Daily Market Outlook - Tuesday, Jan. 20

Image source: Pixabay

Global markets faced further turbulence as Treasuries joined a widespread bond sell-off and equities took a hit, spurred by renewed trade tensions following President Donald Trump’s unexpected tariff threats on Greenland. The fragile market sentiment, recently bolstered by enthusiasm for artificial intelligence investments, was put to the test. Treasuries suffered significant losses as trading resumed after the U.S. holiday on Monday. Concerns mounted over the Trump administration’s confrontational stance toward global counterparts, which could potentially dampen appetite for U.S. assets. Longer-term bonds bore the brunt of the decline, with the 30-year yield climbing four basis points to 4.88%. Meanwhile, the U.S. dollar index dropped to its lowest level in two weeks. Futures pointed to a rough start for U.S. markets when Wall Street reopened, while European stocks were expected to extend their losses after suffering their steepest drop since mid-November. In Asia, shares dipped 0.4%, marking the sharpest decline in nearly a week. As investor confidence wavered, a rush toward safe-haven assets drove gold and silver prices to unprecedented highs. On Tuesday, Chinese stocks took a dip as regulators cracked down on speculative activity and unusual trading behaviours. Meanwhile, Hong Kong's markets followed suit, edging lower amid broader regional market softness. In Japan, attention turned to the 40-year government bond yield, which surged to 4%—its highest level since the bond’s introduction in 2007. Additionally, demand for a 20-year bond issuance fell short of the past year’s average, signalling waning interest. Bond markets in Australia and New Zealand followed suit with sharp declines, while German Bund futures also slid.

Domestically, The ONS labour market report showed the UK unemployment rate steady at 5.1% for the three months to November, with a potential rise due to a 5.3% single-month figure. December saw a 43k drop in HMRC payroll employment, contrasting with an 82k 3m/3m gain in November's Labour Force Survey, which faces methodology concerns. Private sector regular pay grew 3.6% 3m/y in November, aligning with BoE’s Q4 forecast of 3.5%. Public sector pay growth (7.9% 3m/y) outpaced private sector growth (3.6% 3m/y), highlighting fragile private sector conditions. The Bank of England is expected to reduce rates in the coming months. December inflation data is anticipated to show a 3.3% annual CPI rate, slightly below the BoE’s November forecast. Food price inflation remains lower than expected, driven by isolated items like chocolate, with potential for further disinflation. An ONS webinar on 29 January will detail the implementation of scanner data for groceries, expected to slightly lower annual CPI rates by 0.1ppt starting March. CPI is projected to return to the 2% target by Q2.

Overnight Headlines

- ZEW German Investor Morale Expected To Rise Again In January

- EU Retaliatory Tariffs On US Goods Could Kick In Feb. 7, Officials Warn

- China Keeps Benchmark LPR On Hold Despite Slowing Growth

- Citi Sees Risk Of Three BoJ Rate Hikes In 2026 If Yen Weakness Persists

- BoJ Seen Holding Rates Near Term; 40Y Bond Yield Hits 4%

- Japan’s PM Backs Food Tax Cut Ahead Of Election As JGB Yields Spike

- Treasuries Join Global Bond Selloff As Tariff Fears Grip Markets

- Google’s Gemini Developer Requests Double In 5 Months

- UK Lawmakers Push For AI Stress Tests In Financial Sector

- BHP Iron Ore Output Climbs; Potash Costs Rise Again

- Chinese Visitors To Japan Plunge 45% In Dec Amid Diplomatic Tensions

- BTC Steadies As Markets Brace For Trade War Rhetoric From Davos

- Oil Holds Range As Greenland Tensions And Surplus Concerns Linger

FX Options Expiries For 10am New York Cut

(1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

- EUR/USD: 1.1600-15 (1.4BLN), 1.1650 (1.2BLN), 1.1710-15 (1.6BLN)

- 1.1720-25 (1BLN), 1.1745-50 (1.3BLN)

- USD/CHF: 0.7835 (606M), 0.7950 (191M), 0.8010 (200M)

- GBP/USD: 1.3390 (330M), 1.3405 (201M), 1.3420 (358M), 1.3485 (385M)

- AUD/USD: 0.6700 (1BLN), 0.6710 (211M), 0.6745-55 (356M)

- NZD/USD: 0.5770 (318M). USD/CAD: 1.3825 (468M)

- USD/JPY: 157.50-60 (534M), 158.00 (670M), 158.65-75 (480M)

- 159.00 (758M), 160.00 (1BLN)

CFTC Positions as of January 16th:

- Speculators have reduced their net short positions in CBOT US Treasury futures as follows: 5-year Treasury futures by 43,633 contracts to 2,269,120, 10-year Treasury futures by 45,047 contracts to 870,505, 2-year Treasury futures by 41,774 contracts to 1,304,880, and UltraBond Treasury futures by 10,650 contracts to 235,097. Additionally, speculators have shifted to a net long position of 13,835 contracts in CBOT US Treasury bonds futures, compared to 6,832 net shorts the previous week.

- Bitcoin net long position stands at 69 contracts. The Swiss franc shows a net short position of -43,392 contracts, the British pound at -25,270 contracts, the euro with a net long position of 132,656 contracts, and the Japanese yen at -45,164 contracts.

Technical & Trade Views

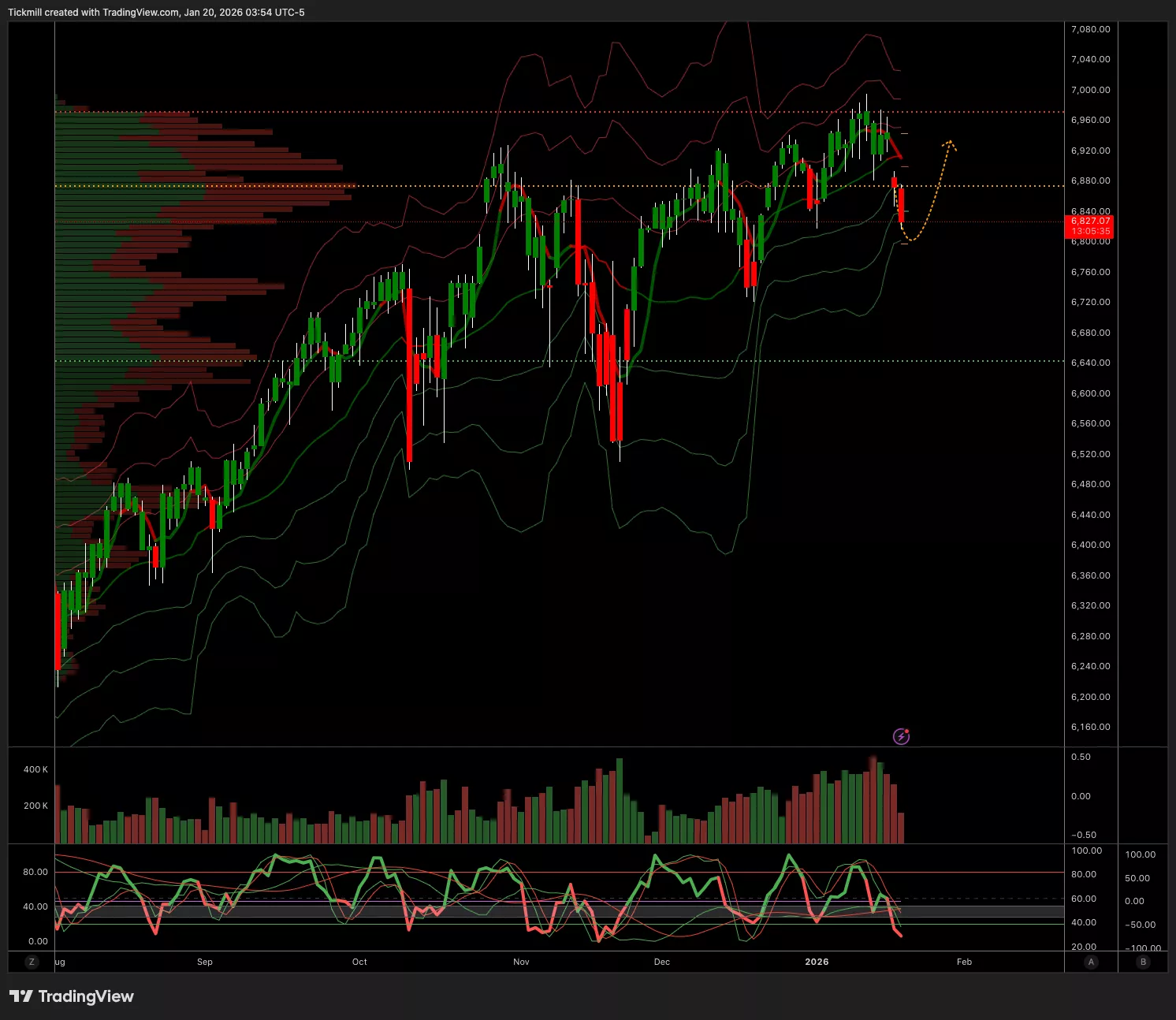

SP500

- Daily VWAP Bearish

- Weekly VWAP Bullish

- Above 6875 Target 6940

- Below 6840 Target 6800

EURUSD

- Daily VWAP Bullish

- Weekly VWAP Bearish

- Above 1.1690 Target 1.1780

- Below 1.1650 Target 1.1590

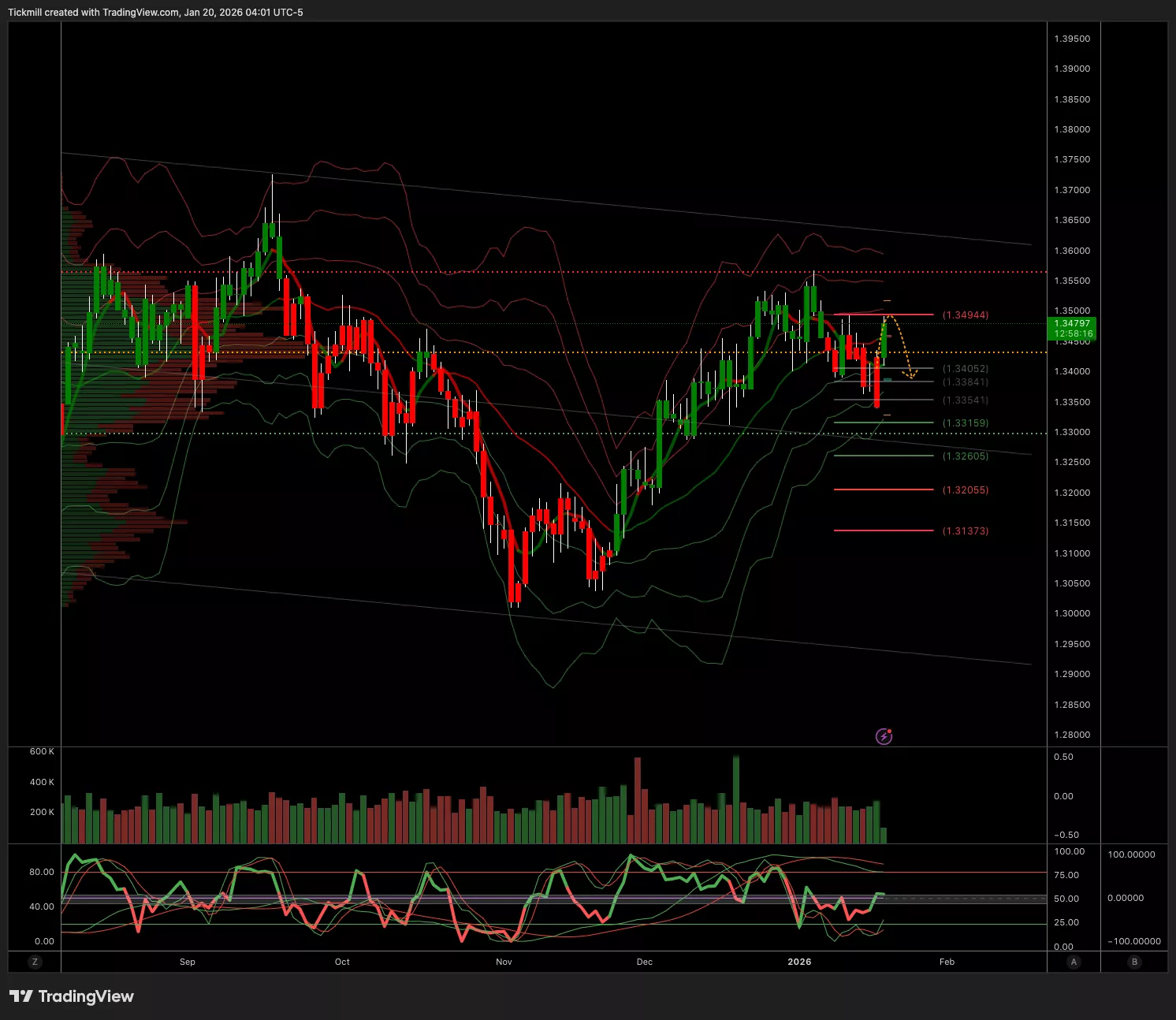

GBPUSD

- Daily VWAP Bullish

- Weekly VWAP Bearish

- Above 1.35 Target 1.36

- Below 1.3390 Target 1.3290

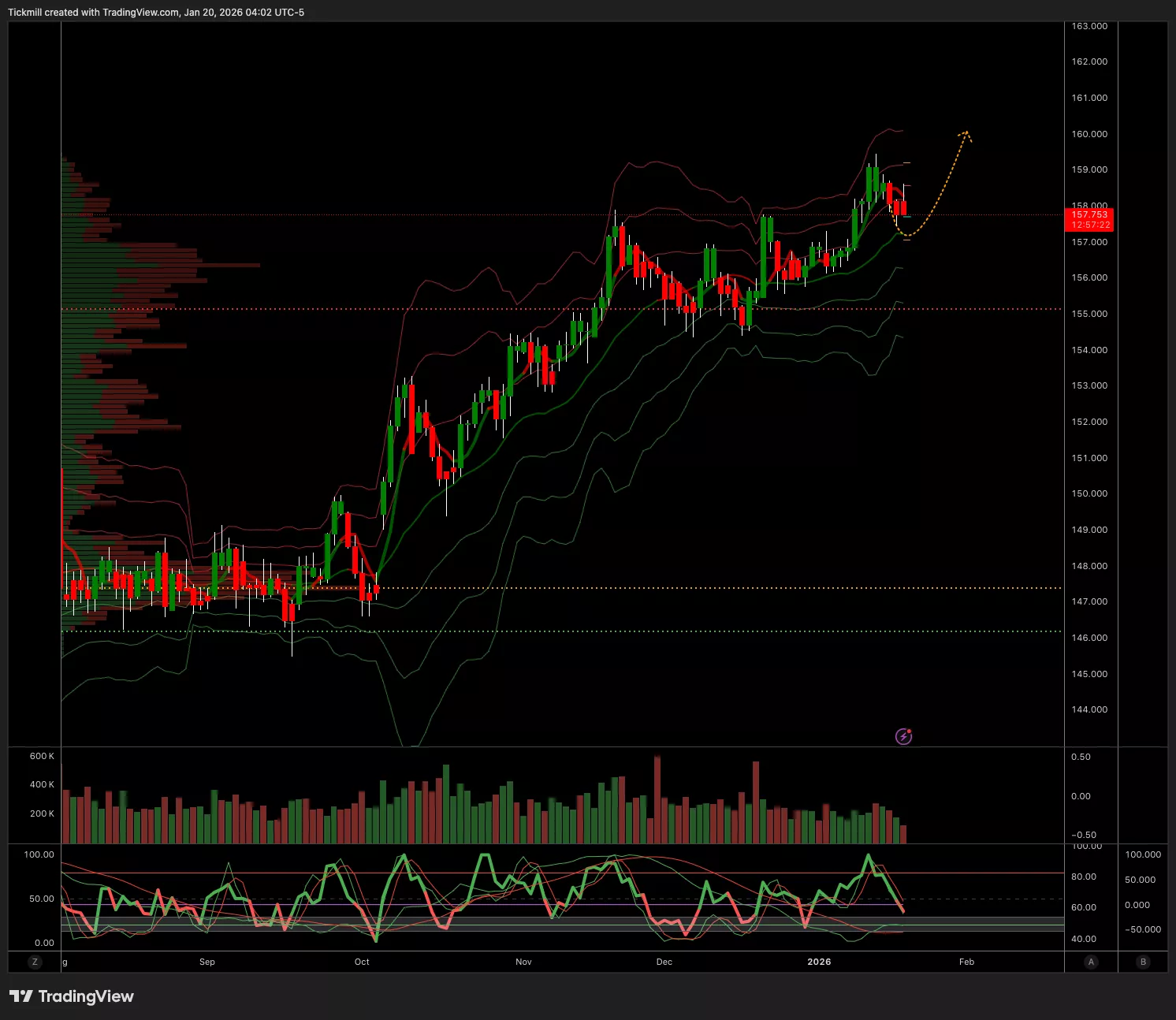

USDJPY

- Daily VWAP Bearish

- Weekly VWAP Bullish

- Above 157.40 Target 160

- Below 157 Target 155

XAUUSD

- Daily VWAP Bullish

- Weekly VWAP Bullish

- Above 4650 Target 4800

- Below 4600 Target 4550

BTCUSD

- Daily VWAP Bearish

- Weekly VWAP Bullish

- Above 98.5k Target 101k

- Below 95k Target 87.7k

More By This Author:

The FTSE Finish Line - Monday, Jan. 19

Emini S&P 500 Weekly Live Market & Trade Analysis - Monday, Jan. 19

Daily Market Outlook - Monday, Jan. 19