Daily Market Outlook - Wednesday, June 25

Image Source: Pexels

Asian stocks edged higher as the truce between Israel and Iran showed signs of holding, while Treasury investors raised their expectations for potential US interest rate cuts. On Wednesday, MSCI’s index of Asian equities climbed, extending a more than 2% rally from the previous day after US President Donald Trump announced a ceasefire between the two Middle Eastern nations. Meanwhile, US equity futures remained steady following Tuesday's gains, where the S&P 500 rose 1.1% and the Nasdaq 100 advanced 1.5%, marking its first new high since February. Treasuries stabilised alongside the dollar index. The benchmark 10-year Treasury yield fell five basis points on Tuesday after Federal Reserve Chair Jerome Powell noted that “many paths are possible” for future monetary policy. This coincided with data revealing a drop in consumer confidence. Investors kept a close watch on developments in the Middle East, as the fragile peace agreement faced scrutiny. Both Iran and Israel appeared to be adhering to the ceasefire after initial violations drew criticism from Trump. Oil prices rebounded following their steepest two-day decline since 2022, as traders assessed the ceasefire and an industry report pointing to a further drop in US crude inventories. The dollar weakened against most major currencies. Asian currencies, including the Philippine peso and Indonesian rupiah, gained for a second straight day, while the Australian dollar fluctuated after inflation data came in below expectations.

Federal Reserve Chair Jerome Powell began his semi-annual testimony to Congress on Tuesday, addressing the House Committee on Financial Services. While his written statement provided minimal new insights, Powell adopted a more candid tone during the questioning from panel members. He expressed optimism about the current economic performance and labour market while highlighting uncertainties surrounding the inflation outlook. Powell reiterated that the strong economy allows the Fed to adopt a "wait-and-see" approach. However, he left room for a dovish shift in policy if the impact of tariffs proves less inflationary than anticipated. Conversely, a more aggressive stance might be necessary if the labour market weakens more than expected. He also noted that factors like reduced migration, which could slow labour force growth, might play a role in future decisions. The market interpreted Powell’s remarks as favouring a more dovish outlook, influenced by recent comments from other Fed officials, including Christopher Waller, Michelle Bowman, and Austan Goolsbee, who appeared to lean in a similar direction. This shift seems to have moved the conversation away from the more cautious tone reflected in the Fed’s updated Summary of Economic Projections (SEP). It’s also likely that ongoing pressure from the White House to cut rates has subtly influenced the broader debate.

Yesterday’s updates from UK MPC members offered limited new insights. Deputy Governor Ramsden justified his dovish stance in June, citing a contracting private sector labour market. External member Greene advocated a cautious approach to rate cuts but leaned slightly hawkish, emphasising risks of prolonged above-target inflation and a steadier labor market. Governor Bailey, addressing the House of Lords Economic Affairs Committee, described inflation as a "hump" but avoided committing to future decisions. He hinted at potential changes to QT, suggesting the annual pace could drop from £100bn to £75bn, influenced by the steep yield curve and gilt sales.

Events in the Middle East are expected to stay at the forefront of market focus during the European trading session, with minimal corporate or macroeconomic activities scheduled today. We can expect to hear more from Trump regarding the Middle East as he visits The Hague for a NATO summit today, where the main topic will be defence spending. This afternoon, U.S. reports will only include new home sales figures. Federal Reserve Chair Jerome Powell will return to Capitol Hill to provide testimony before the Senate, but since he already spoke to the House the day before, there probably won’t be anything particularly new to share. In political news from outside DC, Zohran Mamdani, a 33-year-old state legislator who identifies as a democratic socialist, is set to achieve a surprising victory in New York City's Democratic mayoral primary against former Governor Andrew Cuomo.

Overnight Headlines

- BoE’s Bailey Warns On UK Productivity In Challenge To Reeves

- Fed’s Powell Reiterates Caution On Rate Cuts Amid Tariff Review

- Fed’s Schmid: Supports Wait-And-See Approach On Data

- Bond Traders Boost Bets On US 10-Year Yield Dropping Toward 4%

- BoJ’s Tamura: Inflation On Track, Stronger Than Expected

- China Doubles Down On Yuan As Dollar Confidence Wanes

- China’s Xi To Skip BRICS Summit, PM Li To Lead Delegation

- Australia CPI Cools In May, Paves Way For RBA Rate Cut

- US Consumer Confidence Deteriorates On Labour Market Concerns

- France Accuses Tesla Of Misleading Public On Self-Driving Claims

- FedEx Tumbles On Disappointing Guidance; Earnings Amid Tariff

- Trump Strains NATO Relations As Rutte Aims To Keep US Engaged

- UK Will Buy Nuclear-Capable F-35s In Strategic Pivot

- Starbucks Denies Full Exit Of China Operations Amid Growth Plans

- Anthropic Picks Tokyo As First Asia Hub In Global Expansion

- BIS Warns Stablecoins Pose Serious Financial Stability Risks

FX Options Expiries For 10am New York Cut

(1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

- USD/JPY: 143.45-50 (824M), 143.90-00 (1.5BLN), 144.20 (1.13BLN)

- 144.50 (2.21BLN), 144.65-70 (419M), 145.00-10 (1.6BLN)

- 145.40-45 (551M), 145.80-85 (460M), 146.00 (1.04BLN), 146.15-20 (400M)

- 146.35 (275M), 146.50 (430M), 147.00 (511M), 148.00 (2.0BLN)

- EUR/JPY: 167.00 (211M), 168.00 (475M)

- USD/CHF: 0.8000 (220M), 0.8050 (317M), 0.8070-75 (300M), 0.8125 (325M)

- 0.8165 (347M), 0.8250 (822M). EUR/CHF: 0.9450 (209M)

- GBP/USD: 1.3400 (1.1BLN), 1.3455-65 (448M), 1.3490 (326M)

- EUR/GBP: 0.8650 (209M). AUD/USD: 0.6400 (287M), 0.6420-30 (921M)

- 0.6525-35 (474M), 0.294M), 0.6665-75 (294M), 0.6590 (626M)

- 0.6600-05 (372M). NZD/USD: 0.5690 (690M), 0.6265 (757M)

- USD/CAD: 1.3540 (650M), 1.3700 (344M), 1.3785 (439M)

CFTC Positions as of the Week Ending June 20th

- Speculators reduced their net short position in CBOT US Treasury bonds futures by 22,628 contracts, bringing the total to 79,745.

- They also trimmed their net short position in CBOT US Ultrabond Treasury futures by 24,696 contracts, now at 203,747.

- Conversely, speculators raised their net short position in CBOT US 10-year Treasury futures by 18,845 contracts to a total of 724,101.

- Increased activity also occurred in CBOT US 5-year Treasury futures, with a 74,384 contract increase in the net short position, reaching 2,470,920.

- The net short position for CBOT US 2-year Treasury futures rose by 36,591 contracts to 1,180,516.

- Equity fund managers upped their net long position in the S&P 500 CME by 10,532 contracts, now totaling 825,013.

- Equity fund speculators raised their net short position in the S&P 500 CME by 31,419 contracts, bringing it to 316,744.

- The net long position for the Japanese yen stands at 144,595 contracts, while the euro's net long position is 93,025 contracts.

- The British pound's net long position is at 51,634 contracts, and the Swiss franc has a net short position of -21,268 contracts.

- Bitcoin has a net short position of -2,009 contracts.

Technical & Trade Views

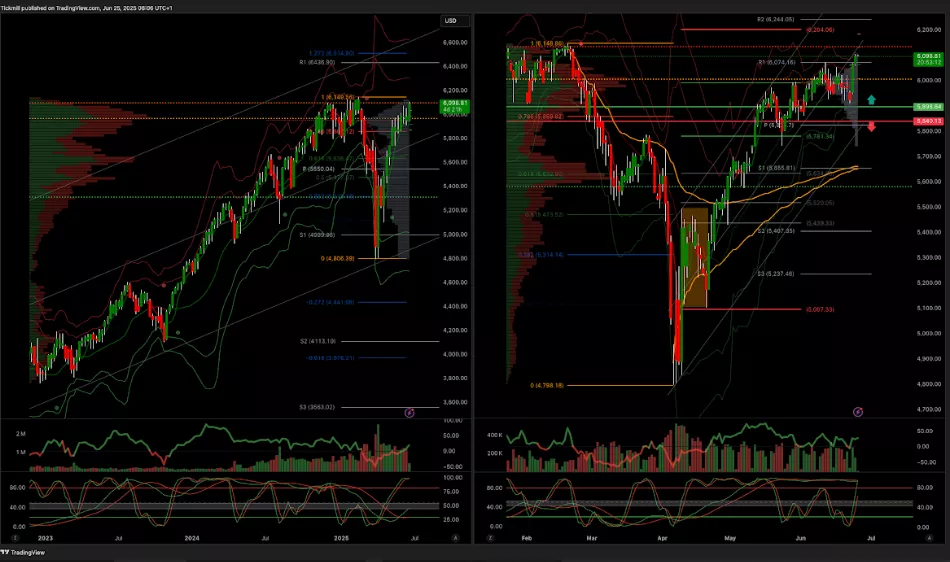

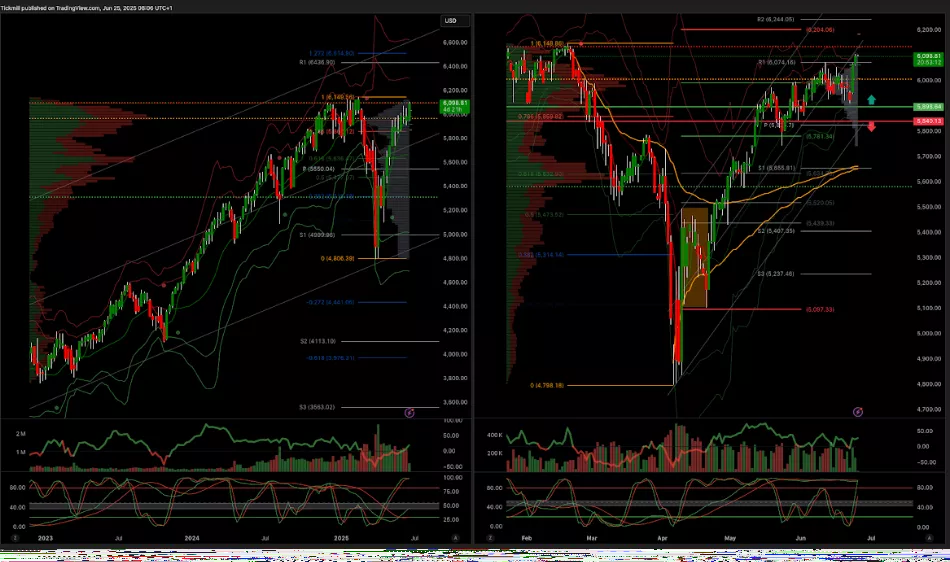

SP500 Pivot 5900

- Daily VWAP bullish

- Weekly VWAP bullish

- Above 5900 target 6100

- Below 5800 target 5700

(Click on image to enlarge)

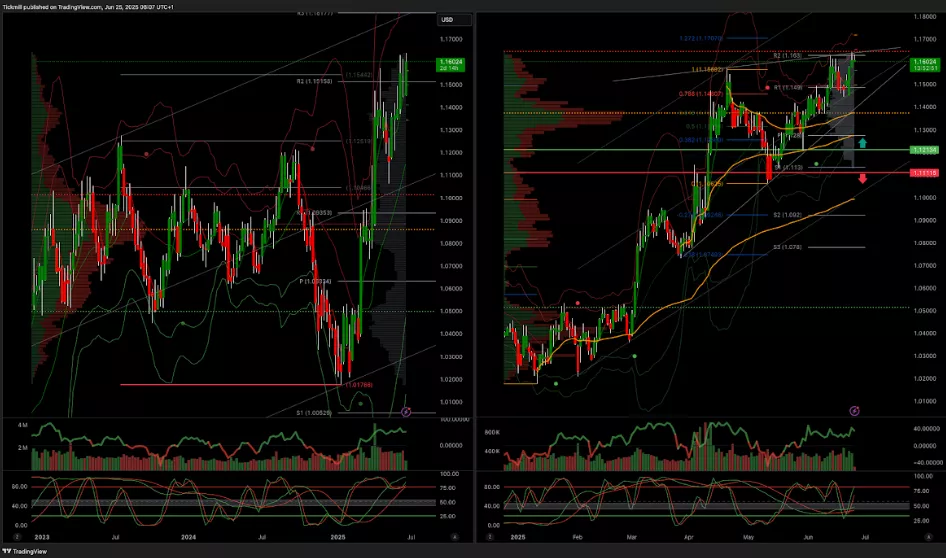

EURUSD Pivot 1.12

- Daily VWAP bullish

- Weekly VWAP bullish

- Above 1.11 target 1.19

- Below 1.11 target 1.0950

(Click on image to enlarge)

GBPUSD Pivot 1.34

- Daily VWAP bearish

- Weekly VWAP bearish

- Above 1.34 target 1.38

- Below 1.3350 target 1.32

(Click on image to enlarge)

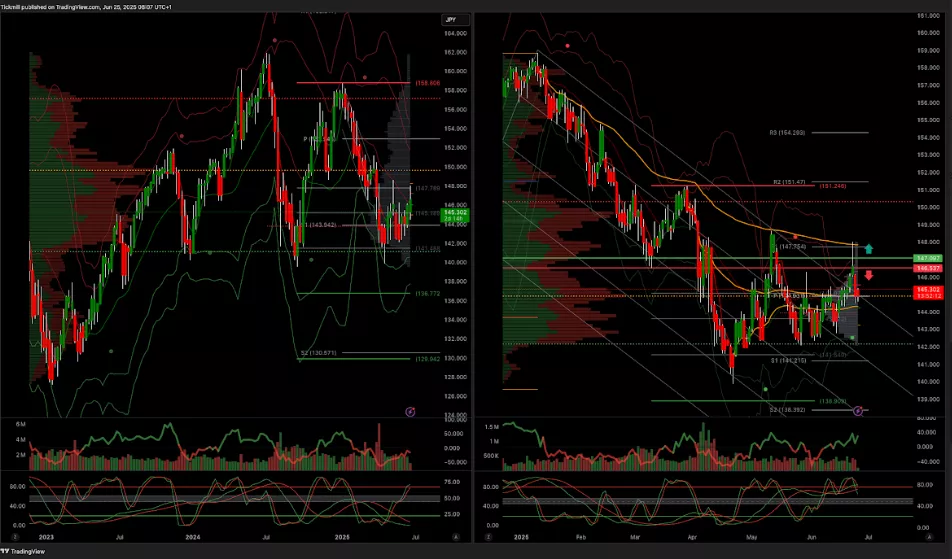

USDJPY Pivot 147

- Daily VWAP bearish

- Weekly VWAP bullish

- Above 147.10 target 148.26

- Below 146.53 target 139

(Click on image to enlarge)

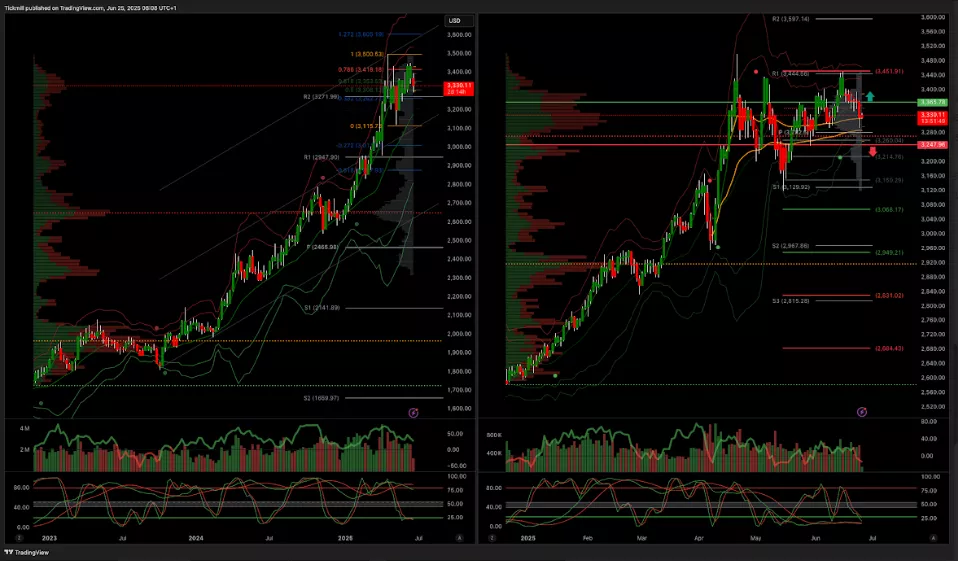

XAUUSD Pivot 3365

- Daily VWAP bearish

- Weekly VWAP bullish

- Above 3410 target 3600

- Below 3240 target 3000

(Click on image to enlarge)

BTCUSD Pivot 105k

- Daily VWAP bullish

- Weekly VWAP bearish

- Above 105k target 118k

- Below 98.3K target 95.5k

(Click on image to enlarge)

More By This Author:

The FTSE Finish Line - Tuesday, June 24

Daily Market Outlook - Tuesday, June 24

The FTSE Finish Line - Monday, June 23