Stocks Are Trying To Stabilize Within A Triangle

Image Source: Unsplash

I hope you had a great weekend and are ready for some interesting volatility this week. Last week’s close was quite interesting—we saw unsuccessful negotiations between Trump and Zelensky, yet stocks still surprised and managed a strong rebound on Friday, despite the fact that no agreement was reached.

Meanwhile, it's interesting to see crude oil sideways and still looks bearish with 4h trend. Overall, due to ongoing uncertainty, I expect the stock market to stay trapped in some big ranges for now, with no major breakouts in the dollar or stock market just yet. However, in the near term, the S&P 500 could see a higher relief rally following Friday’s positive close.

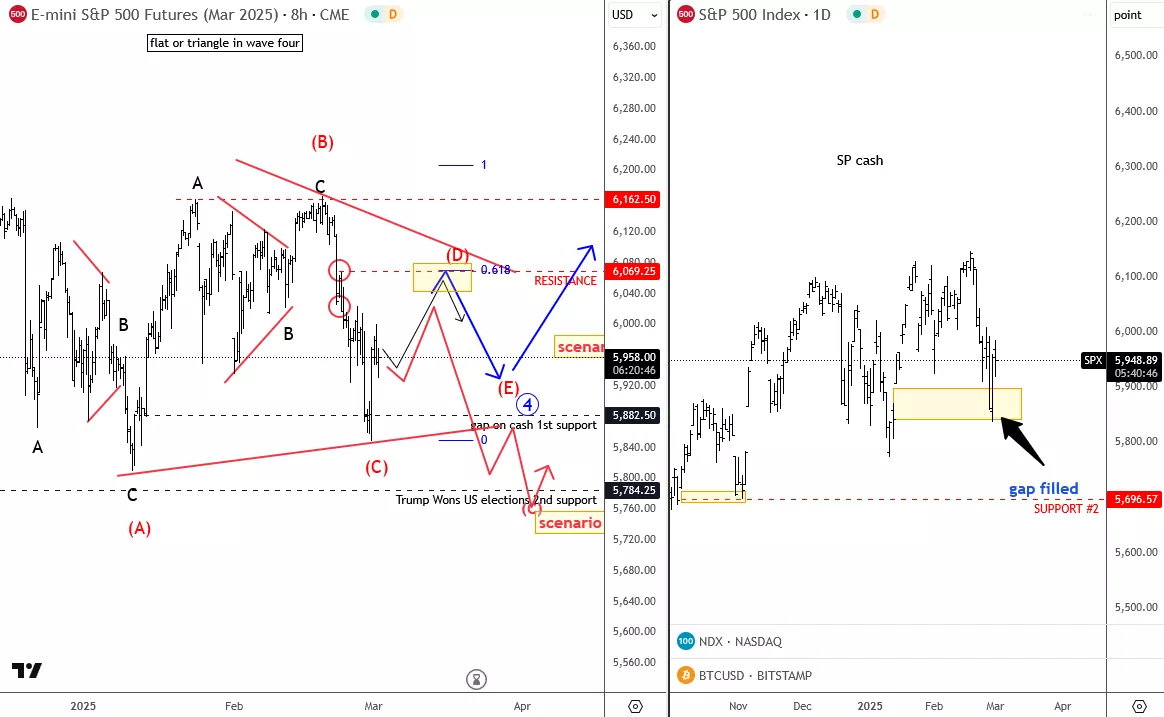

(Click on image to enlarge)

Looking at the 4h wave count, we see two possibilities now, triangle or a flat, and ideally this is now a triangle with wave D headed to +6k after gap fill on Friday, on cash market. So be aware of some risk-on this week.

If last Friday low is broken, then keep an eye on deeper supports near 5780, at November 2024 swing low.

More By This Author:

Bitcoin Cash Could Be In Final Stages Of A Correction

BlackRock Bitcoin ETF Is At Key Support

Elliott Wave Analysis: S&P 500 In Flat Or Triangle; Keep An Eye On 5880 And 5784 Supports

For more analysis, check our video here.