Pound Hits 4.5-Month High: New Peaks On The Horizon

Photo by Colin Watts on Unsplash

The GBP/USD pair surged to 1.3008 on Thursday, marking its highest level in 4.5 months. This upward momentum has fuelled speculation about additional gains for the British pound.

Global Factors to Drive GBP/USD Movement

The market has largely priced in the US dollar’s decline, which has provided a tailwind for the pound. The UK is in a favourable position amid ongoing global trade tensions. With limited trade ties to the US, the country is less exposed to major tariffs. Its neutral stance on global conflicts further supports the pound’s stability.

Today’s Bank of England (BoE) meeting is unlikely to significantly affect the pound, as markets have already priced in the expectation that interest rates will remain at 4.50%. Investors will instead focus on the BoE’s commentary, which is expected to maintain a cautious tone. Key points of interest include updates on inflation and GDP estimates.

The BoE’s forecasts are expected to remain unchanged, underscoring its data-dependent approach. The central bank’s wording is expected to signal a gradual approach to future rate cuts, reinforcing a measured and cautious monetary stance.

Looking ahead, global developments will have a greater impact on the pound’s trajectory than domestic factors, with its outlook remaining positive given the current geopolitical and economic climate.

Technical Analysis of GBP/USD

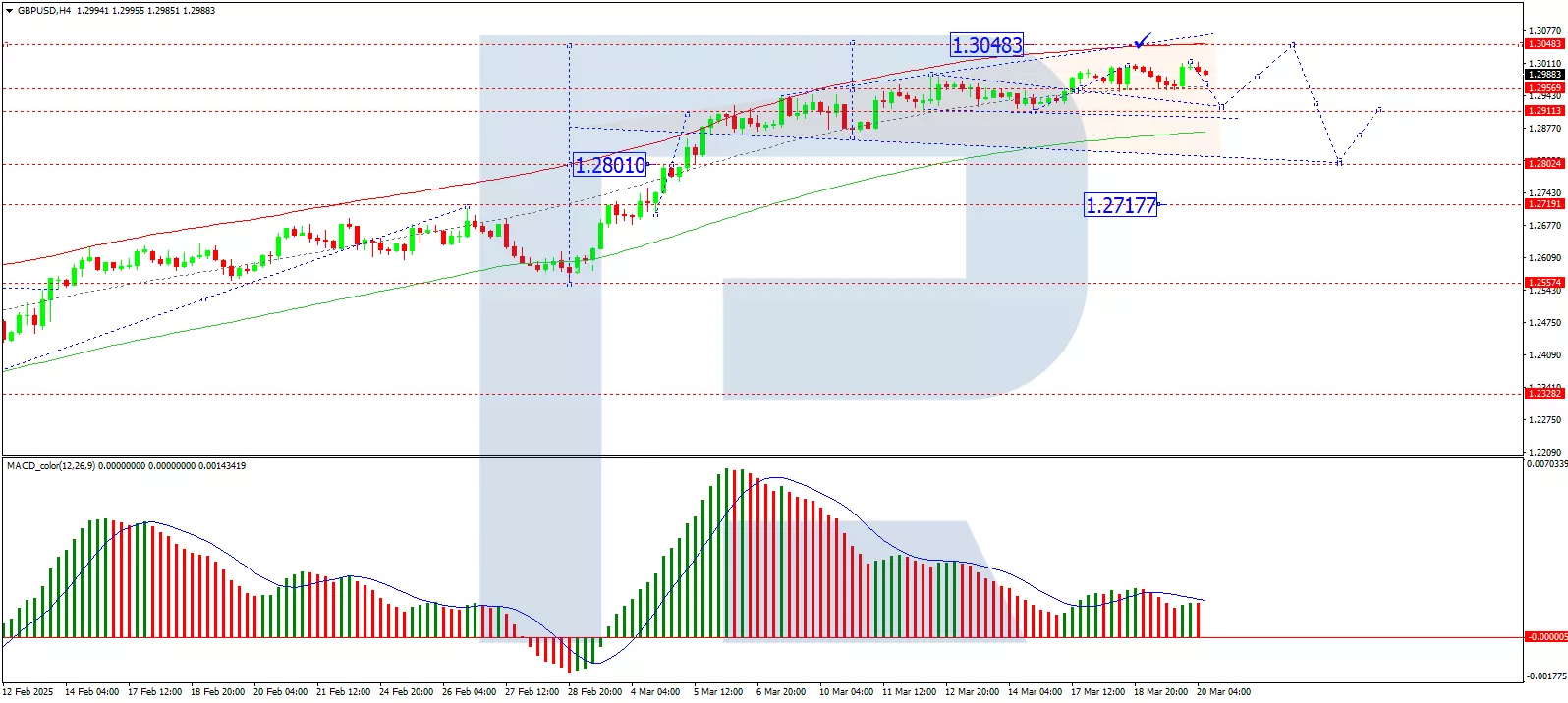

(Click on image to enlarge)

On the H4 chart, GBP/USD completed a growth wave, reaching 1.3013. Currently, the pair is consolidating below this level. A downward extension of the consolidation range to 1.2925 is anticipated, followed by a potential upward wave targeting 1.3048. Beyond this, a downward correction to 1.2800 could materialise. This scenario is supported by the MACD indicator, whose signal line is trending downward toward the zero level.

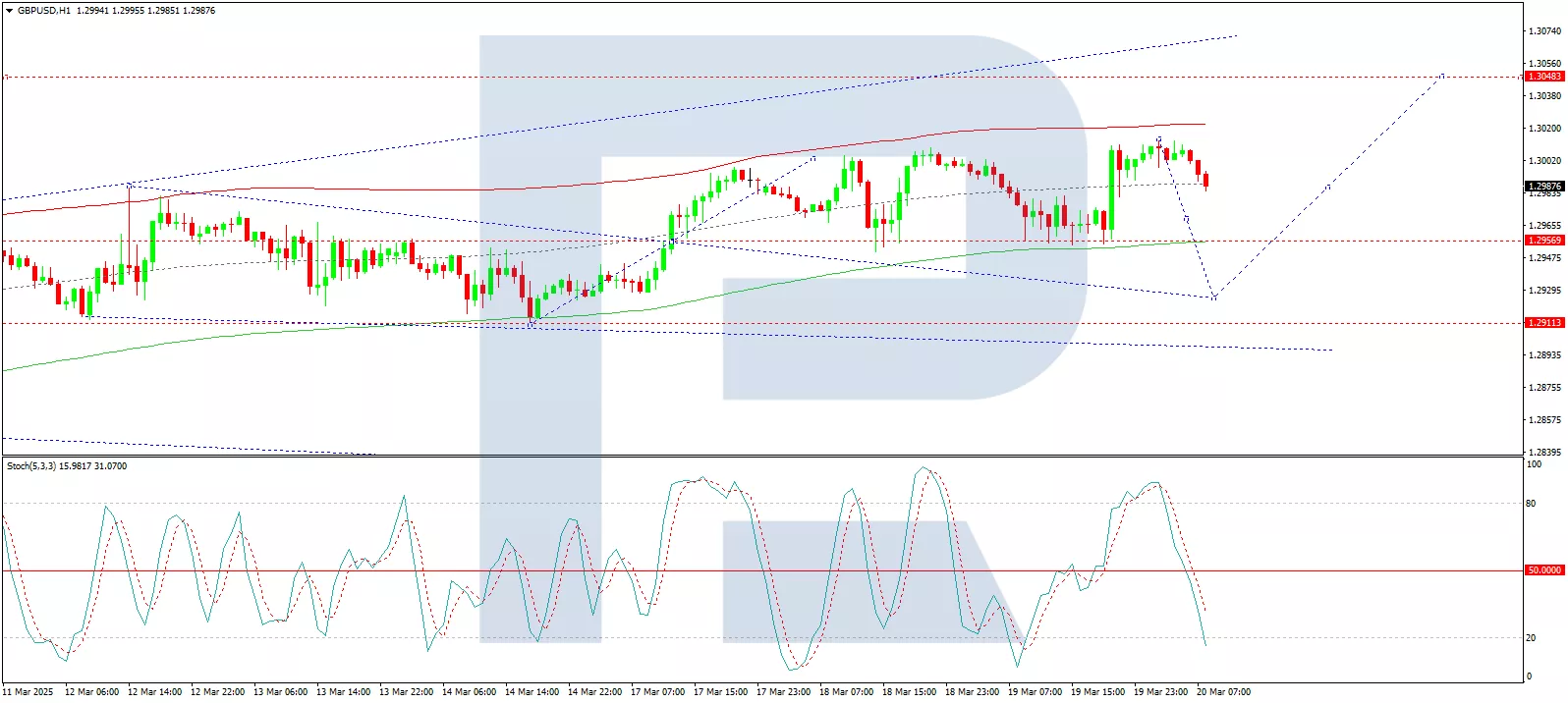

(Click on image to enlarge)

On the H1 chart, GBP/USD is forming a downward wave structure toward 1.2925. Once this wave completes, a move higher to 1.3048 is possible. Further ahead, a decline to 1.2717 remains a possibility. This outlook is corroborated by the Stochastic oscillator, whose signal line is below 50 and trending downward toward 20.

Conclusion

The pound’s recent rally to a 4.5-month high reflects a combination of US dollar weakness and the UK’s advantageous position in global trade dynamics. While the BoE meeting is unlikely to deliver surprises, the central bank’s cautious tone and data-dependent approach will be closely watched. Technically, GBP/USD is poised for further gains, though a corrective pullback is possible. Investors should watch global developments, which will likely dictate the pound’s next moves.

More By This Author:

Japanese Yen Continues To Slide As Bank Of Japan Disappoints Markets

Gold Prices Hit Record Highs: New Milestones Ahead

Gold Poised For Record Highs Strong Demand And Stable Outlook

Disclaimer: Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for ...

more