Elliott Wave Technical Analysis: Euro/U.S. Dollar - Thursday, April 10

EURUSD Elliott Wave Analysis Trading Lounge

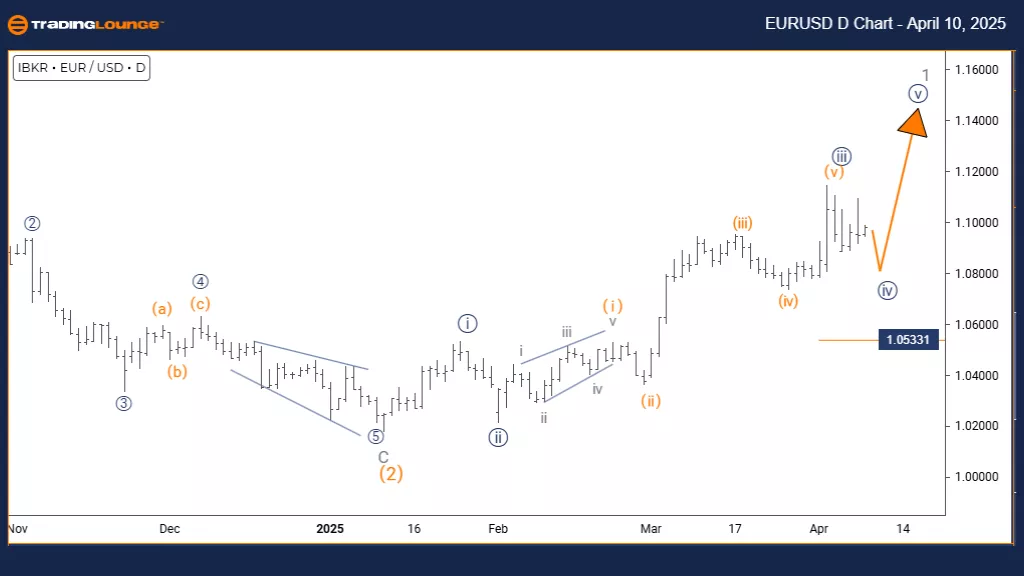

Euro/ U.S. Dollar (EURUSD) Day Chart

EURUSD Elliott Wave Technical Analysis

FUNCTION: Counter-Trend

MOD: Corrective

STRUCTURE: Navy blue wave 4

POSITION: Gray wave 1

DIRECTION NEXT HIGHER DEGREES: Navy blue wave 5

DETAILS: Navy blue wave 3 appears complete; navy blue wave 4 currently forming.

Cancel invalid level: 1.05331

The EURUSD daily chart indicates a counter-trend corrective movement currently unfolding in the currency pair. Technically, this phase is classified as navy blue wave 4, developing within the broader context of gray wave 1, which follows the completion of navy blue wave 3’s upward impulse.

This corrective pattern signals a temporary pause in the dominant trend, with expectations of the next move resuming once wave 4 finalizes. The analysis sets a key invalidation level at 1.05331, which serves as a reference point for confirming or dismissing this current wave outlook.

On the daily timeframe, this structure provides a detailed view of the correction’s progress while preserving alignment with the overall Elliott Wave count. Market participants should prepare for the completion of navy blue wave 4 before the emergence of navy blue wave 5, expected to continue the primary trend upward.

The wave structure reflects a clear hierarchy: navy blue wave 4 is a part of the larger gray wave 1. Traders should watch for common corrective patterns, such as a three-wave structure or sideways price action, which are typical in these phases.

This technical situation may create opportunities for short-term trades during the correction and longer-term positioning for the expected continuation of the main trend. The daily chart remains a reliable tool for tracking this transition in EURUSD price action.

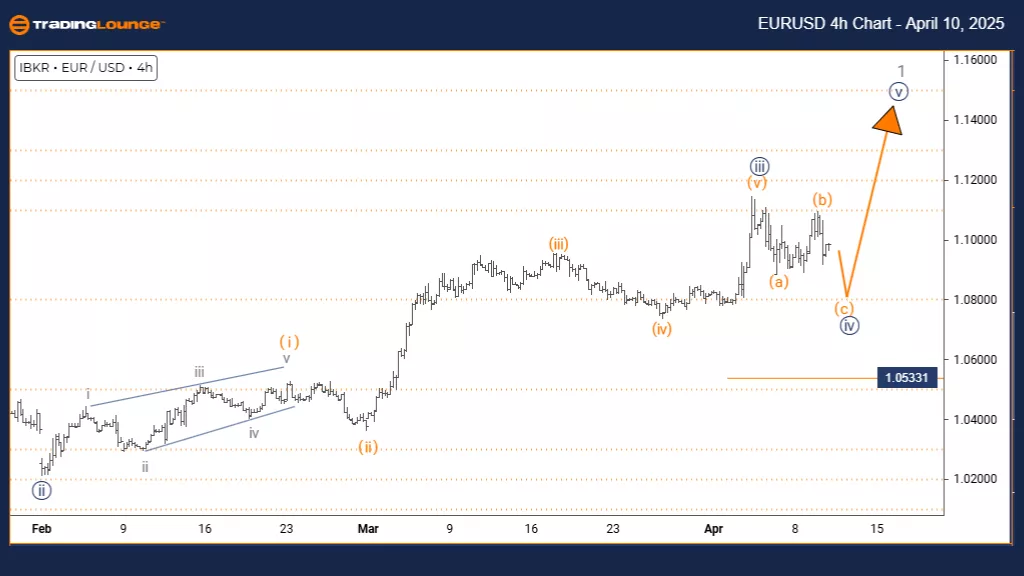

Euro/ U.S. Dollar (EURUSD) 4 Hour Chart

EURUSD Elliott Wave Technical Analysis

FUNCTION: Counter-Trend

MOD: Corrective

STRUCTURE: Navy blue wave 4

POSITION: Gray wave 1

DIRECTION NEXT HIGHER DEGREES: Navy blue wave 5

DETAILS: Navy blue wave 3 appears complete; navy blue wave 4 is currently developing.

Cancel invalid level: 1.05331

The EURUSD Elliott Wave Analysis on the 4-hour chart shows a counter-trend correction currently taking place. The assessment highlights navy blue wave 4 as the dominant structure within the larger gray wave 1 context. Analysts note that the impulsive wave 3 has likely finished, and the pair is now in a corrective phase under wave 4.

A crucial invalidation point is set at 1.05331, which traders should use to gauge the accuracy of this wave structure. Breaching this level may invalidate the current outlook. The 4-hour timeframe gives a focused view of how this correction is evolving, while also maintaining awareness of the larger Elliott Wave framework.

Upon the conclusion of navy blue wave 4, the expectation is a transition into navy blue wave 5, signaling a potential return to the primary upward trend. This structure supports a clear understanding of wave hierarchy, where wave 4 is not just an isolated move but part of the broader gray wave 1.

Traders are encouraged to observe standard corrective patterns, such as three-wave sequences or periods of price consolidation, which often accompany these market phases. This scenario provides potential trading setups for both short-term pullback opportunities and long-term trend continuation entries.

Technical Analyst: Malik Awais

More By This Author:

Elliott Wave Insights For S&P 500, Nasdaq 100, DAX 40, FTSE 100 & ASX 200

Elliott Wave Technical Analysis: Car Group Limited - Wednesday, April 9

Elliott Wave Technical Analysis: AbbVie Inc. - Wednesday, April 9

At TradingLounge™, we provide actionable Elliott Wave analysis across over 200 markets. Access live chat rooms, advanced AI & algorithmic charting tools, and curated trade ...

more