Daily Market Outlook - Wednesday, Feb. 26

Image Source: Pixabay

Stocks, Treasury bonds, and other assets steadied as investors looked to move beyond disappointing U.S. economic data that had rattled financial markets on Tuesday. Futures for U.S. and European stock indices pointed to potential gains, while yields on 10-year Treasuries rebounded during Asian trading. Meanwhile, gold, Bitcoin, and oil traded within tight ranges following overnight declines. Hong Kong equities surged, extending a rally that began last month, driven by optimism that China’s technological advancements could revitalize its sluggish economy. Global investors, previously optimistic about a sustained recovery in Chinese stocks, were unsettled by Trump’s push to further reduce economic ties with China. This year, Chinese equities have gained momentum, bolstered by enthusiasm around advancements in DeepSeek artificial intelligence and President Xi Jinping’s recent meeting with business leaders, which many view as a potential end to the government’s crackdown on the private sector.

On Tuesday, a weak U.S. consumer confidence report spurred concerns over the economic outlook, prompting investors to shift toward safer assets.The economic impact of policy shifts since Trump’s inauguration is emerging in key indicators. Uncertainty has risen, disrupting confidence. The Conference Board’s consumer confidence survey saw its expectations index drop over 20 points since November. More unusual survey results are likely, such as last week’s Services PMI falling below 50, though the ISM Services survey may not follow due to its inclusion of public sector activities and federal funding cuts. Interpretation challenges persist, with inflation expectations diverging along partisan lines—Republicans foresee under 2%, Democrats closer to 4%. Despite these shifts, the "jobs hard to get" metric in consumer confidence remains stable. However, hopes for swift action on his tax cut proposals grew after House Republicans passed a budget framework.

Wage settlements in the Eurozone eased to 4.1% year-on-year in Q4, down from 5.6% in Q3, aligning with ECB and Indeed wage surveys. ECB forecasts predict pay growth slowing from 4.3% in 2024 to 2.7% by 2026. While the trend reassures the Governing Council, hawkish members like Nagel argue the 2.75% policy rate is near neutral and caution against hasty rate cuts. However, slowing wage growth and weak activity data strengthen the case for gradual rate reductions to reach a neutral level.

Market stability on Wednesday could face a test later in the day, with NVIDIA set to release its earnings report. The stock shows a 10% implied options movement through Friday, with a positioning score of 7/10. It has been range-bound for eight months amid competition and regulatory complexities. Market expectations are stable, anticipating modest performance compared to typical $1-2 billion beats and $2 billion quarter over quarter guidance increases. Consensus estimates project January revenues at $38.1B and April at $42.2B. Focus may shift to July commentary on Blackwell timing, China demand, and long-term outlook through 2026.

Overnight Newswire Updates of Note

- ECB's Stournaras: Too Soon To Discuss Pausing Cuts

- Automaker Stellantis Recalls 68K Units In France Due To Fire Risk

- UK Retail May Shed 160K Part-Time Jobs On Tax Increase

- Aussie’s Jan Inflation Holds Steady As Housing Gains Ease

- Yen Hits 4-Month High Against Dollar On US Economy Concerns

- HK Budget To Fight Deficit, Growth Slowdown, US Trade War Hits

- China: Taiwan Seeks To Give Away Chip Industry To US

- DeepSeek Reopens AI Model Access As China Rivalry Heats Up

- PayPal Plans To Ramp Up Adoption Of Its Stablecoin Through 2025

- Traders Bet Big On Bond Rally As Tariff Growth Shock Looms

- Trump To Probe Copper Tariffs, Opening Door To New Levy On Metal

- Trump Proposes $5M ‘Gold Card’ To Grant Investors US Residency

- US House Passes Budget Resolution To Cut Taxes, Spending By Trillions

- Trump: Zelensky To Visit White House Friday To Sign Minerals Deal

- Israel’s Opposition Leader: Egypt Should Control Gaza For Up To 15Y

(Sourced from reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

- EUR/USD: 1.0420-30 (3.1BLN), 1.0435-45 (1.8BLN), 1.0450 (3.2BLN)

- 1.0465-75 (1.7BLN), 1.0495-1.0500 (2.7BLN), 1.0510-20 (2.7BLN)

- 1.0525-30 (4BLN), 1.0550 (2.3BLN), 1.0570-85 (1.9BLN), 1.0600 (3.6BLN)

- USD/CHF: 0.8955 (1.1BLN), 0.9035-45 (470M). EUR/CHF: 0.9400 (731M)

- GBP/USD: 1.2500 (587M), 1.2675 (773M)

- EUR/GBP: 0.8320 (335M), 0.8385-0.8400 (681M)

- AUD/USD: 0.6320-25 (920M), 0.6350 (404M), 0.6400 (1.1BLN)

- USD/CAD: 1.4300 (1.2BLN), 1.4350-55 (770M)

- USD/JPY: 149.00 (1BLN), 149.45-55 (720M), 149.75-80 (872M)

- 150.00 (1.8BLN), 150.25 (774M)

- EUR/JPY: 155.00 (1.3BLN), 156.00 (250M), 156.50 (250M)

- AUD/JPY: 93.50 (510M), 0.9565 (205M)

CFTC Data As Of 21/2/25

- Positions Report from the CFTC for the Week Ending February 18th

- The net short position in euros stands at -51,420 contracts.

- The net long position for the Japanese Yen stands at 60,569 contracts.

- The Swiss franc has recorded a net short position of -38,359 contracts.

- The net short position for the British pound stands at -579 contracts.

- The net short position for Bitcoin stands at -367 contracts.

- Equity fund managers have increased their S&P 500 CME net long position by 18,069 contracts, bringing the total to 948,011. Meanwhile, equity fund speculators have reduced their S&P 500 CME net short position by 332 contracts, resulting in a total of 365,901.

- Speculators have raised their positions on CBOT. The net long position in US Treasury Bonds futures has risen by 3,780 contracts, reaching a total of 47,781. Speculators are increasing their activity on the CBOT. US Ultrabond Treasury futures net short position decreased by 6,301 contracts, totalling 246,242. Speculators have reduced their positions. Chicago Board of Trade US 2-Year Treasury futures have seen a net short position decrease of 9,093 contracts, bringing the total to 1,289,519. Speculators are reducing their positions on the CBOT. The net short position in US 10-Yr Treasury futures has decreased by 41,507 contracts, bringing the total to 709,527. Meanwhile, speculators have reduced their net short position in CBOT US 5-Yr Treasury futures by 124,202 contracts, resulting in a total of 1,737,533.

Technical & Trade Views

SP500 Pivot 6040

- Daily VWAP bearish

- Weekly VWAP bearish

- Seasonality suggests bearishness Into March 7th

- Long above 6075 target 6195

- Short Below 6045 target 5743

(Click on image to enlarge)

EURUSD Pivot 1.0435

- Daily VWAP bullish

- Weekly VWAP bullish

- Seasonality suggests bearishness into March 30th

- Above 1.0505 target 1.0634

- Below 1.0435 target 0.9758

(Click on image to enlarge)

GBPUSD Pivot 1.2614

- Daily VWAP bullish

- Weekly VWAP bullish

- Seasonality suggests bearishness into March 10th

- Above 1.2685 target 1.2812

- Below 1.2615 target 1.1878

(Click on image to enlarge)

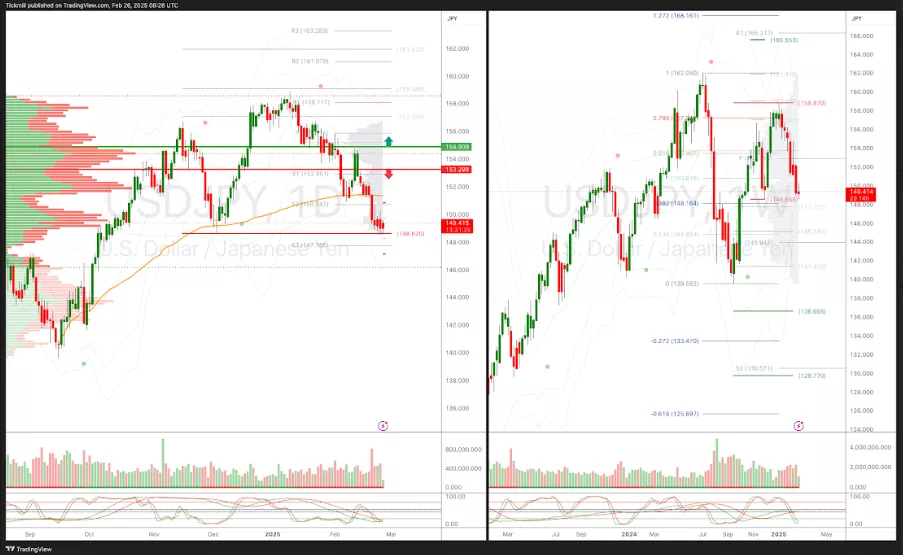

USDJPY Pivot 153.77

- Daily VWAP bearish

- Weekly VWAP bearish

- Seasonality suggests bullishness into Apr 9th

- Above 1.5377 target 165.50

- Below 152.41 target 150

(Click on image to enlarge)

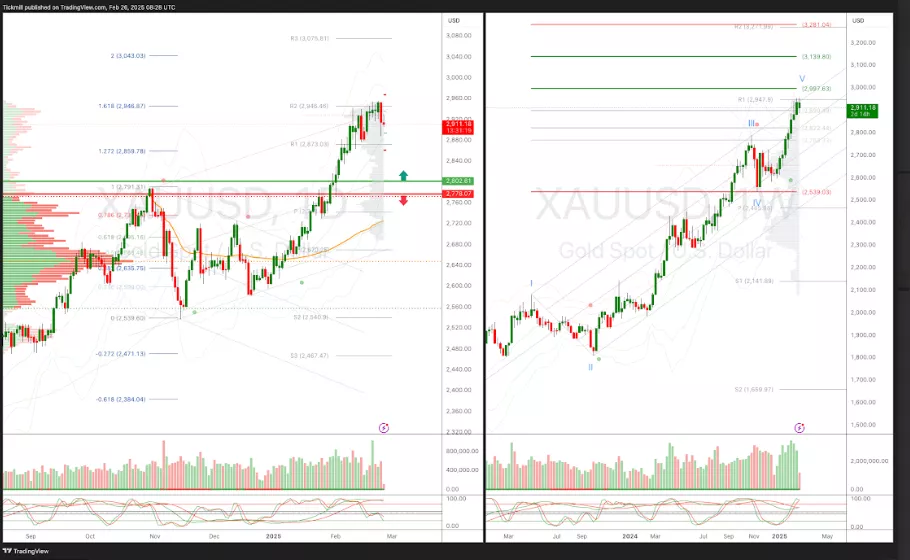

XAUUSD Pivot 2692

- Daily VWAP bearish

- Weekly VWAP bullish

- Seasonality suggests volatile bullishness into Feb 22nd

- Above 2725 target 2997

- Below 2692 target 2475

(Click on image to enlarge)

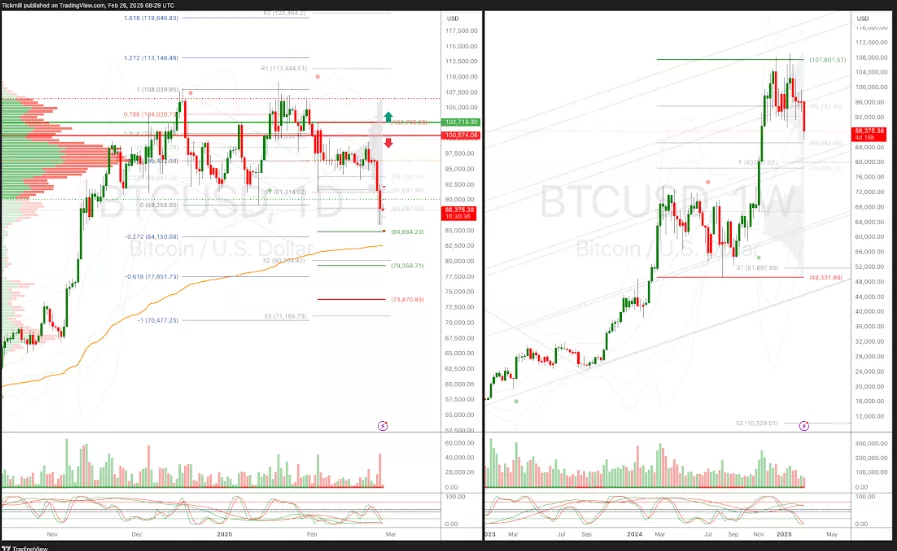

BTCUSD Pivot 101,960

- Daily VWAP bullish

- Weekly VWAP bearish

- Seasonality suggests bullishness into Apr 9th

- Above 104,020 target 110,000

- Below 101,942 target 86,266

(Click on image to enlarge)

More By This Author:

The FTSE Finish Line - Tuesday, Feb. 25

Daily Market Outlook - Tuesday, Feb. 25

The FTSE Finish Line - Thursday, Feb. 20