Daily Market Outlook - Tuesday, June 24

Image Source: Unsplash

Brent Crude oil, which opened at $81.40 per barrel yesterday, has dropped below $70 per barrel, a level last seen on June 12 when Israel struck Iran. The decline follows President Trump’s announcement of a brokered ceasefire between Israel and Iran, though the durability of this peace remains uncertain. Other markets have adopted a predictable "risk-on" sentiment, with equity indices making solid gains. Both European and US stock index futures surged, and MSCI’s Asia Pacific share index was on track for its largest increase in over two months. Meanwhile, gold and the Dollar have joined oil as notable losers. While there is cautious optimism about reduced uncertainty for market participants, short-term volatility still warrants a prudent approach.

In Japan, the latest 20-year JGB auction showed weaker demand, with a cover ratio of 3.11x compared to the 12-month average of 3.31x. This comes despite recent news from Japan’s Ministry of Finance about plans to cut >20-year bond issuance by ¥3.2 trillion over the next nine months, favouring shorter-term bonds instead. The 20-year yield stands at 2.35%, near the lower end of June’s range and well below the May peak of 2.60%.

Ahead of today’s NATO conference, reports suggest the UK government will approve a target of 5% of GDP for defence spending by 2035, up from just over 2% currently. Critics, however, question whether this represents a meaningful reallocation of resources given the headline figures. In the U.S., the Fed’s Goolsbee echoed dovish remarks from Bowman, suggesting the Fed could cut rates if tariff-driven inflation fails to materialise.

Yesterday marked the release of the influential flash June S&P Global PMI business surveys. At first glance, the headline figures showed little difference between the UK and the euro area, with the UK Composite at 50.7 and the euro area at 50.2. However, a closer look at the subcomponents reveals notable divergences. Firstly, the employment index for the UK remains significantly weaker than the euro area, continuing the gap that emerged following October’s job-taxing Budget. This suggests that, based on PMI data, UK employment is likely to see continued quarterly declines for now. Secondly, there is a stark contrast in price indices. While the euro area’s composite input price index has fallen to 55.5, below its long-term average, the UK’s equivalent remains elevated at 63.7, well above its average. This contrast highlights the UK’s dual challenge of higher price pressures and weaker employment trends compared to the euro area. These findings, while not groundbreaking, underscore the Bank of England’s cautious and measured approach to interest rate decisions. Balancing the trade-off between slowing economic activity and persistently high inflation remains a key focus for policymakers.

As the tensions between Israel and Iran seem to be subsiding, investors are now turning their attention to Federal Reserve Chair Jerome Powell’s testimony before Congress this afternoon. This year, the Fed has refrained from altering interest rates due to the inflationary effects stemming from Trump's tariffs. However, some Fed officials are diverging from Powell’s hawkish stance, which has drawn criticism from Trump. Michelle Bowman of the Fed mentioned she would be open to a rate cut in July, while Governor Christopher Waller indicated he would also entertain a reduction next month. More Fed officials are set to speak later, including New York Fed President John Williams, who will deliver keynote remarks in New York, and Cleveland Fed President Beth Hammack, who is scheduled to discuss monetary policy in London. Likewise, European central bankers are active, with Bank of England Governor Andrew Bailey planning public appearances in London and several ECB officials making speeches.

Overnight Headlines

- German Ifo Business Morale Set To Climb Amid Mideast Tension

- Israel, Iran Agree To Ceasefire To End ‘12 Day War,’ Trump Says

- Trump Thanks Iran For ‘Very Weak’ Retaliation Against US Air Strikes

- Iran Positions Launchers For Potential Attack On US Forces, WSJ Reports

- Trump’s Iran Attack Spurs Concerns Of Retaliation In The US

- Air India Cancels Europe, US East Coast Flights On Iran Crisis

- Gold Falls As Haven Demand Ebbs After Trump Announces Ceasefire

- Oil Slides, Stocks Rise As Trump Announces Truce

- Dollar Slips In Broad Risk Rally After Trump Announces Ceasefire

- Fed Official Bowman Calls For Rate Cut As Soon As July

- Fed Chair Powell Testifies Before Congress This Week

- ECB’s Nagel: Bond-Buying Is Only For Exceptional Cases

- ECB’s Lagarde Urges EU Lawmakers To Speed Up Digital Euro Law

- EU Commissioner: EU Needs Rare Earths Reserves Against China Threat

- UK Defence Spending To Hit 5% Of GDP By 2035, Starmer To Tell NATO

FX Options Expiries For 10am New York Cut

(1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

- EUR/USD: 1.1490-00 (781M), 1.1530 (618M), 1.1545-50 (1.5BLN)

- 1.1575 (396M), 1.1600 (437M), 1.1670-80 (391M),

- USD/JPY: 145.00 (597M), 147.25 (251M), 147.50 (211M)

- 148.95-00 (439M)

- USD/CHF: 0.8100-05 (355M), 0.8150 (250M), 0.8210 (300M)

- EUR/CHF: 0.9505 (250M)

- GBP/USD: 1.3400 (280M), 1.3435 (281M), 1.3450 (341M)

- 1.3465-75 (850M), 1.3500 (256M)

- EUR/GBP: 0.8500 (291M), 0.8550 (281M)

- AUD/USD: 0.6400 (250M), 0.6450 (321M), 0.6550 (214M)

- USD/CAD: 1.3600 (418M), 1.3775 (724M), 1.3810 (260M)

CFTC Positions as of the Week Ending June 20th

- Speculators reduced their net short position in CBOT US Treasury bonds futures by 22,628 contracts, bringing the total to 79,745.

- They also trimmed their net short position in CBOT US Ultrabond Treasury futures by 24,696 contracts, now at 203,747.

- Conversely, speculators raised their net short position in CBOT US 10-year Treasury futures by 18,845 contracts to a total of 724,101.

- Increased activity also occurred in CBOT US 5-year Treasury futures, with a 74,384 contract increase in the net short position, reaching 2,470,920.

- The net short position for CBOT US 2-year Treasury futures rose by 36,591 contracts to 1,180,516.

- Equity fund managers upped their net long position in the S&P 500 CME by 10,532 contracts, now totaling 825,013.

- Equity fund speculators raised their net short position in the S&P 500 CME by 31,419 contracts, bringing it to 316,744.

- The net long position for the Japanese yen stands at 144,595 contracts, while the euro's net long position is 93,025 contracts.

- The British pound's net long position is at 51,634 contracts, and the Swiss franc has a net short position of -21,268 contracts.

- Bitcoin has a net short position of -2,009 contracts.

Technical & Trade Views

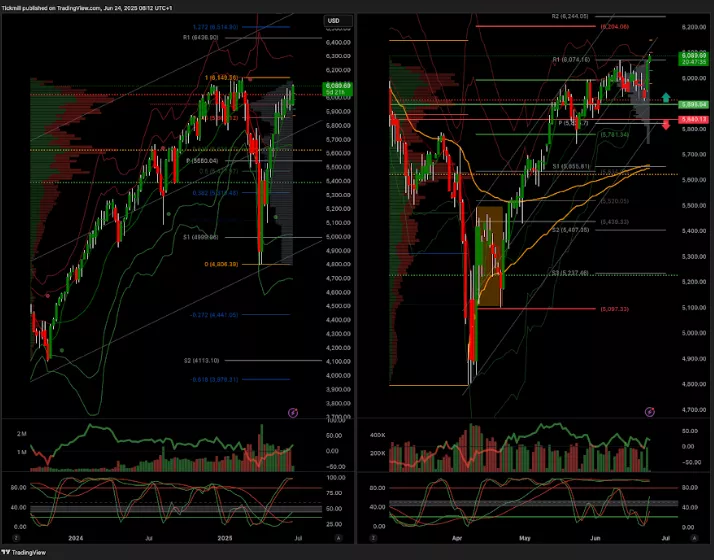

SP500 Pivot 5900

- Daily VWAP bullish

- Weekly VWAP bullish

- Above 5900 target 6100

- Below 5800 target 5700

(Click on image to enlarge)

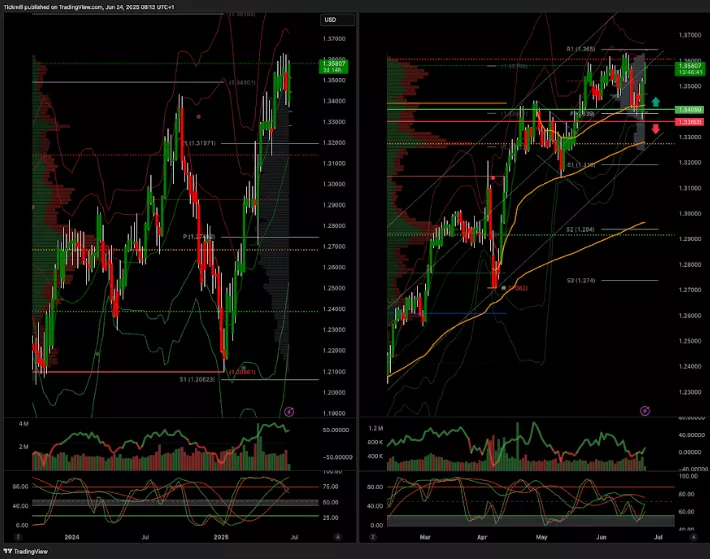

EURUSD Pivot 1.12

- Daily VWAP bullish

- Weekly VWAP bullish

- Above 1.11 target 1.19

- Below 1.11 target 1.0950

(Click on image to enlarge)

GBPUSD Pivot 1.34

- Daily VWAP bearish

- Weekly VWAP bearish

- Above 1.34 target 1.38

- Below 1.3350 target 1.32

(Click on image to enlarge)

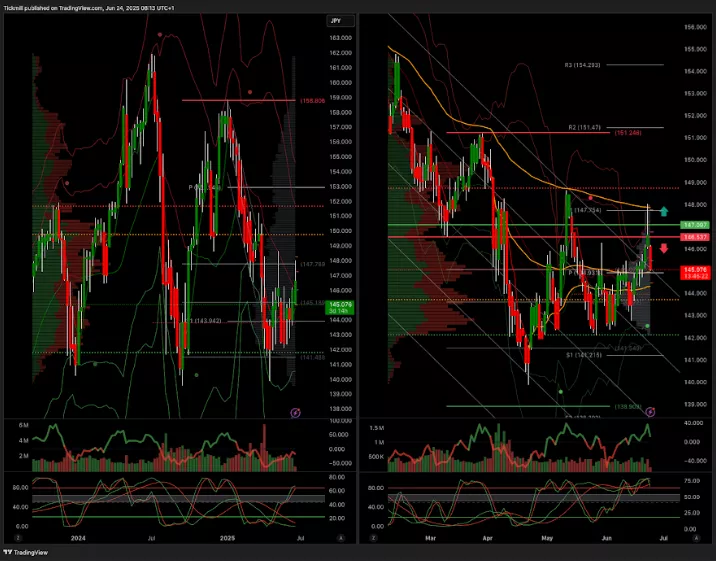

USDJPY Pivot 147

- Daily VWAP bearish

- Weekly VWAP bullish

- Above 147.10 target 148.26

- Below 146.53 target 139

(Click on image to enlarge)

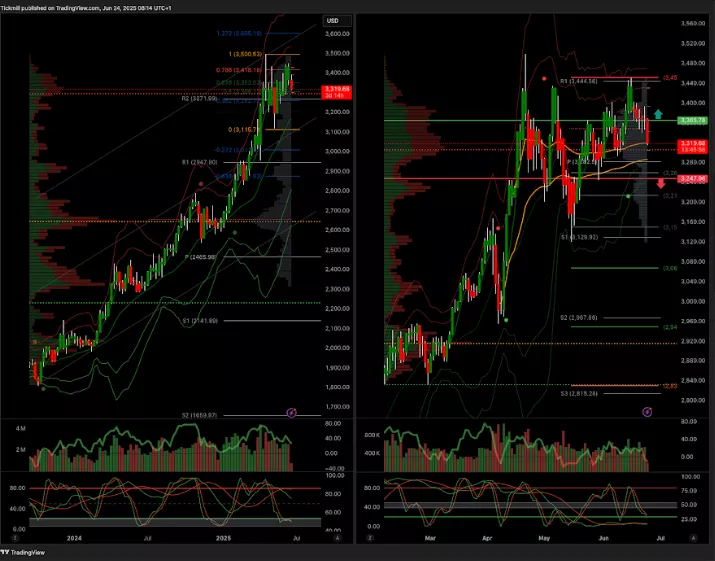

XAUUSD Pivot 3365

- Daily VWAP bearish

- Weekly VWAP bullish

- Above 3410 target 3600

- Below 3240 target 3000

(Click on image to enlarge)

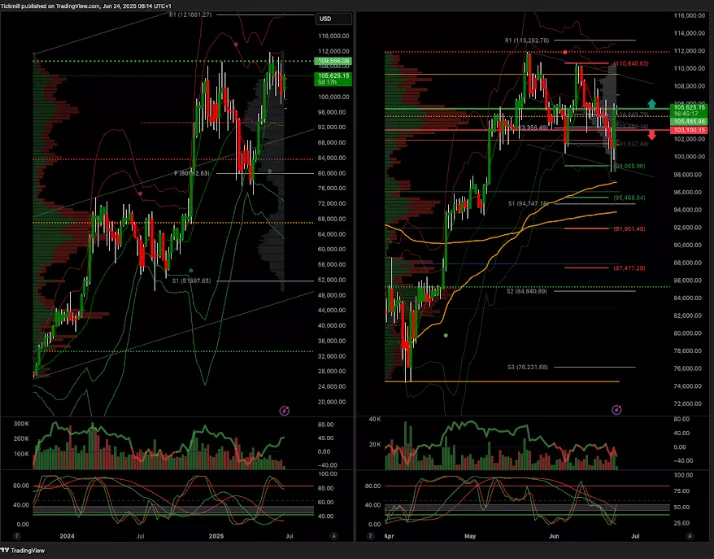

BTCUSD Pivot 105k

- Daily VWAP bullish

- Weekly VWAP bearish

- Above 105k target 118k

- Below 98.3K target 95.5k

(Click on image to enlarge)

More By This Author:

The FTSE Finish Line - Monday, June 23

S&P 500 Weekly Action Areas & Price Targets - Monday, June 23

Daily Market Outlook - Monday, June 23