Elliott Wave Technical Analysis: Euro/U.S. Dollar - Tuesday, April 29

EURUSD Elliott Wave Analysis Trading Lounge

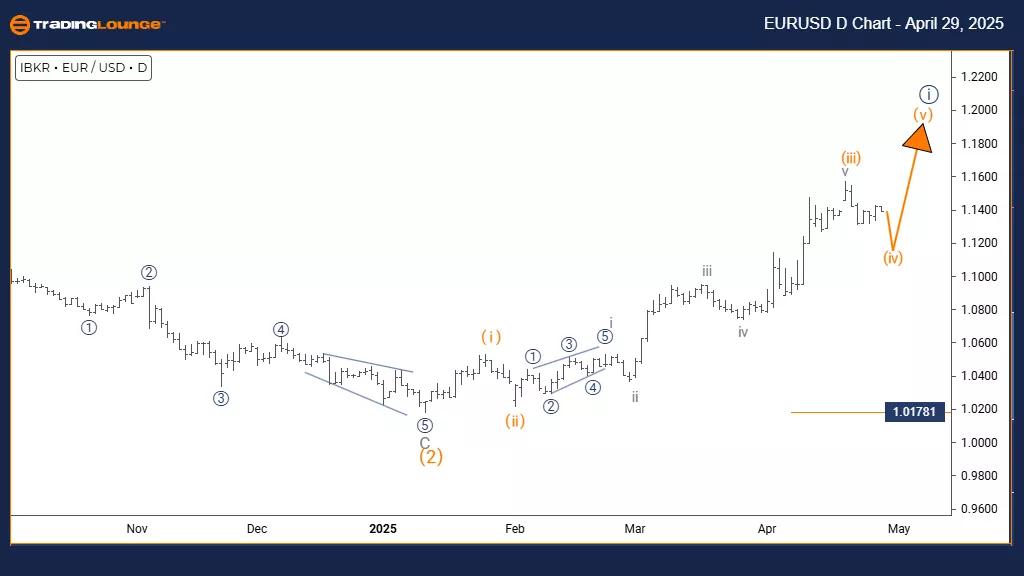

Euro/ U.S. Dollar (EURUSD) Day Chart

EURUSD Elliott Wave Technical Analysis

FUNCTION: Counter Trend

MODE: Corrective

STRUCTURE: Orange wave 4

POSITION: Navy blue wave 1

DIRECTION NEXT HIGHER DEGREES: Orange wave 5

DETAILS: Orange wave 3 appears completed; orange wave 4 correction is currently developing. Wave invalidation level: 1.01781

The EURUSD daily chart highlights a counter-trend correction unfolding within a broader bullish framework. After completing the orange wave 3 advance, the pair has shifted into the orange wave 4 retracement phase inside the larger navy blue wave 1 uptrend. This indicates a short-term downward move before resuming the dominant upward trajectory.

Orange wave 4 represents a corrective retracement typically ranging between 23% and 38% of the wave 3 rise. Having finalized the strong surge of wave 3, conditions are now set for this expected pullback, usually featuring overlapping price movements and reduced momentum, hallmarks of a corrective wave. From the daily timeframe perspective, this phase is likely a medium-term pause within a larger bullish narrative.

The next expected leg is the orange wave 5 to the upside, following the completion of the wave 4 correction. This final upward impulse is anticipated to drive prices higher and complete the current bullish cycle. Key support lies at 1.01781 — any breach below this invalidation point would necessitate a reassessment of the current wave interpretation.

Market participants should closely observe wave 4 developments for classical reversal patterns and momentum indicators hinting at oversold conditions. This correction offers potential opportunities to prepare for the expected wave 5 surge. Utilizing technical tools will be vital to verify when the correction finalizes and the fresh bullish phase begins.

This retracement phase serves as a natural pause within the greater uptrend, offering traders a strategic window to adjust or enter positions in anticipation of the next upward move. Paying attention to price behavior near key Fibonacci retracement zones will be crucial for timing re-entries as the pattern shifts from wave 4 to wave 5. The daily chart perspective underlines the broader importance of the ongoing correction.

Technical indicators and price action signals will play pivotal roles in identifying the moment when downward momentum fades and the final impulsive move upward starts. This analysis stresses the importance of monitoring for trend exhaustion while honoring the invalidation level that would negate the current bullish outlook. A confirmed transition into wave 5 would suggest the final advance before a larger corrective phase emerges.

Euro/ U.S. Dollar (EURUSD) 4 Hour Chart

EURUSD Elliott Wave Technical Analysis

FUNCTION: Counter Trend

Mode: Corrective

STRUCTURE: Orange wave 4

POSITION: Navy blue wave 1

DIRECTION NEXT HIGHER DEGREES: Orange wave 5

DETAILS: Orange wave 3 appears completed; orange wave 4 correction is currently active. Wave invalidation level: 1.01781

The EURUSD 4-hour chart highlights a counter-trend correction evolving within a broader bullish structure. Following the completion of orange wave 3’s advance, the pair has now shifted into the orange wave 4 corrective phase inside the broader navy blue wave 1 uptrend. This development suggests a short-term downward move is underway before the dominant bullish trend resumes.

Orange wave 4 signifies the corrective phase typically retracing between 23% and 38% of wave 3's prior gains. With wave 3's strong rally concluded, conditions are set for this pullback, generally characterized by overlapping price movements and reduced momentum, typical of corrective structures. The 4-hour timeframe signals this could be a brief pause within a larger bullish cycle.

The anticipated next movement is the orange wave 5 to the upside, expected after wave 4's correction completes. This final upward impulse aims to drive prices higher and conclude the current bullish sequence. Key invalidation level to monitor remains 1.01781 — a break below this point would necessitate reassessment of the wave structure.

Market participants should closely observe the evolution of wave 4, looking for traditional reversal signals such as bullish candlestick patterns and momentum indicators pointing to oversold conditions. The correction offers strategic entry opportunities for those aiming to position for the expected wave 5 rally. Employing technical tools will be essential to confirm the end of the correction and onset of the new impulsive move.

This correction marks a typical pause within the prevailing uptrend, presenting a window for traders to reassess and plan before the bullish continuation. Paying close attention to price reactions at key Fibonacci retracement zones will be crucial for effectively timing entries as the market transitions from wave 4 to wave 5.

Technical Analyst: Malik Awais

More By This Author:

Elliott Wave Technical Analysis: Bitcoin Crypto Price News For Tuesday, April 29

Elliott Wave Technical Forecast: Block, Inc. - Monday, April 28

Elliott Wave Technical Analysis: JPMorgan & Chase Co. - Monday, April 28

At TradingLounge™, we provide actionable Elliott Wave analysis across over 200 markets. Access live chat rooms, advanced AI & algorithmic charting tools, and curated trade ...

more