentum As Fed Bolsters The US Dollar

Pound Hits 4.5-Month High: New Peaks On The Horizon

Disclaimer: Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for ...

more