Daily Market Outlook - Wednesday, Jan. 21

Japanese bonds rebounded strongly following a sharp selloff that had reverberated across global debt markets, while US equity-index futures edged higher, signalling that market turbulence may be stabilising. The yield on Japan's 40-year bonds fell 22 basis points to 3.99% after Finance Minister Katayama called for calm, following a selloff that had driven long-term yields to unprecedented levels. US Treasuries posted modest gains, and S&P 500 futures rose 0.3%, hinting at some recovery after the index experienced its steepest drop since October. Meanwhile, global stock markets remained under pressure. Asian equities declined 0.7%, and European stock futures suggested a flat opening. Safe-haven assets continued to attract investors, with gold and platinum reaching new highs, while silver neared its historical peak. Investor sentiment was further rattled by former President Trump’s announcement of tariffs on European nations that rejected his proposal to purchase Greenland. This sparked a reevaluation of risks, following an AI-driven rally that had pushed global equities to record highs. The selloff in Japanese bonds exacerbated concerns, intensifying uncertainties surrounding US trade policies and economic outlook. The turmoil in Japan’s bond market during the Asian trading session spilt over into European and US markets, leading to declines and rising bond yields. Adding to the unease were reports of a Danish pension fund contemplating withdrawing from the US Treasury market, amplifying market volatility. The market's reaction evoked memories of the notorious "Sell America" trend, leaving investors speculating whether Trump might revisit his previous "TACO" strategy, reminiscent of his tariff moves last April. Trump's rhetoric indicates unwavering determination regarding Greenland, but market participants remain hopeful this could be a calculated bluff aligned with his "Art of the Deal" methodology. Many are looking to his highly anticipated Davos speech later today, hoping for a possible softening in his stance.

UK inflation concluded 2025 at 3.4% year-on-year, according to the ONS this morning. This figure is 0.1 percentage points (ppt) higher than market expectations but 0.1ppt below the Bank of England's (BoE) November Monetary Policy Report (MPR) forecast. Adding to the mixed signals, while the headline inflation exceeded consensus, core inflation and services CPI rates came in 0.1ppt lower than expected, at 3.2% y/y and 4.5% y/y respectively. For services inflation, this also marked a 0.1ppt downside surprise compared to the BoE’s projections. VBFood price inflation edged up slightly to 4.5% y/y from 4.2% y/y previously but remains significantly below the BoE's November MPR forecast of 5.3% y/y. The modest month-to-month changes in annual rates appear to be driven largely by one-off factors. For example, the alcohol and tobacco category contributed the most to the 0.1ppt increase in the headline rate, mainly due to delayed duty changes implemented in December rather than November, following the late Budget. Similarly, airfares within the transport category added upward pressure, although unusual base effects related to Christmas timing suggest this contribution should be partially discounted. As with the labour market report released yesterday, there are no major policy-shifting developments. However, the steady accumulation of incremental evidence—such as inflation consistently undershooting BoE expectations—supports the continuation of the rate-cutting cycle, even though inflation remains above target levels.

EURUSD’s performance at the start of the year was underwhelming, largely due to position adjustments following the pair's upward movement in December. Based on CFTC data, which serves as a proxy for overall market trends, the decline began with new short positions emerging in early January. This was followed by a long liquidation as the market tested and subsequently dropped below the 1.1656 level. As illustrated in the chart, the flow was both significant and sustained last week, primarily driven by leveraged and hedge fund accounts. While this activity has brought the market to a more balanced state, it also left it vulnerable to the Greenland tariff threats announced by President Trump over the weekend. The sharp rise in EURUSD on Tuesday, which pushed it back to this year’s highs, reflects this vulnerability. At the same time, it suggests there is likely to be ongoing interest in increasing short USD exposure, as market participants aim to either clear or re-establish their positions after recent adjustments. Further dollar weakness aligns with the political landscape for the year, as President Trump seeks to close the Republican polling gap ahead of the midterm elections on November 3. This dynamic is fostering more activist policymaking, which could continue to influence market movements.

Overnight Headlines

- Democratic Senators Demand Fed Records As Powell Probe Widens

- Treasury Secretary Bessent Increases Pressure On Fed’s Powell

- Trump Suggests New ‘Board Of Peace’ To Replace UN

- EU Moves Closer To Deploying Trade Bazooka On US Over Greenland

- ECB’s Lagarde: Uncertainty Back Amid Trump’s Latest Threats

- US Bank Stocks Fall Ahead Of Credit Card Rate Cap Deadline

- Trump Signs Executive Order Restricting Firms From Buying US Homes

- Nvidia’s Huang Plans China Visit As He Seeks Market Reopening

- BoJ Likely To Pause As It Assesses Impact Of December Rate Hike

- Japan’s Second-Largest Bank Plans Large-Scale JGB Purchases

- JGB Turmoil Could Trigger $130B US Treasury Selling, Citi Says

- Vanguard Sold Out Of JGBs Ahead Of Massive Selloff

- HSBC Flags High Yen Risk Premium With No Easy Fix

- China Vanke Wins Approval To Extend Yuan Bond Amid Debt Strain

- US Captures Seventh Sanctioned Tanker With Venezuela Links

FX Options Expiries For 10am New York Cut

(1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

- EUR/USD: 1.1670-75 (783M), 1.1690-95 (1.7BLN), 1.1700-05 (410M)

- 1.1730 (440M), 1.1800 (370M)

- USD/CHF: 0.7925 (956M), 0.7980 (350M)

- GBP/USD: 1.3480-95 (244M). USD/CAD: 1.3825 (200M)

- AUD/USD: 0.6735 (352M), 0.6750 (242M), 0.6800 (395M)

- USD/JPY: 156.95-157.10 (2BLN), 158.00 (1.3BLN), 158.50 (1.5BLN)

- 159.50 (561M)

CFTC Positions as of January 16th:

- Speculators have reduced their net short positions in CBOT US Treasury futures as follows: 5-year Treasury futures by 43,633 contracts to 2,269,120, 10-year Treasury futures by 45,047 contracts to 870,505, 2-year Treasury futures by 41,774 contracts to 1,304,880, and UltraBond Treasury futures by 10,650 contracts to 235,097. Additionally, speculators have shifted to a net long position of 13,835 contracts in CBOT US Treasury bonds futures, compared to 6,832 net shorts the previous week.

- Bitcoin net long position stands at 69 contracts. The Swiss franc shows a net short position of -43,392 contracts, the British pound at -25,270 contracts, the euro with a net long position of 132,656 contracts, and the Japanese yen at -45,164 contracts.

Technical & Trade Views

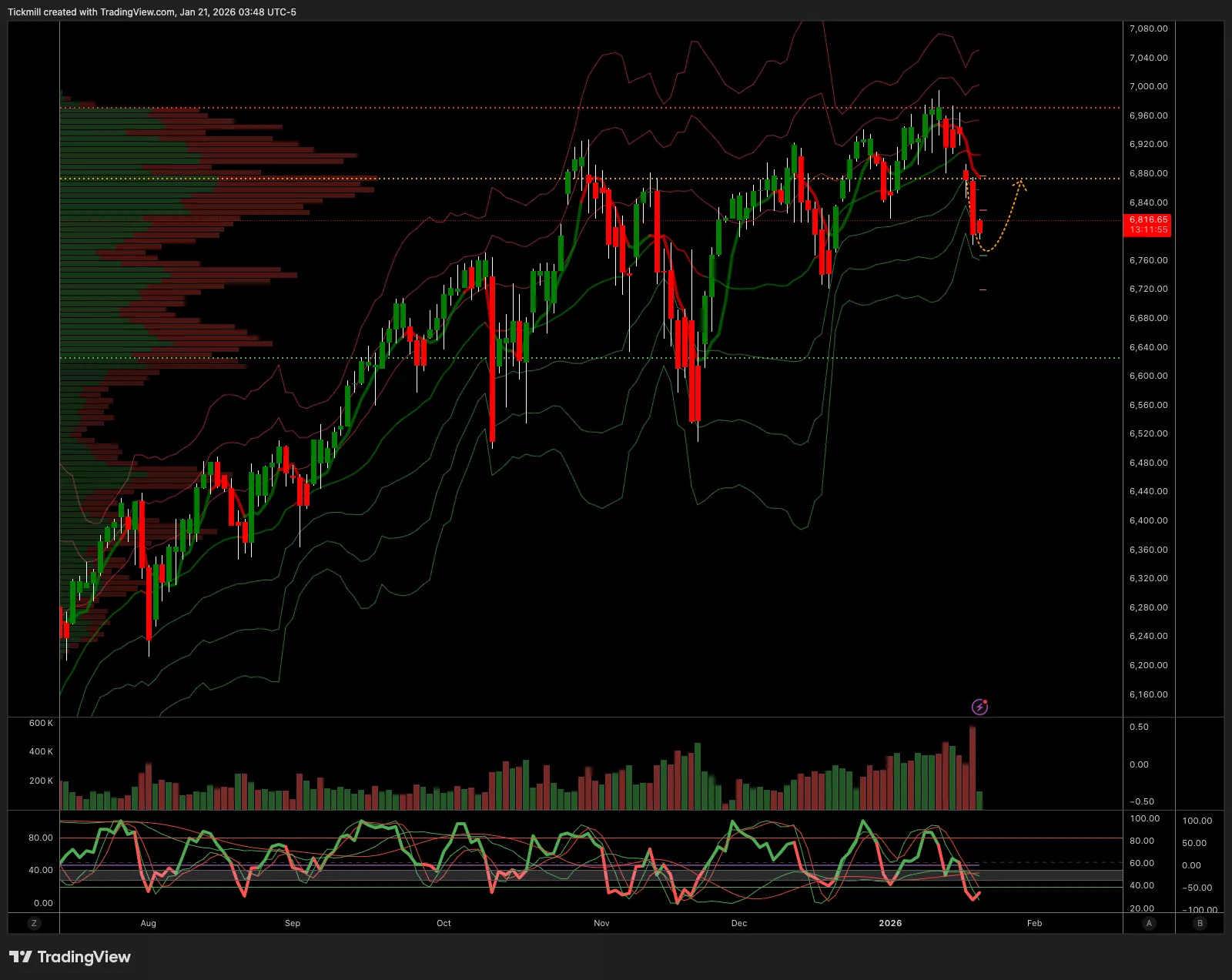

SP500

- Daily VWAP Bearish

- Weekly VWAP Bullish

- Above 6830 Target 6875

- Below 6780 Target 6739

EURUSD

- Daily VWAP Bullish

- Weekly VWAP Bearish

- Above 1.1690 Target 1.1780

- Below 1.1650 Target 1.1590

GBPUSD

- Daily VWAP Bullish

- Weekly VWAP Bearish

- Above 1.35 Target 1.36

- Below 1.3390 Target 1.3290

USDJPY

- Daily VWAP Bearish

- Weekly VWAP Bullish

- Above 157.40 Target 160

- Below 157 Target 155

XAUUSD

- Daily VWAP Bullish

- Weekly VWAP Bullish

- Above 4690 Target 5000

- Below 4645 Target 4550

BTCUSD

- Daily VWAP Bearish

- Weekly VWAP Bullish

- Above 91k Target 94k

- Below 90.5k Target 85k

More By This Author:

The FTSE 100 Finish Line - Tuesday, Jan. 20

Daily Market Outlook - Tuesday, Jan. 20

The FTSE Finish Line - Monday, Jan. 19