Daily Market Outlook - Wednesday, Nov. 5

Image Source: Unsplash

A sell-off on Wall Street erupted into a significant liquidation in Asia, leading to the steepest stock losses in Japan and South Korea since April's "Liberation Day" tariff announcement. On Wednesday, Japan's Nikkei 225 plummeted nearly 7% from its record high reached just the day before. Meanwhile, South Korea's KOSPI nosedived by as much as 6.2% during the session before clawing back some ground, as tech stocks took a severe beating. Among the hardest hit was SoftBank Group, which plunged as much as 14.4%, feeling the ripple effects of a 2% drop in the Nasdaq Composite overnight. Tech giants like Samsung Electronics and SK Hynix also suffered significant losses, sliding by up to 7.8% and 9.2%, respectively.

US futures have rebounded heading into the European session, erasing the majority of losses seen during the Asian session as bargain hunters stepped in. Bitcoin made a strong comeback, climbing 1.8% to hit 102k after briefly dipping below the 100k threshold for the first time since June. Meanwhile, gold shone brighter, gaining 0.8% to reach $3,962 per ounce. Despite turbulence in equities, the foreign exchange market remained largely steady. The U.S. dollar index brushed against a five-month high of 100.25, showing resilience amid market uncertainty.

In the bond market, yields on 10-year U.S. Treasury notes initially fell to 4.0542%, down from Tuesday's close of 4.091%, but have since nudged higher. Beyond financial markets, political developments in the U.S. saw Democrats celebrate sweeping victories in key elections across Virginia, New Jersey, and New York City. In a historic moment, Zohran Mamdani, a Democratic socialist and the first Muslim elected as mayor of New York City, claimed victory in America’s largest metropolis—a landmark achievement in the first major electoral test of President Trump’s latest administration.

UK Budget concerns regained focus yesterday following Reeves's cautionary speech on the challenging context of the event. With three weeks remaining, expectations for the overall fiscal framework are beginning to solidify. While many variations of projections are circulating in the City, estimates seem to suggest a borrowing requirement of £32bn for the 2029-30 fiscal year—still the key horizon for adhering to fiscal rules. Without corrective policy measures, this indicates a £32bn upward revision in borrowing for that year. Assuming capital spending plans remain unchanged and recognising the growing uncertainties over time, this £32bn could also approximate the impact on the current budget, the primary fiscal rule metric. To maintain a £10bn fiscal headroom, £32bn in fiscal tightening would be necessary within this horizon. Alternatively, if the headroom target is raised as speculated, £37bn in savings would be required to achieve a £15bn buffer. As highlighted in previous discussions, identifying policy options to achieve this while upholding manifesto commitments on tax remains a significant challenge. One consequence of the absolute and relative decline in gilt yields over the past month has been downward pressure on the exchange rate. On a trade-weighted basis, the GBP has now fallen back to levels last seen in the immediate aftermath of Trump’s "Liberation Day" in April. However, this performance reveals a divergence: the GBP is approximately 2.5% stronger against the USD compared to that time, but around 1% weaker against the EUR. The move against the USD somewhat overstates the strength of GBP fundamentals. Looking ahead to the upcoming fiscal event in three weeks, the risks are clear. First, the scale of the required budget consolidation presents a significant challenge in crafting and implementing a policy package that satisfies both political and financial stakeholders. As history shows, financial market perceptions of credibility can result in a divergence between gilt yields and the GBP. Second, the magnitude and structure of the anticipated tax measures could further lower expectations for the Bank Rate, eroding GBP’s yield advantage. In the very short term, it’s worth noting that the most recent drop in the exchange rate is unlikely to have been factored into the BoE's November Monetary Policy Report projections, due tomorrow.

Overnight Headlines

- China Suspends Of 24% Tariff On US Goods, Retains 10% Levy

- BoJ September Minutes Show Growing Support For Rate Hike

- Canada Budget Adds $119B To Deficits As Growth Stalls

- Canada Cuts Public-Sector Jobs, Targets Investment In Budget Push

- New Zealand Jobless Rate Hits Nine-Year High Amid Weak Economy

- Global Chip Selloff Erases $500B In Value As Fears Mount

- Super Micro Raises Outlook On Expanding AI Order Book

- AMD Reports Sharply Higher Profits, Sales In Q3

- Amgen Raises Full-Year Forecast After Strong Q3 Results

- Rivian Q3 Revenue Surges 78% On Deliveries, Price Gains

- IBM To Lay Off Thousands Of Employees Before Year-End

- OpenAI Launches Sora App For Android Devices

- Google Proposes App Store Reforms In Epic Games Settlement

- JPMorgan Faces US Probes Linked To Trump-Era Debanking Efforts

- Trump Orders More Trade Talks After Meeting Swiss Officials

FX Options Expiries For 10am New York Cut

(1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

- EUR/USD: 1.1440 (213M), 1.1480-90 (722M), 1.1500 (609M)

- 1.1525-30 (630M), 1.1600-10 (848M), 1.1615-20 (1.12BLN)

- USD/JPY: 153.35-40 (381M), 153.50 (289M), 154.00 (207M)

- 155.00 (467M)

- GBP/USD: 1.3050 (259M), 1.3150 (655M), 1.3200 (666M)

- EUR/GBP: 0.8740-45 (852M), 0.8800 (562M), 0.8850 (466M)

- AUD/USD: 0.6475-85 (424M), 0.6600 (284M)

- NZD/USD: 0.5650 (840M), 0.5675 (1.05BLN), 0.5750 (603M)

CFTC Positions as of the Week Ending 9/10/25

-

October 1, 2025: During the shutdown of the federal government, Commitments of Traders Reports will not be published

Technical & Trade Views

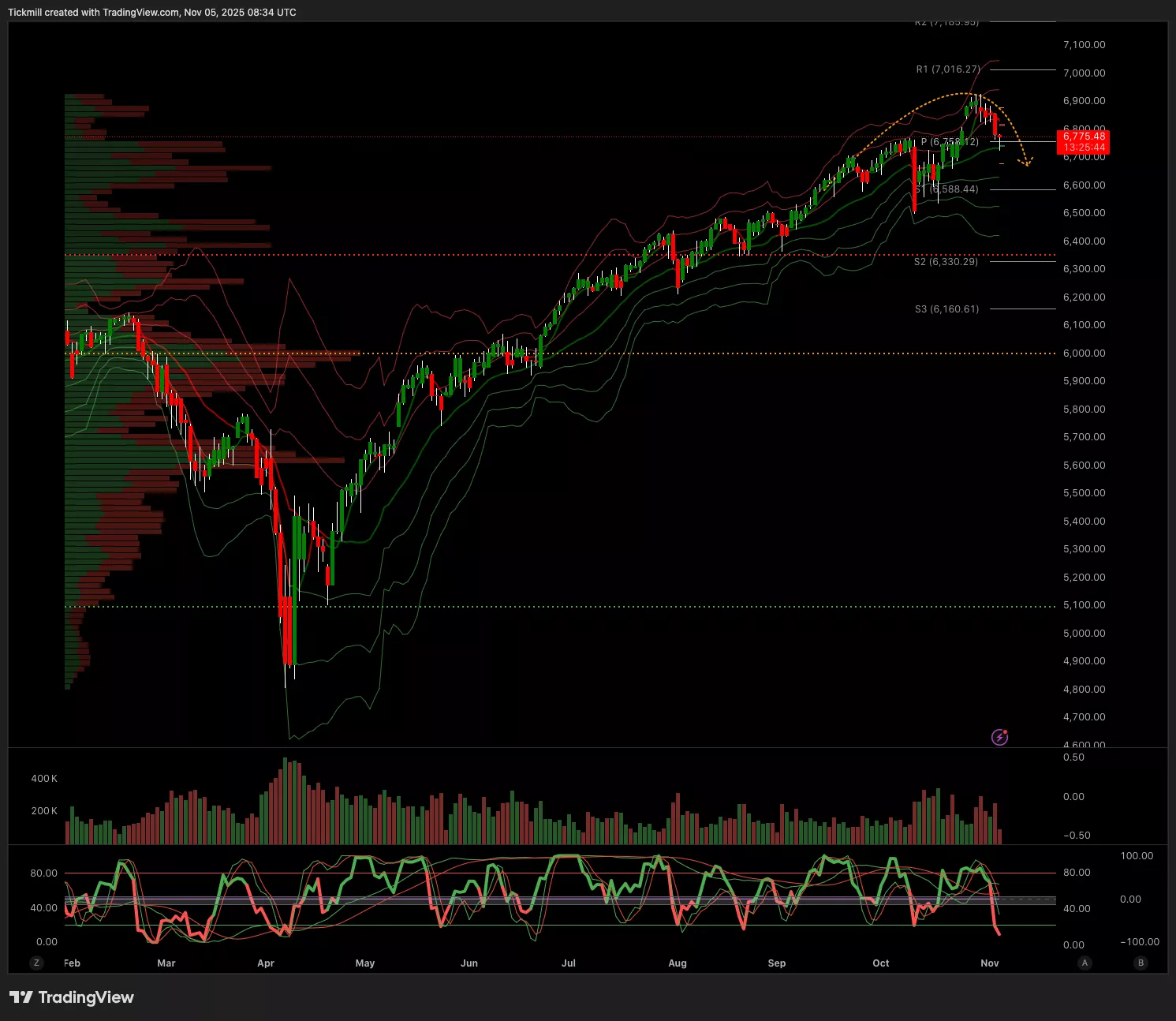

SP500

- Daily VWAP Bearish

- Weekly VWAP Bullish

- Above 6833 Target 6932

- Below 6833 Target 6630

(Click on image to enlarge)

EURUSD

- Daily VWAP Bearish

- Weekly VWAP Bearish

- Below 1.1534 Target 1.14

- Above 1.1534 Target 1.16

(Click on image to enlarge)

GBPUSD

- Daily VWAP Bearish

- Weekly VWAP Bearish

- Below 1.3120 Target 1.2957

- Above 1.3120 Target 1.3178

(Click on image to enlarge)

USDJPY

- Daily VWAP Bearish

- Weekly VWAP Bullish

- Below 153.98 Target 152.30

- Above 153.98 Target 154.73

(Click on image to enlarge)

XAUUSD

- Daily VWAP Bullish

- Weekly VWAP Bearish

- Above 3996 Target 4086

- Below 3996 Target 3846

(Click on image to enlarge)

BTCUSD

- Daily VWAP Bearish

- Weekly VWAP Bearish

- Above 104.3k Target 108.1k

- Below 104.3k Target 97.7k

(Click on image to enlarge)

More By This Author:

Daily Market Outlook - Tuesday, Nov. 4

The FTSE Finish Line - Monday, Nov. 3

Emini S&P 500 Weekly Live Market & Trade Analysis - Monday, Nov. 3