Daily Market Outlook - Monday, June 23

Image Source: Pixabay

Early market reactions to the weekend news of US strikes on Iran have been more subdued than anticipated. The 10-year US Treasury yield, at 4.39%, has risen just 2 basis points, with all overnight price movements remaining within Friday’s range. While oil prices initially surged—Brent Crude opened at $81.40 per barrel compared to Friday’s close of $77.42—they have since retreated to approximately $78 per barrel. In the foreign exchange market, the Dollar Index is about 0.3% stronger but remains below levels seen last Thursday. Asian equity indices are broadly in negative territory, though declines are modest, and S&P futures are down by only around 0.2%. The uncertain nature and timing of Iran’s response could significantly alter market dynamics throughout the day and into the week. Energy markets, in particular, may react sharply if access to the Strait of Hormuz—a critical oil shipping route—is disrupted. Additionally, evolving perceptions of whether the conflict could escalate to involve regime change in Iran could weigh on broader risk sentiment. Sector-specific impacts are also worth noting. For instance, reports suggest significant disruptions and rerouting for airlines, which are also grappling with higher energy costs. Meanwhile, expectations regarding the scope of the conflict may further influence valuations of defence companies.

The Federal Reserve appeared less concerned about the balance of risks during the June FOMC meeting, encouraged by the relative stability of real economic data despite weaker survey results. While there remained an expectation that tariffs would lead to higher prices, the anticipated impact was scaled back, suggesting a milder effect. Chairman Powell noted that the economy had shown a surprising resilience to shocks in recent years. Early June Federal Reserve surveys provided some optimism in this regard. Although activity data from the Empire State and Philadelphia Fed surveys weakened compared to May, the average of price indices showed a slowdown in both prices paid and received, extending to expectations for higher prices in six months. While prices paid remain elevated, the received measures have returned to January levels. This may reflect an optimistic recalibration by respondents, influenced by announced tariff rollbacks and discussions of potential trade deals, offering hope that the impact will be manageable and second-round risks mitigated. Notably, there was also a significant rebound in employment intentions, signalling genuine relief among firms.

The macro slate for the week ahead features a bevy of central bank speakers and a packed schedule of global data, primarily featuring the flash June PMIs. In the U.S., there are at least six Federal Reserve speakers, with Chair Jerome Powell providing Congressional testimony to give clarity on the economic outlook post the June 18 policy meeting. U.S. data to be released includes Friday's core PCE price index, the Fed's favoured inflation measure, along with flash S&P June PMIs, consumer confidence, existing and new home sales, final Q1 GDP, trade figures, weekly jobless claims, durable goods, and personal income and consumption. China will report on industrial profits, and the 14th National People's Congress Standing Committee will convene for its 16th session from June 24 to 27. Japan's Bank of Japan will share a summary of opinions from last week's policy meeting, and BOJ board member Tamura Naoki is scheduled to speak on Wednesday. Additionally, flash PMIs, Tokyo’s June CPI, unemployment data, and retail sales will be released. In Europe, PMIs will be reported, followed by the German Ifo business climate, amid a generally quiet data schedule for the euro zone. European Central Bank President Christine Lagarde will address the European Parliament on Monday. In the UK, data will be limited to manufacturing and services PMI on Monday, although there will be eight Bank of England speakers throughout the week, including Governor Andrew Bailey’s testimony in parliament on Wednesday, to provide insights following last week's rate decision. Australia’s May consumer prices, due on Wednesday, will be crucial for shaping expectations regarding the Reserve Bank of Australia's rates. New Zealand will issue trade data and a consumer confidence survey, while Canada will release its May CPI and April GDP.

Overnight Headlines

- Trump Touts Iran Bombing, Warns More Strikes Could Come

- US Officials Assess Strikes On Iran’s Nuclear Sites

- IAEA Confirms Entrances To Isfahan Site Hit By US Strike

- Investors Flee To Safety Ahead Of Iran’s Response

- UK Confirms No Involvement In Iran Strike, Given Advance Notice

- Iran Hints At Closing Strait Of Hormuz, Signals Wider Retaliation

- US Says Iran Nuclear Sites Suffered ‘Severe Damage’

- Oil Soars As Trump’s Attack On Iran Boosts Supply Risks

- Bitcoin Falls Below $99K As Iran Strikes Trigger Crypto Selloff

- Fed’s Daly: Inflation, Employment Risks Balanced

- Euro Zone Needs More ECB Stimulus, Centeno Says

- UK To Scrap Green Levies For Heavy Industry

- Spain Secures NATO Opt-Out On 5% Defence Spending

- Trump Seeks Indo-Pacific Allies’ Support At NATO Summit

- UK Govt To Invest More Than £500M In Quantum Computing

- Japan PMI Pickup Points To Front-Loading Ahead Of US Tariff Jump

FX Options Expiries For 10am New York Cut

(1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

- EUR/USD: 1.1275 (410M), 1.1300 (335M), 1.1315 (291M)

- 1.1340 (941M), 1.1375-80 (342M), 1.1390-00 (1.27BLN)

- 1.1425-30 ( 311M), 1.1440-50 (1.13BLN), 1.1460-80 (1.35BLN)

- 1.1490-00 (2.3BLN), 1.1545-50 (1.9BLN), 1.1600 (1.13BLN)

- USD/JPY: 145.00 (502M), 145.50 (344M), 146.50 (200M)

- 147.00 (250M), 147.45-50 (361M). EUR/JPY: 167.00 (540M

- USD/CHF: 0.8185 (374M). EUR/CHF: 0.9650 (401M)

- GBP/USD: 1.3430 (225M)

- AUD/USD: 0.6415-35 (539M), 0.6500-10 (919M)

- NZD/USD: 0.5830 (301M), 0.5940 (300M), 0.6035 (213M)

- USD/CAD: 1.3700 (327M), 1.3845-50 (363M)

CFTC Positions as of the Week Ending June 20th

- Speculators reduced their net short position in CBOT US Treasury bonds futures by 22,628 contracts, bringing the total to 79,745.

- They also trimmed their net short position in CBOT US Ultrabond Treasury futures by 24,696 contracts, now at 203,747.

- Conversely, speculators raised their net short position in CBOT US 10-year Treasury futures by 18,845 contracts to a total of 724,101.

- Increased activity also occurred in CBOT US 5-year Treasury futures, with a 74,384 contract increase in the net short position, reaching 2,470,920.

- The net short position for CBOT US 2-year Treasury futures rose by 36,591 contracts to 1,180,516.

- Equity fund managers upped their net long position in the S&P 500 CME by 10,532 contracts, now totaling 825,013.

- Equity fund speculators raised their net short position in the S&P 500 CME by 31,419 contracts, bringing it to 316,744.

- The net long position for the Japanese yen stands at 144,595 contracts, while the euro's net long position is 93,025 contracts.

- The British pound's net long position is at 51,634 contracts, and the Swiss franc has a net short position of -21,268 contracts.

- Bitcoin has a net short position of -2,009 contracts.

Technical & Trade Views

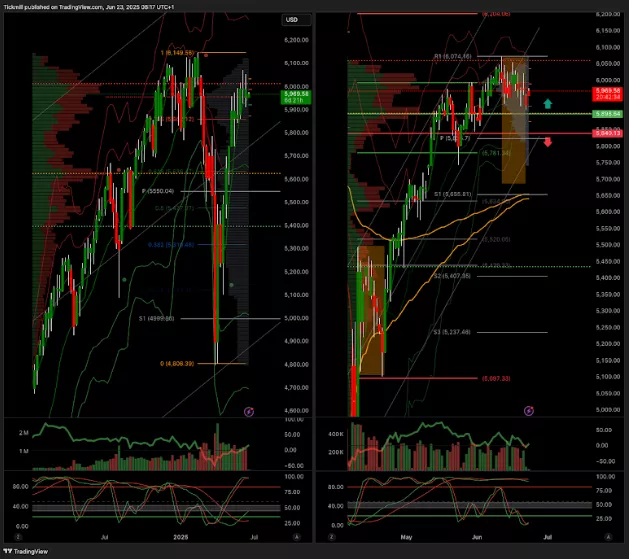

SP500 Pivot 5900

- Daily VWAP bearish

- Weekly VWAP bullish

- Above 5900 target 6100

- Below 5800 target 5700

(Click on image to enlarge)

EURUSD Pivot 1.12

- Daily VWAP bullish

- Weekly VWAP bullish

- Above 1.11 target 1.19

- Below 1.11 target 1.0950

(Click on image to enlarge)

GBPUSD Pivot 1.34

- Daily VWAP bearish

- Weekly VWAP bearish

- Above 1.34 target 1.38

- Below 1.3350 target 1.32

(Click on image to enlarge)

USDJPY Pivot 147

- Daily VWAP bullish

- Weekly VWAP bullish

- Above 147.10 target 148.26

- Below 146.53 target 139

(Click on image to enlarge)

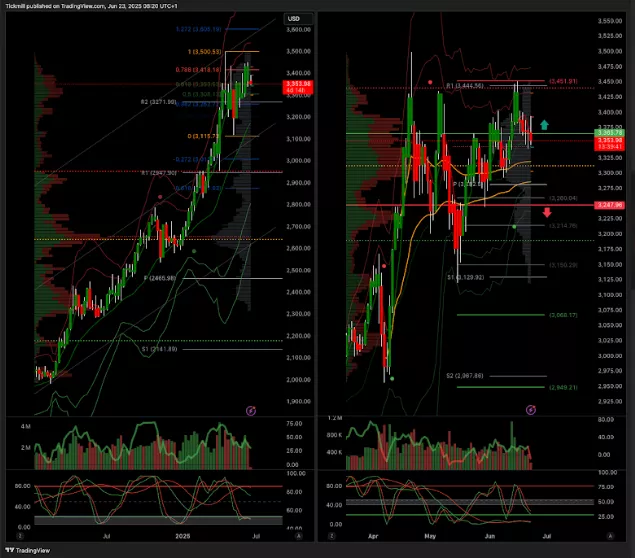

XAUUSD Pivot 3365

- Daily VWAP bearish

- Weekly VWAP bullish

- Above 3410 target 3600

- Below 3240 target 3000

(Click on image to enlarge)

BTCUSD Pivot 105k

- Daily VWAP bearish

- Weekly VWAP bearish

- Above 105k target 118k

- Below 98.3K target 95.5k

(Click on image to enlarge)

More By This Author:

The FTSE Finish Line - Friday, June 20

Daily Market Outlook - Friday, June 20

The FTSE Finish Line - Thursday, June 19