Elliott Waves: EUR/USD Breaking Higher

Image Source: Unsplash

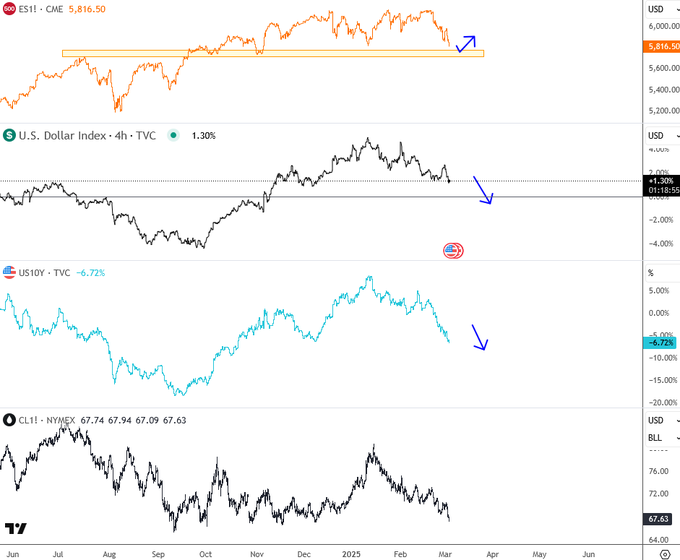

Trump tariffs and trade wars continue to dominate the market, and we have seen a strong sell-off in the US dollar recently. This reinforces the idea that the US may not win this battle easily, as some other countries have already responded and are trying to hit back. So it’s not a surprise that in this uncertainty stocks are also in a consolidation, but approaching a potential support.

I think that if stocks would rally, this will put more fuel on dollar bears.

Looking at the EURUSD Elliott Wave count, we see some very nice and strong recovery, that looks like a wave three so more upside can be coming as big A-B-C drop can be coming to an end at that 1.02 area. In fact we been talking about this call weeks back and even highlighted COT data that has been showing extremes. We talked about strong support already back on January 16.

(Click on image to enlarge)

For a detailed view and more analysis like this, you may want to watch below our latest recording of a live webinar streamed on March 03 2025:

More By This Author:

Ratio Chart Of U.S. Dollar Index Against 10Y U.S. Notes Is Pointing Much Lower

Stocks Are Trying To Stabilize Within A Triangle

Bitcoin Cash Could Be In Final Stages Of A Correction