Daily Market Outlook - Tuesday, Nov. 4

Image Source: Unsplash

U.S. stock futures took a dip, reflecting a cautious mood on Wall Street as investors reevaluated the high valuations of tech stocks and mulled over mixed messages from Federal Reserve officials. S&P 500 futures slid 0.9%, following a modest gain in the main index on Monday, despite over 300 of its components ending in the red. Nasdaq 100 futures saw a sharper drop of 1.2%, with Palantir Technologies Inc. losing more than 4% in after-hours trading as concerns over its lofty valuation reemerged after a record-setting rally. Meanwhile, European markets prepared for a subdued start, and Asian equities fell 0.8%. In South Korea, regulators issued a rare “investment caution” on SK Hynix Inc., whose stock has skyrocketed 240% this year. The U.S. dollar extended its winning streak to a fifth session, climbing to its highest level since August against most major currencies. This came as traders digested conflicting signals from Federal Reserve officials. Fed Chair Jerome Powell reiterated that a December rate cut is far from certain, dampening hopes for immediate monetary easing. The Institute for Supply Management (ISM) reported that its manufacturing index dipped to 48.7, marking the 16th straight month of contraction. With the U.S. government shutdown delaying official economic data, policymakers have increasingly relied on private surveys like the ISM report to assess economic activity and labor-market trends. The release of Friday’s employment report is also expected to be postponed. Elsewhere in the markets, gold declined for the third consecutive session, Treasury yields held steady, and oil prices fell following OPEC+’s decision to pause production hikes. The yen gained strength after Japan’s finance minister issued another verbal warning about currency moves, while the Australian dollar weakened after the Reserve Bank of Australia held interest rates steady. On the other hand, India’s rupee rebounded from near-record lows, likely due to suspected intervention by the country’s central bank. On the policy front, Federal Reserve Governor Lisa Cook highlighted that the risks of further labor-market softening outweigh concerns about reigniting inflation, though she stopped short of endorsing another rate cut. "Policy is not on a predetermined path," she said, adding that December remains an open discussion. Her sentiment was echoed by San Francisco Fed President Mary Daly, who urged policymakers to keep an open mind about potential easing. Meanwhile, Fed Governor Stephen Miran emphasized that monetary policy continues to be restrictive.

Chancellor Reeves is set to hold a press conference at the Treasury this week, the address seems to confirm that the government will breach its manifesto pledges not to raise the main rates for income tax, National Insurance, or VAT in the upcoming Budget, just three weeks away. But the real question is: will this actually shake the gilt market? Markets remain concerned about Reeve’s ability to meet fiscal rules without bending—if not outright breaking—the spirit or letter of those manifesto promises. Recent market movements suggest investors have already priced in the likelihood of tough fiscal measures. Over the last three weeks, the ~30 basis point tightening of gilt spreads against US Treasuries in the 10-year sector appears to reflect expectations of the government’s commitment to fiscal discipline. Additionally, the drop in shorter-term gilt yields may indicate growing confidence that a stricter fiscal stance could pave the way for the Bank of England to implement further rate cuts, offering monetary stimulus as a counterbalance. In essence, much of what Reeves unveiled today regarding fiscal consolidation may already be baked into market sentiment. However, the less predictable factor remains the potential political fallout—whether in opinion polls or among MPs—and how that could influence the long-term trajectory of the current fiscal strategy.

Overnight Headlines

- RBA Holds Rate At 3.60%, Cites Sticky Inflation, Housing Rebound

- Goldman, BofA See No Imminent Intervention Risk As Yen Nears 155

- Japan’s Takaichi Aims For Growth Plan Compilation By Next Summer

- BoJ Stays Firm On Cautious Hike Path; US Shutdown Hinders Assessment

- Fed’s Goolsbee: Shutdown Makes Inflation Harder To Track, Risk Shifted

- WH Officials Urged Trump Not To Raise AI Chip Export Curbs With China

- China Warns US To Avoid ‘Red Lines’ Despite Xi–Trump Trade Truce

- China VP Lifeng Urges HK To Deepen Financial Links With Mainland

- Japan Factory Activity Contracts At Fastest Pace In 19 Months

- UK Chancellor Reeves Faces Smaller-Than-Expected £14B Fiscal Hole

- Eli Lilly Calls On Europe To Ditch Clawback Taxes On Drugmakers

- Amazon Accuses Berkshire Utility Of Failing To Power Data Centres

- Microsoft To Invest $15B In UAE, Secures Nvidia Chips Export Licences

- Palantir Reports Record Revenue, Raises Forecasts On AI Demand

- Starbucks Sells Majority Stake In China Unit To Boyu Capital

- Samsung SDI In Talks To Supply Tesla With Storage Batteries, Shares Jump

- Ørsted Sells 50% Of World’s Largest Wind Farm To Apollo For $6.5B

FX Options Expiries For 10am New York Cut

(1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

- EUR/USD: 1.1455-60 (360M), 1.1475 (945M), 1.1515-25 (1.5BLN)

- 1.1540 (205M), 1.1625-30 (458M), 1.1635-40 (1.7BLN), 1.1650-55 (758M)

- USD/JPY: 152.00 (215M), 153.50 (260M). EUR/JPY: 175.00 (367M)

- USD/CHF: 0.7875 (460M)

- GBP/USD: 1.3150 (284M), 1.3100 (322M), 1.3150 (702M), 1.3175 (453M)

- 1.3200 (284M), 1.3250-60 (1.17BLN). EUR/GBP: 0.8735-40 (354M)

- 0.8750 (203M), 0.8800-10 (459M)

- AUD/USD: 0.6490-95 (332M), 0.6500-05 (328M)

- USD/CAD: 1.3980-85 (1.42BLN), 1.4050 (321M), 1.4110 (679M)

- 1.4145 (380M)

CFTC Positions as of the Week Ending 9/10/25

-

October 1, 2025: During the shutdown of the federal government, Commitments of Traders Reports will not be published

Technical & Trade Views

SP500

- Daily VWAP Bearish

- Weekly VWAP Bullish

- Above 6863 Target 6932

- Below 6863 Target 6726

(Click on image to enlarge)

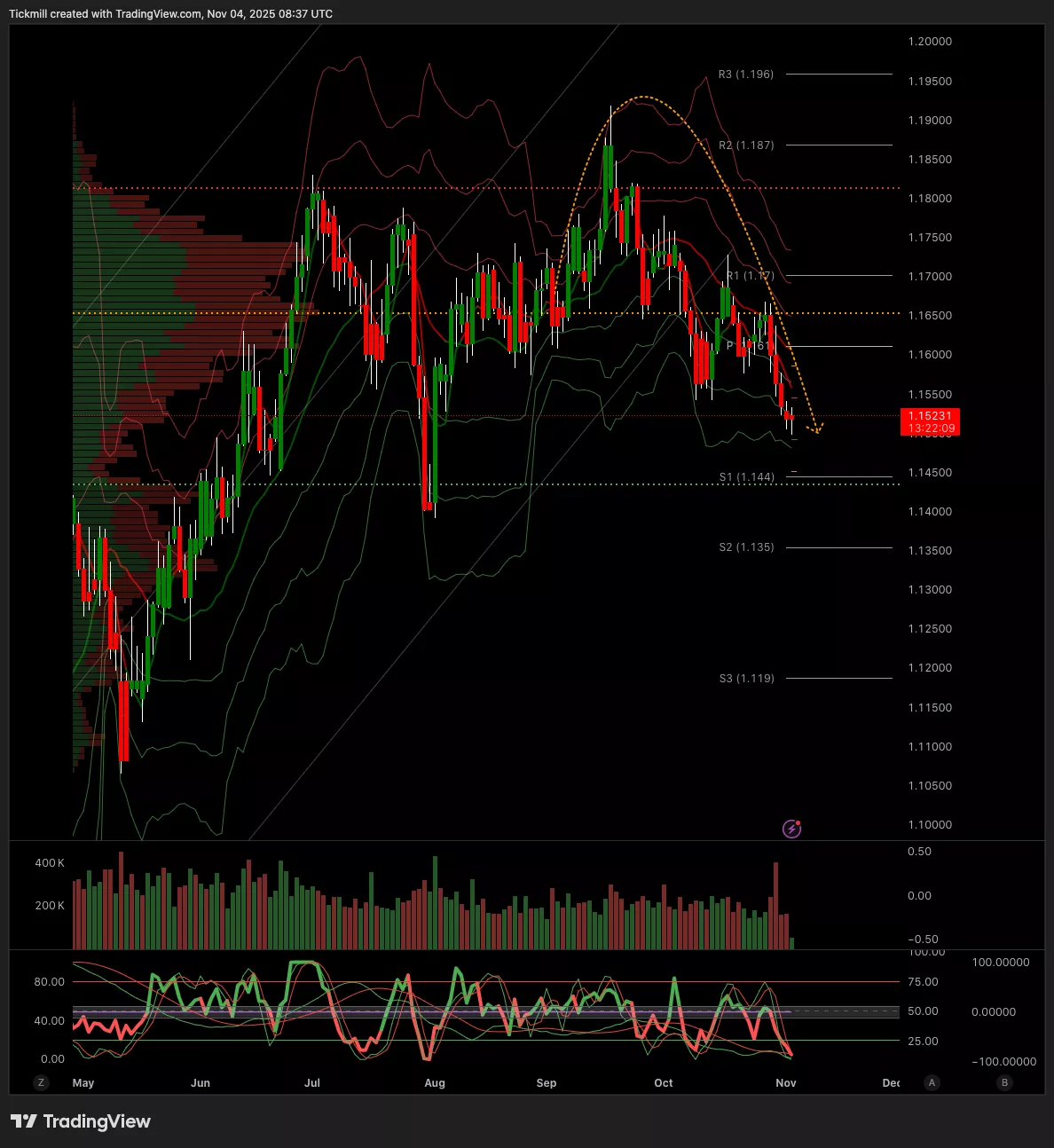

EURUSD

- Daily VWAP Bearish

- Weekly VWAP Bearish

- Below 1.1560 Target 1.1610

- Above 1.1560 Target 1.1496

(Click on image to enlarge)

GBPUSD

- Daily VWAP Bearish

- Weekly VWAP Bearish

- Below 1.3150 Target 1.3085

- Above 1.3150 Target 1.3210

(Click on image to enlarge)

USDJPY

- Daily VWAP Bullish

- Weekly VWAP Bullish

- Below 153.46 Target 152.19

- Above 153.46 Target 155.60

(Click on image to enlarge)

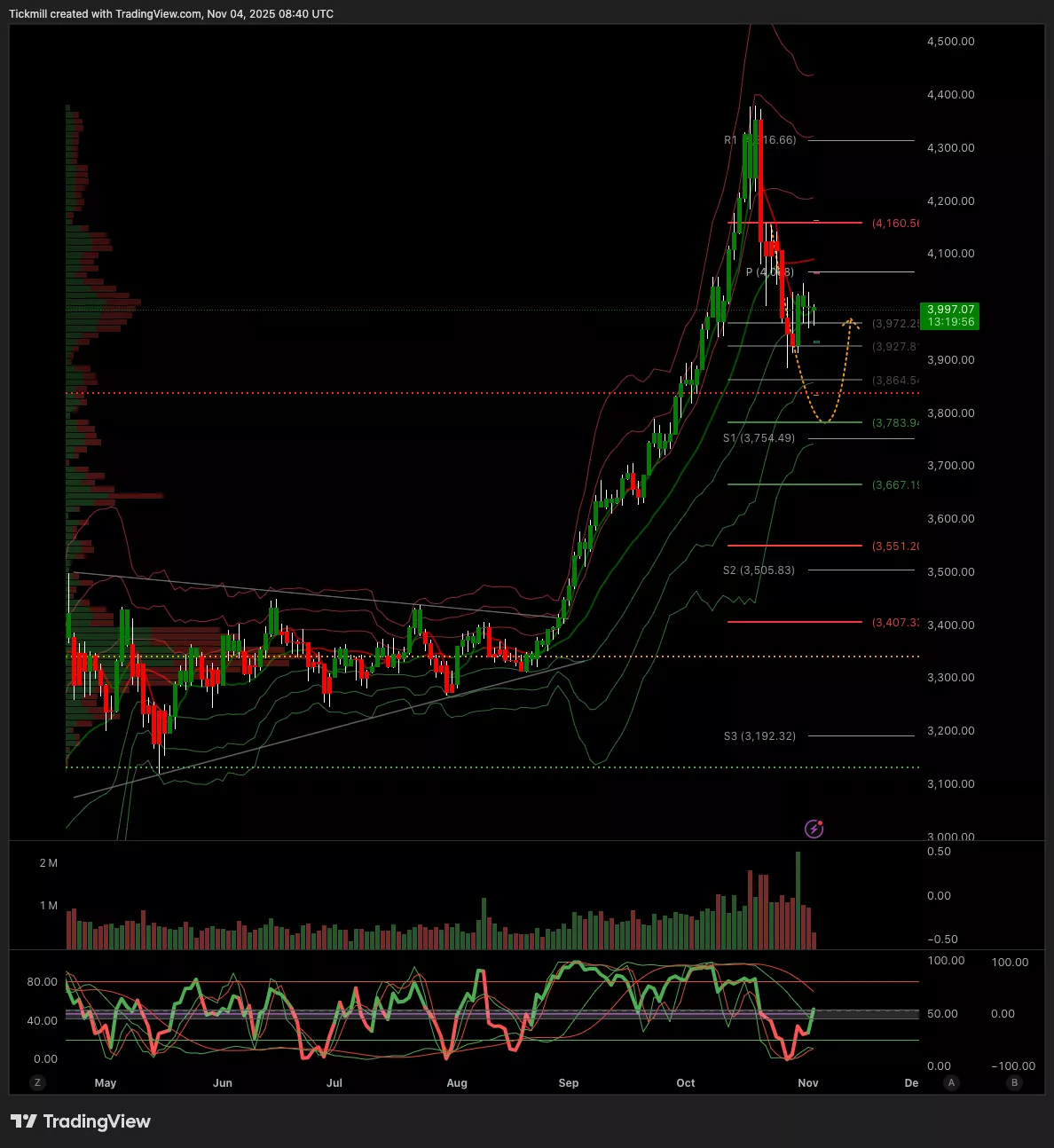

XAUUSD

- Daily VWAP Bullish

- Weekly VWAP Bearish

- Above 3975 Target 4095

- Below 3965 Target 3860

(Click on image to enlarge)

BTCUSD

- Daily VWAP Bearish

- Weekly VWAP Bearish

- Above 108k Target 109k

- Below 108k Target 102k

(Click on image to enlarge)

More By This Author:

The FTSE Finish Line - Monday, Nov. 3

Emini S&P 500 Weekly Live Market & Trade Analysis - Monday, Nov. 3

Daily Market Outlook - Monday, Nov. 3