Elliott Wave Technical Analysis Day Chart: U.S. Dollar/Swiss Franc

Photo by Claudio Schwarz on Unsplash

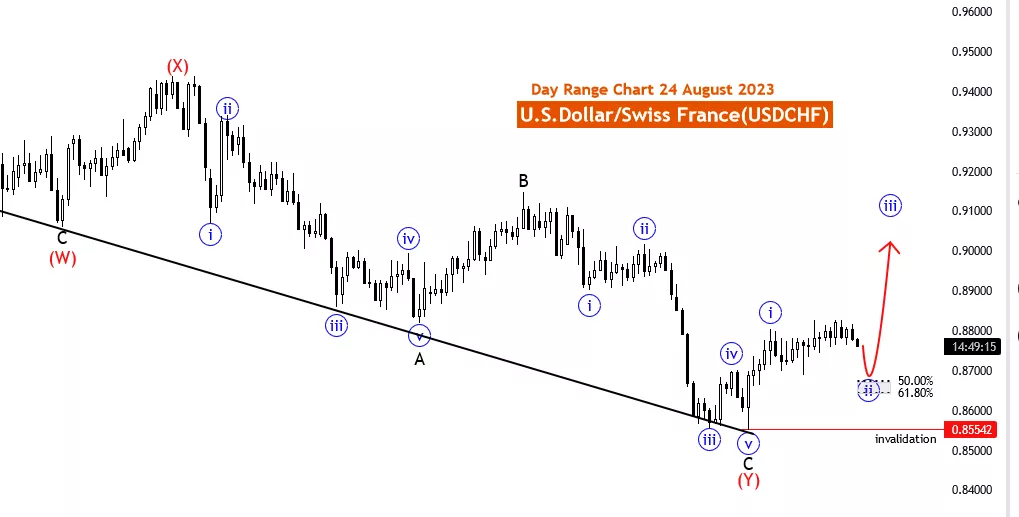

USD/CHF Elliott Wave Analysis Trading Lounge Day Chart, 24 August 2023

U.S.Dollar/Swiss Franc (USD/CHF) Day Chart

USD/CHF Elliott Wave Technical Analysis

Function: Counter Trend

Mode: Corrective

Structure: Flat

Position: New Black Wave 1

Direction Next higher Degrees: wave (3 of 1)

Details: Blue corrective wave 2 likely end between 50.00 to 61.80. Wave Cancel invalid level: 0.85542

The USD/CHF Elliott Wave Analysis for August 24, 2023, delves into the day chart of the U.S. Dollar/Swiss Franc currency pair, providing traders with a comprehensive understanding of counter-trend trading within the context of corrective wave patterns.

The analysis is centered around the concept of counter-trend trading, a strategy that involves capitalizing on price movements that run contrary to the prevailing trend. This is particularly relevant in the context of corrective patterns, which are temporary price consolidations that occur within the larger trend. In this case, a flat correction structure is examined, offering traders insights into potential short-term price reversals.

The focal point of the analysis is the development of the blue corrective wave 2. The analysis indicates that this corrective wave is likely to conclude within a fib level range of 50.00 to 61.80. These Fibonacci retracement levels play a pivotal role in technical analysis, helping traders identify potential support and resistance levels for price reversals. By targeting these levels, traders can make informed decisions about entry, exit, and profit-taking points.

A critical element discussed in the analysis is the concept of the Wave Cancel invalid level. This level serves as a crucial marker for traders to adjust their trading strategies in response to unexpected price movements that could invalidate the projected wave pattern. Effective risk management practices, including adjusting positions based on invalidation levels, are crucial for minimizing potential losses.

The analysis extends its outlook to the next higher degree, indicating that the emergence of the new Black Wave 1 is expected to pave the way for wave (3 of 1). Understanding the hierarchical structure of waves and their degrees is essential for traders to anticipate potential price movements and trends accurately.

To conclude, the USD/CHF Elliott Wave Analysis for August 24, 2023, offers traders a comprehensive exploration of counter-trend trading within a corrective wave structure. By recognizing the intricacies of corrective patterns, fib levels, and Wave Cancel invalid levels, traders can make informed decisions that align with their trading goals. Nonetheless, it is advised for traders to complement this analysis with additional market research, fundamental analysis, and prudent risk management practices to develop a well-rounded trading strategy.

More By This Author:

Elliott Wave Technical Analysis: DexCom Inc. - Wednesday, Aug. 23

Elliott Wave Technical Analysis: Binance Coin/U.S. Dollar

Elliott Wave Technical Analysis: Zscaler Inc. - Tuesday, Aug. 22

Analyst Peter Mathers TradingLounge™ Australian Financial Services Licence - AFSL 317817