The FTSE 100 Finish Line - Tuesday, Jan. 20

Photo by Joshua Mayo on Unsplash

UK stocks faced significant pressure on Tuesday, driven by a wave of global risk aversion following President Trump's announcement of potential tariffs on European nations unless the U.S. is allowed to purchase Greenland. The FTSE 100, representing leading blue-chip companies, fell 1.1% before staging a modest recovery later in the session. Meanwhile, the domestically focused mid-cap index declined by 1%, with both indexes heading for their steepest single-day drops since mid-November. President Trump escalated tensions by threatening an additional 10% tariff on imports from countries such as Denmark, Norway, Sweden, and the United Kingdom, effective February 1. The unconventional move has tied the tariffs to the U.S. receiving permission to purchase Greenland, causing uncertainty across global financial markets. Investors are now closely monitoring Trump’s next steps, as he appears unwavering in his stance, declaring there is "no turning back" on the Greenland proposal. Adding to the market's unease, new data highlighted signs of weakness in the UK labour market ahead of the government’s anticipated November budget announcement. Slowing wage growth may, however, provide some relief to the Bank of England regarding inflationary pressures.

In London trading, pharmaceutical stocks struggled, falling 2.1%, with AstraZeneca sliding 2.6%. The Anglo-Swedish pharmaceutical giant announced plans to delist its American Depositary Shares and debt securities from Nasdaq, which weighed on its shares. Building materials supplier Ibstock saw its stock plummet 3.9% after issuing a cautious forecast, citing continued sluggishness in the residential construction sector. This made Ibstock the biggest loser on the FTSE 250. Conversely, precious metals miners enjoyed gains, climbing 1.2%. Gold surged to a record high above $4,700 an ounce, while silver hovered near its peak, as investors sought safe-haven assets amid heightened tariff threats. Informa, an events organizer, led the FTSE 100 with a 2.6% rise after announcing a £200 million ($269.6 million) share buyback programme and projecting 6% underlying revenue growth by 2026. The media sector also saw a 0.9% uptick.

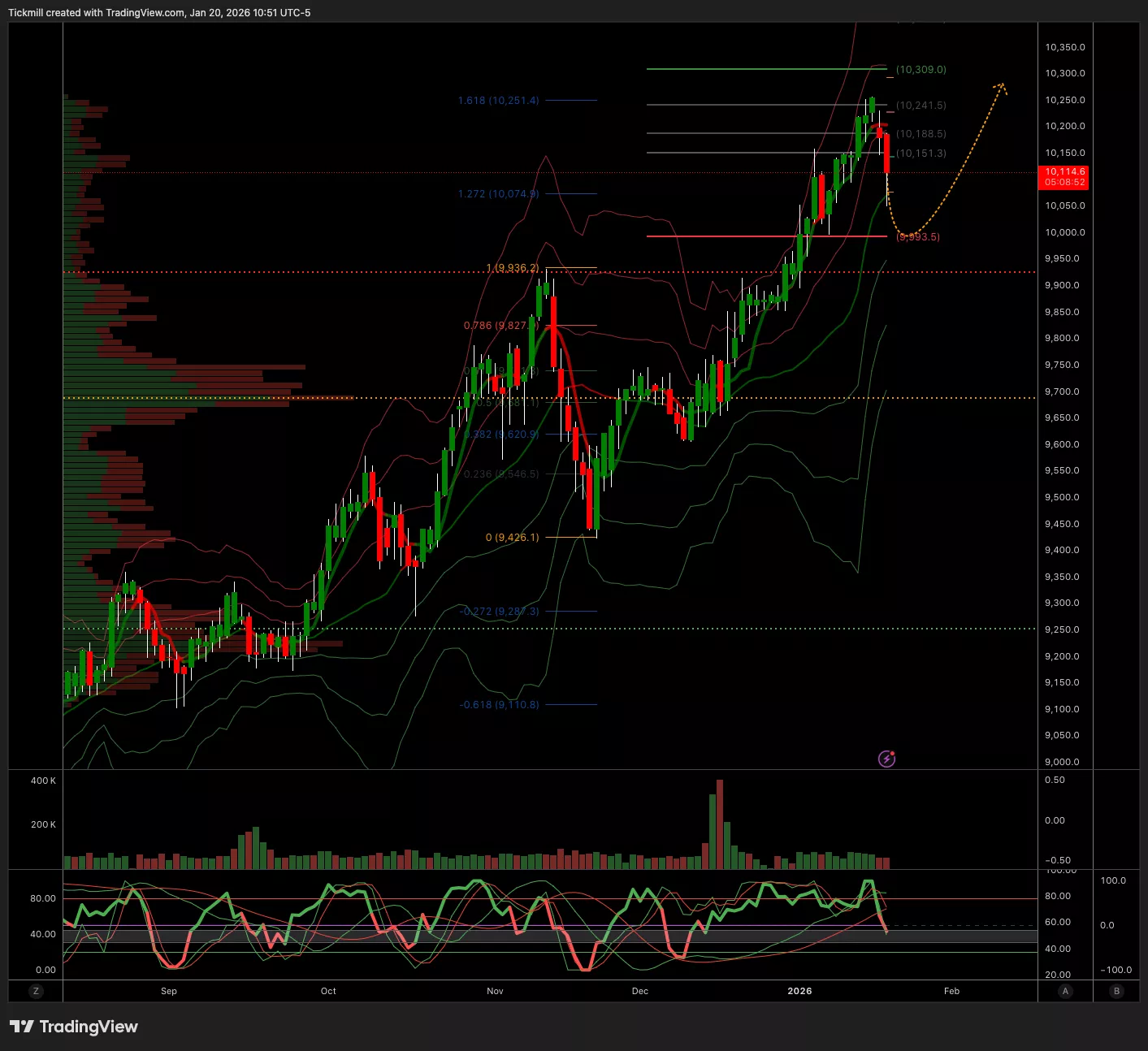

TECHNICAL & TRADE VIEW - FTSE100

- Daily VWAP Bearish

- Weekly VWAP Bullish

- Above 10150 Target 10300

- Below 10070 Target 9950

More By This Author:

Daily Market Outlook - Tuesday, Jan. 20

The FTSE Finish Line - Monday, Jan. 19

Emini S&P 500 Weekly Live Market & Trade Analysis - Monday, Jan. 19