The FTSE Finish Line - Monday, June 23

Image Source: Pexels

UK stocks began the week on a dull note as investors searched for indications of intensification in the ongoing Middle East conflict, while instruments manufacturer Spectris soared following its agreement to a takeover by private equity firm Advent. Investors prepared for Iran's reaction to U.S. airstrikes targeting some of its nuclear facilities over the weekend, as they faced the potential for escalating geopolitical tensions in an area vital to the global oil supply, especially the Strait of Hormuz. The oil and gas sectors saw gains, following crude prices that approached five-month highs. Energy companies BP and Shell each rose about 1%, while Harbour Energy increased by 2%. Meanwhile, airline stocks, including EasyJet, Wizz Air, and British Airways' parent company, International Consolidated Airlines, fell between 1.1% and 2.3% due to rising crude prices. Economic data indicated a modest growth in British business activity during June, although concerns lingered due to the ongoing conflict in the Middle East. Meanwhile, Federal Reserve Chair Jerome Powell is expected to testify before Congress on Tuesday and Wednesday. Traders will closely monitor his insights regarding the economy and interest rates.

Goldman Sachs forecasts that FTSE 100 companies will return 6% of their market capitalisation to shareholders through dividends and buybacks this year, significantly higher than global averages, making the market especially appealing to income-focused investors. The attractiveness of British stocks is also bolstered by the implementation of Section 899 in Trump's tax legislation, which may impose taxes on U.S. dividends, according to Goldman Sachs. "The potential for capital rotation towards the UK could speed up, particularly given the FTSE 350's free cash flow yield exceeding 6%," the bank states. However, despite the UK's leadership in shareholder returns, there's no such thing as a "free lunch," warns Goldman. The U.S. bank observes that British firms with sluggish dividend growth are trading at lower valuations, like those in the basic resources, Energy, and Utilities sectors. In contrast, companies with strong dividend growth have higher valuations, such as those in Technology and Travel & Leisure. Additionally, buybacks are expected to decline, according to Goldman, as the equity base in the UK continues to diminish, with corporates being the main purchasers of UK stocks.

Single Stock Stories & Broker Updates:

-

Spectris shares increased by 14.8% to 3,768p, marking the highest price since February 2024. The stock is the leading gainer on the FTSE mid-cap index, which has decreased by 0.12%. The scientific instruments manufacturer has accepted an acquisition offer from private equity firm Advent, representing the largest takeover in the UK this year, with a valuation of approximately £4.4 billion ($5.91 billion), including debt. Each shareholder of Spectris will receive £37.63 per share in cash, reflecting an 84.6% premium compared to the stock’s closing price on June 6 before the acquisition interest was revealed. Year to date, SXS has gained around 31%.

-

Hays shares fell 2.73% to 64.05p after UBS downgraded them from "buy" to "neutral," reducing the price target from 100p to 70p. The company forecasted a more than 57% drop in annual operating profit to £45 million, below market expectations of £56.4 million, due to macroeconomic uncertainty impacting hiring. Despite this, the average rating from 10 brokerages remains "buy" with a median price target of 92.50p. Year-to-date, the stock is down about 20%.

Technical & Trade View

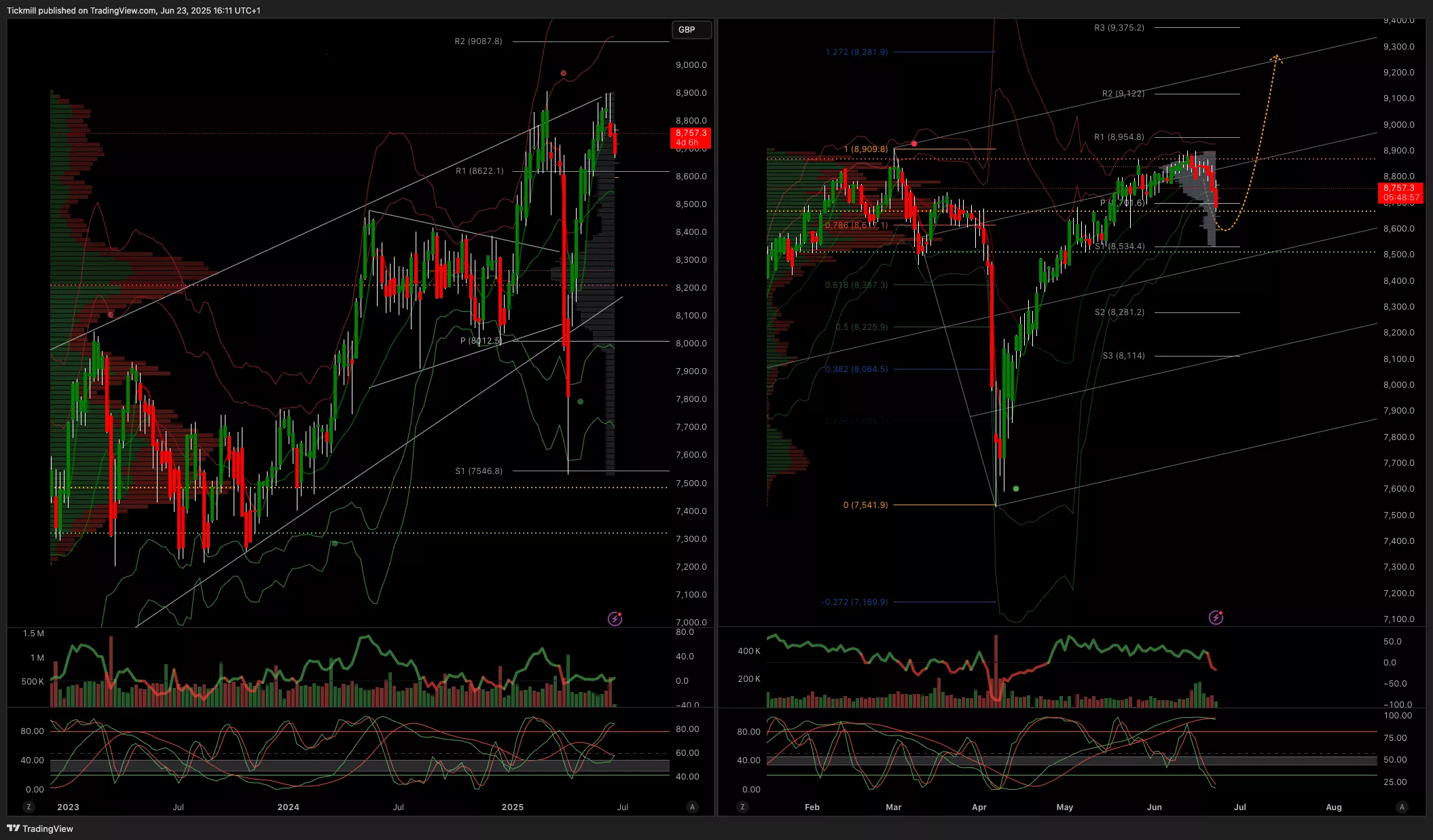

FTSE Bias: Bullish Above Bearish below 8700

- Primary support 8600

- Below 8500 opens 8400

- Primary objective 9200

- Daily VWAP Bearish

- Weekly VWAP Bearish

(Click on image to enlarge)

More By This Author:

S&P 500 Weekly Action Areas & Price Targets - Monday, June 23Daily Market Outlook - Monday, June 23

The FTSE Finish Line - Friday, June 20