The FTSE Finish Line - Monday, Nov. 3

Image Source: Pexels

The UK's FTSE 100 edged lower on Monday as the market braced for a busy week of corporate earnings and a key interest rate decision from the Bank of England. Major companies such as AstraZeneca, BP, Diageo, and IAG are set to release their earnings, adding to the week's significance.

On Thursday, the Bank of England's Monetary Policy Committee (MPC) will announce its November decision, with expectations pointing to the Bank Rate remaining steady at 4%. However, market sentiment last week implied a 30% chance of a rate cut. Economic data since August has largely underperformed, particularly in wage growth, though recent MPC commentary has not heavily underscored this weakness. Hawkish members, including Mann, Pill, Greene, and Lombardelli, remain firmly against a rate cut in the near term. For a cut to materialise, all five other members would need to support it. Taylor and Dhingra appear inclined toward a cut, while Ramsden may lean that way as well. The final decision likely rests with moderate voices such as Breeden and Governor Bailey. With inflation expectations still elevated, Bailey may prioritise combating inflation over reacting to potentially short-lived economic soft spots. The decision is seen as finely balanced, with strong arguments on both sides. Notably, the structure of the Monetary Policy Report (MPR) and MPC minutes will see changes, including a more concise summary and individual paragraphs for each member’s perspective.

On Monday, financial stocks, including life insurers and banks, provided the biggest lift to the index. Prudential rose 2%, while HSBC gained 0.4%. In contrast, industrial metal miners lagged, with Rio Tinto and Glencore both falling over 1%. Among other UK assets, the pound dipped 0.1% against the dollar, and government bond yields edged higher. BP shares climbed 1.5% to 448.9p, making it one of the top FTSE 100 performers (+0.13%). The company sold non-controlling stakes in its Permian and Eagle Ford midstream assets to Sixth Street for $1.5 billion, retaining 51% in Permian and 25% in Eagle Ford. This move aligns with BP's $20 billion divestment target by 2027. Year-to-date, BP's stock has risen 12.54%, compared to the FTSE 100's gain of 19.05%.

Technical & Trade View

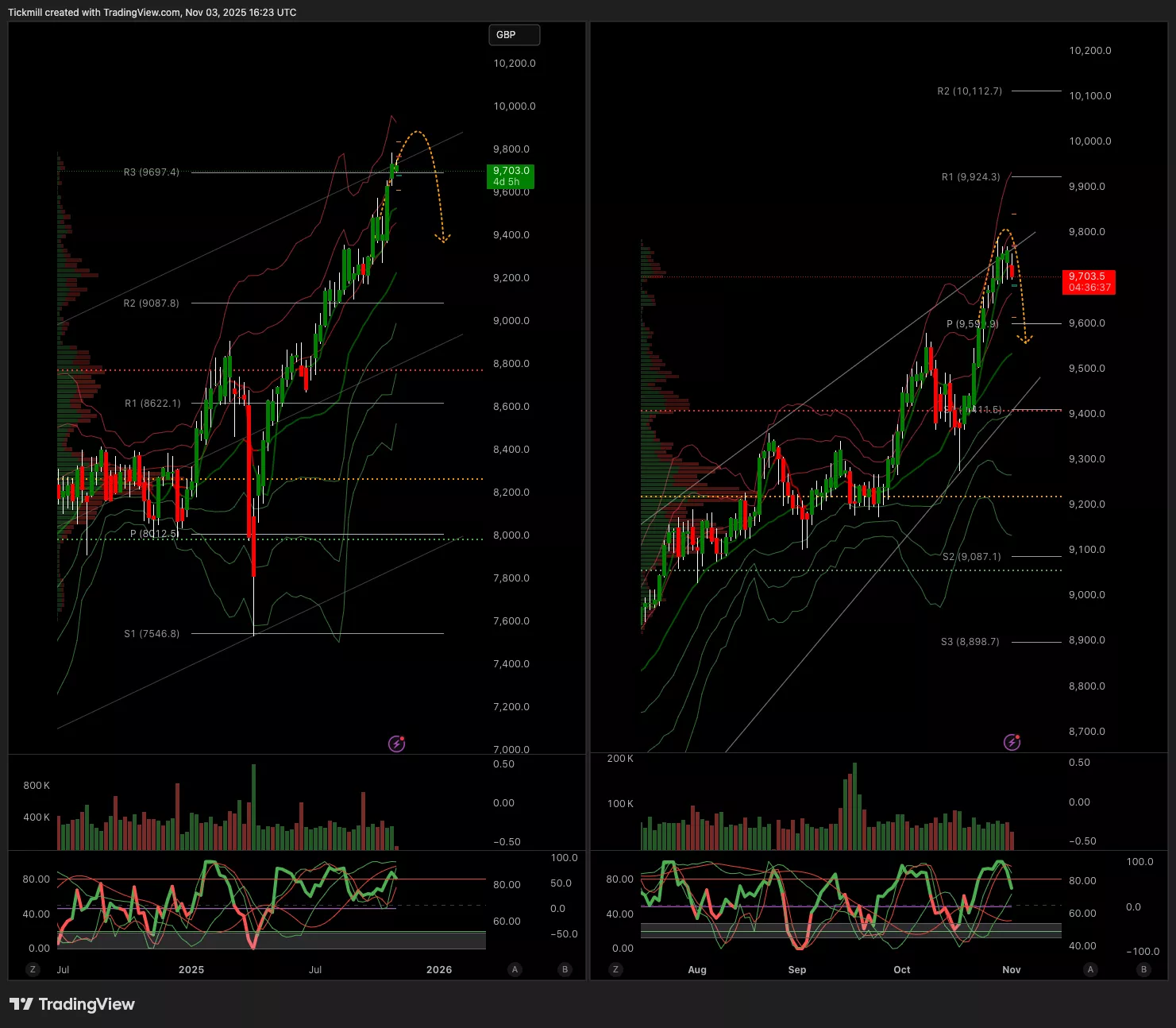

FTSE Bias: Bullish Above Bearish below 9704

- Primary support 9500

- Below 9660 opens 9580

- Primary objective 9873

- Daily VWAP Bearish

- Weekly VWAP Bullish

(Click on image to enlarge)

More By This Author:

Emini S&P 500 Weekly Live Market & Trade Analysis - Monday, Nov. 3

Daily Market Outlook - Monday, Nov. 3

The FTSE Finish Line - Friday, Oct. 31